FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

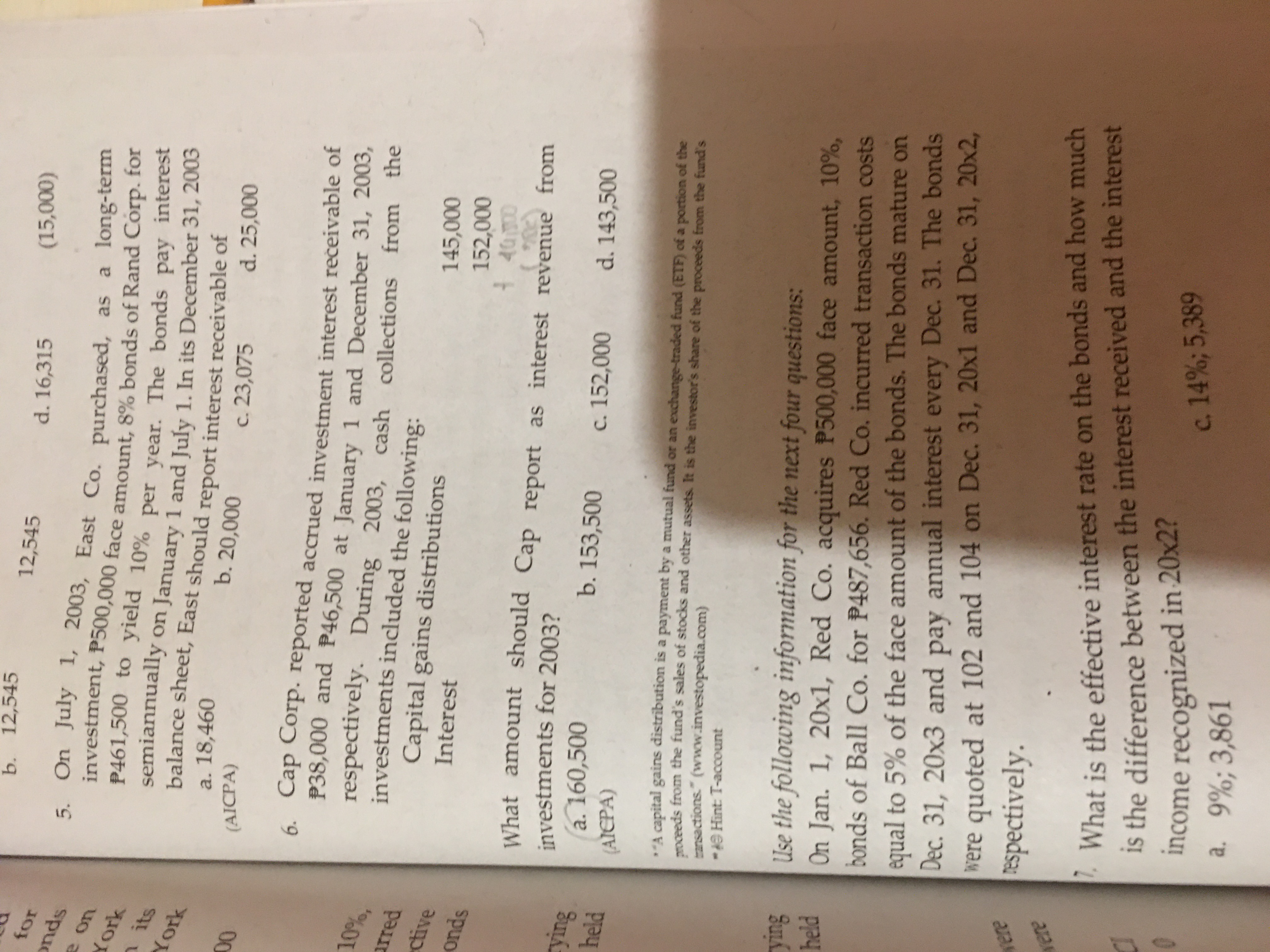

Transcribed Image Text:b. 12,545

12,545

d. 16,315

onds

5. On July 1, 2003, East Co. purchased, as a long-term

investment, P500,000 face amount, 8% bonds of Rand Corp. for

P461,500 to yield 10% per vear. The bonds pay interest

semiannually

balance sheet, East should report interest receivable or

Xork

on January 1 and July 1. In its December 31, 2005

York

a. 18,460

b. 20,000

c. 23,075

d. 25,000

(AICPA)

00

6. Cap Corp. reported accrued investment interest rečeivable of

P38,000 and P46,500 at January 1 and December 31, 2003,

respectively. During 2003,

investments included the following:

Capital gains distributions

10%,

cash collections from the

arred

ctive

Interest

000,

spuno

What amount should Cap report as interest revenue from

investments for 2003?

a. 160,500

b. 153,500

c. 152,000

d. 143,500

(AICPA)

A capital gains distribution is a payment by a mutual fund or an exchange-traded fund (ETF) of a portion of the

meeds from the fund's sales of stocks and other assets. It is the investor's share of the proceeds from the fund's

ransactions." (www.investopedia.com)

-AO Hint: T-account

SuLh

Use the following information for the next four questions:

On Jan. 1, 20x1, Red Co. acquires P500,000 face amount, 10%,

held

bonds of Ball Co. for P487,656. Red Co. incurred transaction costs

equal to 5% of the face amount of the bonds. The bonds mature on

were quoted at 102 and 104 on Dec. 31, 20x1 and Dec. 31, 20x2,

Espectively.

Dec. 31, 20x3 and pay annual interest every Dec. 31. The bonds

, What is the effective interest rate on the bonds and how much

Is the difference between the interest received and the interest

income recognized in 20x2?

a. 9%;3,861

c. 14%; 5,389

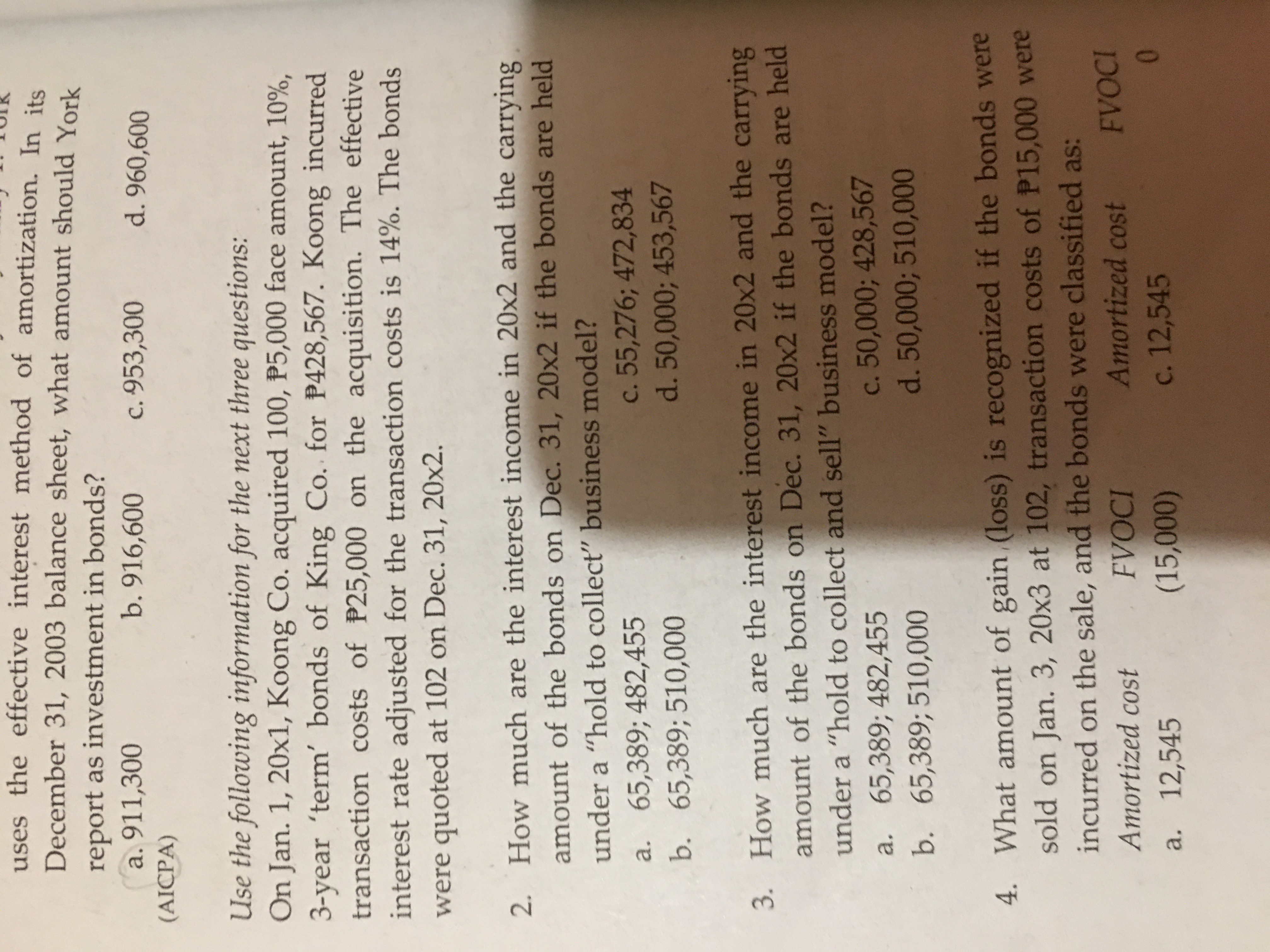

Transcribed Image Text:uses the effective interest method of amortization. In its

December 31, 2003 balance sheet, what amount should York

report as investment in bonds?

a. 911,300

b. 916,600

c. 953,300

d. 960,600

(AICPA)

Use the following information for the next three questions:

On Jan. 1, 20x1, Koong Co. acquired 100, P5,000 face amount, 10%,

3-year 'term' bonds of King Co. for P428,567. Koong incurred

transaction costs of P25,000 on the acquisition. The effective

interest rate adjusted for the transaction costs is 14%. The bonds

were quoted at 102 on Dec. 31, 20x2.

2. How much are the interest income in 20x2 and the carrying

amount of the bonds on Dec. 31, 20x2 if the bonds are held

under a “hold to collect" business model?

a. 65,389; 482,455

b. 65,389; 510,000

c. 55,276; 472,834

d. 50,000; 453,567

3. How much are the interest income in 20x2 and the carrying

amount of the bonds on Dec. 31, 20x2 if the bonds are held

under a “hold to collect and sell" business model?

a. 65,389; 482,455

c. 50,000; 428,567

d. 50,000; 510,000

b. 65,389; 510,000

4. What amount of gain (loss) is recognized if the bonds were

sold on Jan. 3, 20x3 at 102, transaction costs of P15,000 were

incurred on the sale, and the bonds were classified as:

FVOCI

Amortized cost

Amortized cost

FVOCI

a. 12,545

c. 12,545

01

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 9, please answer part c, thanksarrow_forward#7 ABC Company purchased bonds with a face amount of $1200000 between interest payment dates. ABC purchased the bonds at 102, paid brokerage costs of $15800, and paid accrued interest for three months of $25800. The amount to record as the cost of this long-term investment in bonds is $1239800. $1200000. $1224000. $1265600.arrow_forward7arrow_forward

- Question based on, "Carrying value of bonds". I have tried it but unable to understand it.arrow_forward4. Compute the annual cost for interest and redemption of these bondsarrow_forward● Assume Sunset Company purchased this entire bond issue sold y Omar, i.e., 7% of $1,000,000 bonds, at $913,540 on January 1,2024. Market yield was 8% and interest is paid semiannually on June 30 and December 31. Sunset is holding the bond investment as trading securities. The fair value of the bonds on December 31, 2024 is $920,000. 1. At what amount will Sunset report this investment in the December 31, 2024 balance sheet? 2. What is the amount related to the bond investment that Sunset will report in its income statement for the year ended December 31, 2024? (Ignore income taxes.) 3. What is the amount related to the bond investment that Sunset will report in its statement of cash flows for the year ended December 31, 2024? Be sure to list the category of activity in which the cash flow is in. activities activitiesarrow_forward

- HodsonCorp. purchased ten $1,000 8% bonds of Eagle Corporation when the market rate of interestwas 6%. Interest is paid semiannually, and the bonds will mature in four years. Using the PVfunction in Excel®, compute the price Hodson paid (the present value) for the bond investment.arrow_forwardHodson Corp. purchased fifteen $1,000 3% bonds of Power Source Corporation when the market rate of interest was 10%. Interest is paid semiannually, and the bonds will mature in eight years. Using the PV function in Excel, compute the price Hodson paid (the present value) for the bond investment. (Assume that all payments of interest and principal occur at the end of the period. Round your answer to the nearest cent.) Hodson paid on the bond investment.arrow_forwardjituarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education