FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

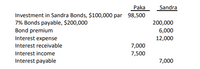

Paka Corporation owns an 80% interest in Sandra Company. Paka acquired Sandra's bonds on January 2, 2014. The following information is from the adjusted

Required:

Prepare the necessary consolidation working paper entries on December 31, 2014 with respect to the intercompany bonds.

Transcribed Image Text:Paka

Sandra

Investment in Sandra Bonds, $100,000 par 98,500

7% Bonds payable, $200,000

Bond premium

200,000

6,000

Interest expense

12,000

Interest receivable

7,000

Interest income

7,500

Interest payable

7,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oso Company purchased a Costco bond for $40,000 on January 1, 2020 at face value with an interest rate of 3% paid and recorded annually on 12/31. Oso Company treats the bond as an available-for-sale investment. 1. On 12/31/20, Oso Company records ALL the entries related to this investment. The fair value of the bond is $45,000. Assume no entries have been recorded to date after the 1/1/20 purchase. Answer the following questions for Oso: a. How much is the investment valued at on Oso's balance sheet? Why is it valued at this amount? b. How much does Oso's net income change by for all entries recorded on 12/31/20 related to this bond? Include the amount and direction. If no change, write no change. 2. On 12/31/21, Oso Company records ALL the entries related to this investment. The fair value of the bond is $42,000. Assume no entries have been recorded since 12/31/20. Answer the following questions for Oso: a. Record the journal entry for any fair value adjustments that are needed. If no…arrow_forwarduses the effective interest method of amortization. In its December 31, 2003 balance sheet, what amount should York report as investment in bonds? a. 911,300 b. 916,600 c. 953,300 d. 960,600 (AICPA) Use the following information for the next three questions: On Jan. 1, 20x1, Koong Co. acquired 100, P5,000 face amount, 10%, 3-year 'term' bonds of King Co. for P428,567. Koong incurred transaction costs of P25,000 on the acquisition. The effective interest rate adjusted for the transaction costs is 14%. The bonds were quoted at 102 on Dec. 31, 20x2. 2. How much are the interest income in 20x2 and the carrying amount of the bonds on Dec. 31, 20x2 if the bonds are held under a “hold to collect" business model? a. 65,389; 482,455 b. 65,389; 510,000 c. 55,276; 472,834 d. 50,000; 453,567 3. How much are the interest income in 20x2 and the carrying amount of the bonds on Dec. 31, 20x2 if the bonds are held under a “hold to collect and sell" business model? a. 65,389; 482,455 c. 50,000; 428,567…arrow_forwardOn November 1, 2015, Journeyman, LLC purchased 900 of the $1,000 face value, 9% bonds of Celebration Incorporated, for $948,000, including accrued interest of $13,500. The bonds matured on January 1, 2017, and interest was paid on March 1 and September 1. If Journeyman uses the straight-line method of amortization and the bonds are classified as available-for-sale, how should the net carrying value of the bonds be shown on Journeyman’s December 31, 2015 balance sheet?arrow_forward

- Teal Corporation purchased on January 1, 2025, as a held-to-maturity investment, $58,000 of the 8%, 6-year bonds of Harrison, Inc. for $63,773, which provides a 6% return. The bonds pay interest semiannually. Prepare Teal's journal entries for (a) the purchase of the investment, and (b) the receipt of semiannual interest and premium amortization. Assume effective-interest amortization is used. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Round answers to O decimal places, e.g. 5,125.) Date Account Titles and Explanation Debit Creditarrow_forwardTanner-UNF Corporation acquired as a long-term investment $1 million of 10-year bonds on July 1, 2023. The purchase price of the bonds was $922,054. After receiving the first interest payment on December 31, 2023, the carrying value of the bonds was $925,106. The market price of the bonds on December 31, 2023, was $927,000. Assuming that Tanner - UNF intends to sell the bonds as soon as possible, how much will be reported as investment in bonds on Tanner - unf's balance sheet on a December 31st 2023?And in which section of the balance sheet will the investment appear?arrow_forwardOn March 25, 2021, Phillips Corporation purchased bonds of Atlas Corporation for $160 million and classified the securities as trading securities. On December 31, 2021, these bonds were valued at $176 million. Three months later, on April 3, 2022, Phillips Corporation sold these bonds for $167 million. As part of the multistep approach to record the 2022 transaction, Phillips Corporation should first update the fair value adjustment by recording: An unrealized holding gain of $25 million in 2022. An unrealized holding loss of $9 million in 2022. An unrealized holding gain of $7 million in 2022. A gain of $7 million in 2022.arrow_forward

- Through November, Cameron has received gross income of $120,000. For December, Cameron is considering whether to accept one more work engagement for the year. Engagement 1 will generate $7,000 of revenue at a cost to Cameron of $3,000, which is deductible for AGI. In contrast, engagement 2 will generate $5,000 of qualified business income (QBI), which is eligible for the 20 percent QBI deduction. Cameron files as a single taxpayer, and he did not contribute to charity during the year. Calculate Cameron's taxable income assuming he chooses engagement 1 and assuming he chooses engagement 2. Assume he has no itemized deductions.arrow_forwardOn October 1,2021 Steve Company borrowed $500,000 from its parent, Pam Company, at an annual interest rate of 5%, with interest payable semiannually on March 31 and September 30. The note’s principle is due in 5 years. Required; a. What balances appear in the December 31, 2021 trial balances of Pam Company and Steve Company with respect to this intercompany loan? b. What balances should appear on the consolidated financial statements of Pam Company and Steve Company with respect to this intercompany loan? c. Prepare the December 31, 2021 elimination entries needed for this intercompany loan.arrow_forwardJim Company purchased $1,200,000 of 8%, 5-year bonds from Sam, Inc. on January 1, 2021, with interest payable on July 1 and December 31. The bonds sold for $1,249,896 at an effective interest rate of 7%. The fair value of the bond at year-end was $1,230,000. A. Using the effective interest method, prepare the purchase of the bonds and the first two interest payments received. B. Assume the bond is categorized as available for sale, prepare the year-end adjustment on December 31.arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education