SWFT Essntl Tax Individ/Bus Entities 2020

23rd Edition

ISBN: 9780357391266

Author: Nellen

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

Woodward corporation reported a pretax book income solve this question

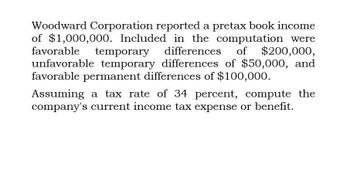

Transcribed Image Text:Woodward Corporation reported a pretax book income

of $1,000,000. Included in the computation were

favorable temporary differences of $200,000,

unfavorable temporary differences of $50,000, and

favorable permanent differences of $100,000.

Assuming a tax rate of 34 percent, compute the

company's current income tax expense or benefit.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Woodward Corporation reported pretax book income of $1,335,000. Included in the computation were favorable temporary differences of $355,000, unfavorable temporary differences of $98,250, and favorable permanent differences of $158,000. Compute the company’s current income tax expense or benefit. In picture- what is the tax rate and current income tax expense?arrow_forwardPackard Corporation reported pretax book income of $501,100. Included in the computation were favorable temporary differences of $11,100, unfavorable temporary differences of $101,100, and unfavorable permanent differences of $90,550. Assuming a tax rate of 34%, the Corporation's current income tax expense or benefit would be: a. $231,761 b. $177,735 c. $170,374 d. $108,987arrow_forwardprovide account answerarrow_forward

- 1.Kumara Corporation reported pretax book income of $1,200,000. Kumara also reports an increase in the taxable temporary differences of $176,000, an increase in the deductible temporary differences of $171,000, and favorable permanent differences of $176,000. Assuming a tax rate of 21 percent, compute the company's deferred income tax expense or benefit. what is the deferred income expensearrow_forwardShaw Corp reported pretax book income of $1,000,000. Included in the computation were favorable temporary differences of $200,000, unfavorable temporary differences of $50,000, and favorable permanent differences of $100,000. Assuming a tax rate of 21 percent, compute the company’s deferred income tax expense or benefit.arrow_forwardAnn Corporation reported pretax book income of $1,190,000. Included in the computation were favorable temporary differences of $140,000, unfavorable temporary differences of $234,000, and favorable permanent differences of $138,000. Compute the company's book equivalent of taxable income. Use this number to compute the company's total income tax provision or benefit. Book equivalent of taxable income Total income tax provision or benefitarrow_forward

- Alvis Corporation reports pretax accounting income of $320,000, but due to a single temporary difference, taxable income is only $190,000. At the beginning of the year, no temporary differences existed. 1. Assuming a tax rate of 25%, what will be Alvis’s net income?2. What will Alvis report in the balance sheet pertaining to income taxes?arrow_forwardRimas Corporation reported pretax book income of $1,360,000. Included in the computation were favorable temporary differences of $220,000, unfavorable temporary differences of $290,000, and favorable permanent differences of $146,000. Compute the company's book equivalent of taxable income. Use this number to compute the company's total income tax provision or benefit Book equivalent of taxable income Total income tax provision or benefitarrow_forwardFor the current year, LNS corporation reported the following taxable income at the end of its first, second, and third quarters. Quarter-End Cumulative Taxable Income First $ 1,860,000 Second 2,620,000 Third 3,510,000 What are LNS’s minimum first, second, third, and fourth quarter estimated tax payments, using the annualized income method? (Enter all amounts as positive values. Leave no answer blank. Enter zero if applicable. Round "Annualization Factor" for Fourth quarter to 7 places. Round other intermediate computations and final answers to the nearest whole dollar amount.)arrow_forward

- Alvis Corporation reports pretax accounting income of $220,000, but due to a single temporary difference, taxable income is only $115,000. At the beginning of the year, no temporary differences existed.Required:1. Assuming a tax rate of 25%, what will be Alvis’s net income?2. What will Alvis report in the balance sheet pertaining to income taxes?arrow_forwardNalad Corp. provided the following data related to accounting and taxable income: Pre-tax accounting income (financial statements) Taxable income (tax return) Income tax rate 20X8 $530,000 20X9 $505,000 305,000 730,000 38% 38% There are no existing temporary differences other than those reflected in these data. There are no permanent differences. Required: 1-a. How much tax expense would be reported in each year if the taxes payable method was used? Tax Expense 20X8 20X9 1-b. What is the implied tax rate? (Round your answers to 1 decimal place.) 20X8 20X9 Implied tax rate 96 % 2-a. How much tax expense would be reported using comprehensive tax allocation (liability method). Tax Expense 20X8 20X9 2-b. How much deferred income tax would be reported using comprehensive tax allocation (liability method).arrow_forwardRobin Corporation reported pretax book income of $4,525,000. Included in the computation were favorable temporary differences of $500,100, unfavorable temporary differences of $650,000, and unfavorable permanent differences of $200,000. Compute Robin’s current income tax expense or benefit.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT