FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

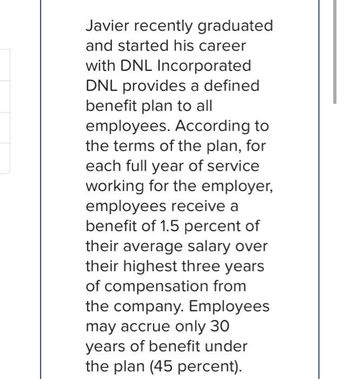

Transcribed Image Text:Javier recently graduated

and started his career

with DNL Incorporated

DNL provides a defined

benefit plan to all

employees. According to

the terms of the plan, for

each full year of service

working for the employer,

employees receive a

benefit of 1.5 percent of

their average salary over

their highest three years

of compensation from

the company. Employees

may accrue only 30

years of benefit under

the plan (45 percent).

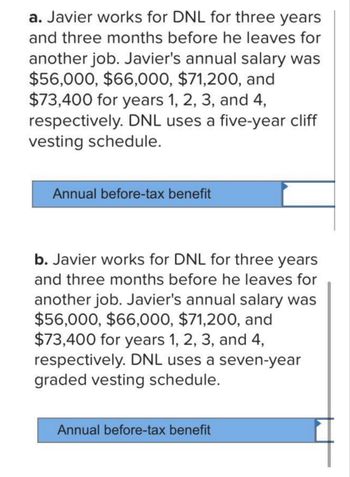

Transcribed Image Text:a. Javier works for DNL for three years

and three months before he leaves for

another job. Javier's annual salary was

$56,000, $66,000, $71,200, and

$73,400 for years 1, 2, 3, and 4,

respectively. DNL uses a five-year cliff

vesting schedule.

Annual before-tax benefit

b. Javier works for DNL for three years

and three months before he leaves for

another job. Javier's annual salary was

$56,000, $66,000, $71,200, and

$73,400 for years 1, 2, 3, and 4,

respectively. DNL uses a seven-year

graded vesting schedule.

Annual before-tax benefit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- In 20-- the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer’s pay on (a) November 15 and (b) December 31.arrow_forwardIn 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,280 $ $ $ $ Grath, John, VP Finance 137,400 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 55,200 Wie, Pam, VP Personnel 45,600 Grant, Mary, VP Secretary 37,200 b. December 31 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,280 $ $ $ $ Grath, John, VP Finance 137,400 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 55,200 Wie, Pam, VP Personnel 45,600…arrow_forwardNoelle, the owner of all of the shares of ClockCo, an S corporation, transfers her stock to Grayson on April 1. ClockCo reports a $70,000 NOL for the entire tax year, but $10,000 of the loss occurs during January-March. Assume 365 days in a year. Round per day computation to five decimals places. Round final answers to the nearest dollar. a. Without a short-year election, $fill in the blank 1 of the loss is allocated to Noelle, and $fill in the blank 2 is allocated to Grayson.arrow_forward

- D4)arrow_forwardDee is paid $2,345 on November 8, 20--. Dee had cumulative gross earnings, including overtime pay, of $131,600 prior to this pay. Round your answers to the nearest cent. a. The amount of OASDI taxes to withhold from Dee's pay is $ b. The amount of HI taxes to withhold from Dee's pay is $arrow_forwardIn 20--, the annual salaries paid each of the officers of Abrew, Inc., follow. The officers are paid semimonthly on the 15th and the last day of the month. Compute the FICA taxes to be withheld from each officer's pay on (a) November 15 and (b) December 31. Round your answers to the nearest cent. If an amount is zero, enter "0". a. November 15 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,520 $ $ $ $ Grath, John, VP Finance 137,760 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 58,800 Wie, Pam, VP Personnel 52,800 Grant, Mary, VP Secretary 45,600 b. December 31 Name and Title AnnualSalary OASDI TaxableEarnings OASDI Tax HI TaxableEarnings HI Tax Hanks, Timothy, President $152,520 $ $ $ $ Grath, John, VP Finance 137,760 James, Sally, VP Sales 68,400 Kimmel, Joan, VP Mfg. 58,800 Wie, Pam, VP Personnel 52,800…arrow_forward

- 3. An employee works 51 hours (51-40 were overtime hours) during a workweek in December of 2021. He earns $10.000/month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has eamed $144,100 during the year. He has requested that his employer withhold 9% of gross pay, which is to be contributed to a 401(k) plan. Taxabin income for federal income tax withholding S 3,213.44 X Taxable income for social security tax-$ 0.00 Taxable income for medicare tax-$ 3,531.25 PREVIOUS NEXT SUBMIT ASSIGNMENTarrow_forward1. During 20--, Garr was paid a weekly salary of $2,540. The amount of FICA to be withheld from the following payments is: OASDI? HI?(a) For the 50th week (b) For the 51st week (c) For the 52nd weekarrow_forwardCentury-Fox Corporation’s employees are eligible for postretirement health care benefits after both beingemployed at the end of the year in which age 60 is attained and having worked 20 years. Jason Snyder was hiredat the end of 1993 by Century-Fox at age 34 and is expected to retire at the end of 2021 (age 62). His retirementis expected to span five years (unrealistically short in order to simplify calculations). The company’s actuary hasestimated the net cost of retiree benefits in each retirement year as shown below. The discount rate is 6%. Theplan is not prefunded. Assume costs are incurred at the end of each year.Year Expected Age Net Cost2022 63 $4,0002023 64 4,4002024 65 2,3002025 66 2,5002026 67 2,800Required:1. Draw a time line that depicts Snyder’s attribution period for retiree benefits and expected retirement period.2. Calculate the present value of the net benefits as of the expected retirement date.3. With respect to Snyder, what is the company’s expected postretirement…arrow_forward

- During 2023, Lincoln Company hires 24 individuals who are certified to be members of a qualifying targeted group. Each employee works in excess of 600 hours and is paid wages of $9,850 during the year. Determine the amount of Lincoln's work opportunity credit. $fill in the blank 1.arrow_forwardThrough November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $7,000 of revenue at a cost to Cameron of $3,000, which is deductible for AGI. In contrast, engagement 2 will generate $5,000 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions. Description Engagement 1 Engagement 2 (1) Gross income before new work engagement $ 120,000 $ 120,000 (2) Income from engagement 7,000 5,000 (3) Additional for AGI deduction (3,000) (4) Adjusted gross income $ 124,000 $ 125,000 (5) Greater of itemized deductions or standard deduction (6) Deduction for QBI (1,000) Taxable incomearrow_forwardAn employee works 51 hours (51 - 40 were overtime hours) during a workweek in December of 2021. He earns $10,000/month, with his employer paying 1.5 times the regular rate of pay for overtime hours. To date, he has earned $144,100 during the year. He has requested that his employer withhold 9% of gross pay, which is to be contributed to a 401(k) plan. Taxable income for federal income tax withholding = $ Taxable income for social security tax = $ Taxable income for medicare tax = $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education