FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Hello tutor please provide this question solution general accounting

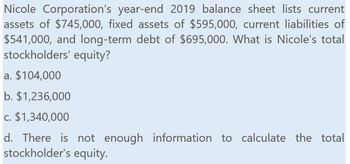

Transcribed Image Text:Nicole Corporation's year-end 2019 balance sheet lists current

assets of $745,000, fixed assets of $595,000, current liabilities of

$541,000, and long-term debt of $695,000. What is Nicole's total

stockholders' equity?

a. $104,000

b. $1,236,000

c. $1,340,000

d. There is not enough information to calculate the total

stockholder's equity.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Suppose the Crane Ltd's 2020 financial statements contain the following selected data (in millions). Current assets Total assets Current liabilities Total liabilities NT$3,536.0 31,408.0 3,016.0 16,640.0 Compute the following values. Interest expense Income taxes Net income NT$520.0 (a) Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 1,976.0 4,590.0 (b) Times interest earned. (Round to 2 decimal places, e.g. 6.25.) % timesarrow_forwardThe 2021 Balance Sheet of Eighty-Five Ltd. show a total of $100,000 in current assets, which is made up of $35,000 (cash), $15,000 (marketable securities), $20,000 (net receivables) and inventories (that make up the difference). If the company’s current liabilities for the year is $55,000, what is its quick ratio? 1.273. 0.780. 1.000. 1.875.arrow_forwardSunland Co. reports the following information for 2020: sales revenue $753,100, cost of goods sold $520,900, operating expenses $84,600, and an unrealized holding loss on available-for-sale debt securities for 2020 of $51,000. It declared and paid a cash dividend of $11,210 in 2020.Sunland Co. has January 1, 2020, balances in common stock $359,700; accumulated other comprehensive income $90,900; and retained earnings $97,460. It issued no stock during 2020. (Ignore income taxes.)Prepare a statement of stockholders’ equity. SUNLAND CO.Statement of Stockholders’ Equitychoose the accounting period December 31, 2020For the Year Ended December 31, 2020For the Quarter Ended December 31, 2020 Total Retained Earnings Accumulated OtherComprehensive Income Common Stock select an item Ending BalanceDividendsBeginning BalanceOther Comprehensive…arrow_forward

- Jones Corp. had a total asset turnover of 4.0 in 2019 and had sales of $10.0 million. If the corresponding statement of financial position or balance sheet reported shareholders’ equity of $1.4 million, what were the total liabilities for Jones Corp.?arrow_forwardTamarisk Co. reports the following information for 2020: sales revenue $769,400, cost of goods sold $502,400, operating expenses $88,400, and an unrealized holding loss on available-for-sale debt securities for 2020 of $57,800. It declared and paid a cash dividend of $14,160 in 2020. Tamarisk Co. has January 1, 2020, balances in common stock $365,300; accumulated other comprehensive income $90,400; and retained earnings $91,010. It issued no stock during 2020. (Ignore income taxes.) Prepare a statement of stockholders' equity. TAMARISK CO. Statement of Stockholders' Equity For the Year Ended December 31, 2020 Accumulated Other Total Retained Earnings Comprehensive Income Common Stockarrow_forwardNicole Corporation's year-end 2019 balance sheet lists current assets of $826,000arrow_forward

- The following balance sheet information (in $ millions) comes from the Annual Report to Shareholders of Merry International Incorporated for the 2024 fiscal year. The following additional information from an analysis of Merry's financial position is available: Current ratio = 1.352272; Acid - test ratio = 0.5769817; Debt to equity ratio = 0.6063000. Required: Compute the missing amounts in the balance sheet. Note: Enter your answers in millions of dollars. Round your intermediate and final answers to the nearest whole dollar. MERRY INTERNATIONAL INCORPORATED Balance Sheet At December 31, 2024 ($ in millions) Assets Current assets \table[[Cash and cash equivalents,,510]. [Accounts and notes receivable]. [Inventory], [Other,, 460], [Total current assets], [Property and equipment, net,1,322,], [Intangible assets, net]. [Investments, 260,], [Notes and other receivables, net,1,276,].[Other assets, 1, 152,]. [Total long-term assets], [Total assets]. [Liabilities and Shareholders' Equity],…arrow_forwardFlint Inc., a greetlng card company, had the following statements prepared as of December 31, 2020. FLINT INC. COMPARATIVE BALANCE SHEET AS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts recelvable 62,400 51,000 Short-term debt Investments (avallable-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepald rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreclatlon-equlpment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salarles and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000 Contributed capital, common stock 30,000 30,000 Retalned earnings 58,000 37,300 Total labiles &. stockholders' equlty $314,100 $296,100 FLINT INC. INCOME STATEMENT FOR THE YEAR ENDING DECEMBER 31, 2020 Sales revenue $339,800 Cost of goods sold 176,500 Gross profit 163,300 Operating expenses…arrow_forwardC. Reither Co. reports the following information for 2020: sales revenue $700,000, cost of goods sold $500,000, operating expenses $80,000, and an unrealized holding loss on available-for-sale debt securities for 2020 of $60,000. It declared and paid a cash dividend of $10,000 in 2020. C. Reither Co. has January 1, 2020, balances in common stock $350,000; accumulated other comprehensive income $80,000; and retained earnings $90,000. It issued no stock during 2020. Instructions Prepare a statement of stockholders’ equity. (Ignore income taxes.)arrow_forward

- The following balance sheet information (in $ millions) comes from the Annual Report to Shareholders of Merry International Incorporated for the 2024 fiscal year. The following additional information from an analysis of Merry's financial position is available: Current ratio = 1.352284; Acid-test ratio = 0.5769942; Debt to equity ratio = 0.6132180. Required: Compute the missing amounts in the balance sheet. Note: Enter your answers in millions of dollars. Round your intermediate and final answers to the nearest whole dollar.arrow_forwardSelected balance sheet accounts for Tibbetts Company on September 30, 2019. are as follows: Cash Marketable securities Accounts receivable, net Inventory Prepaid expenses $ 48,000 87,000 129,000 135, 000 21,000 Total current assetS $420,000 Accounts payable Other accrued liabilities $147,000 33,000 60,000 Short-term debt Total current liabilities $240,000 Required: a. Calculate the working capital, current ratio, and acid-test ratio for Tibbetts Company as of September 30. 2019 b. Summarized here are the transactions/events that took place during the fiscal year ended September 30, 2020. Prepare Journal entries for the below transactions and Indicate the effect of each item on Tibbetts Company's working capital, current ratio, and acid-test ratio. Use + for Increase, - for decrease, and (NE) for no effect. 1. Credit sales for the year amounted to $360,000. The cost of goods sold was $234.000 2 Collected accounts recelvable, $378,000. 3. Purchased inventory on account, $252,000. 4.…arrow_forwardRoyalbird Co. reports the following information for 2020: sales revenue $762,900, cost of goods sold $518,900, operating expenses $83,600, and an unrealized holding loss on available-for-sale debt securities for 2020 of $53,600. It declared and paid a cash dividend of $13,990 in 2020.Royalbird Co. has January 1, 2020, balances in common stock $366,000; accumulated other comprehensive income $83,700; and retained earnings $92,370. It issued no stock during 2020. (Ignore income taxes.)Prepare a statement of stockholders’ equity.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education