FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:5:40

ution Page G Google b Home | bartleby

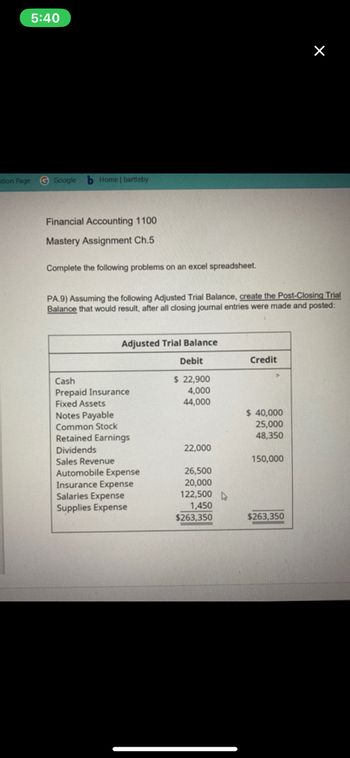

Financial Accounting 1100

Mastery Assignment Ch.5

Complete the following problems on an excel spreadsheet.

PA.9) Assuming the following Adjusted Trial Balance, create the Post-Closing Trial

Balance that would result, after all closing journal entries were made and posted:

Adjusted Trial Balance

Debit

$ 22,900

4,000

44,000

Cash

Prepaid Insurance

Fixed Assets

Notes Payable

Common Stock

Retained Earnings

Dividends

Sales Revenue

Automobile Expense

Insurance Expense

Salaries Expense

Supplies Expense

22,000

26,500

20,000

122,500 D

1,450

$263.350

Credit

$ 40,000

25,000

48,350

150,000

X

$263,350

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- 19. A company's December 31 work sheet for the current period appears below. Based on the information provided, what is net income for the current period? Cash Accounts Receivable Prepaid insurance Supplies Unadjusted Trial Balance Debit 1,975 1,000 1,600 330 Credit Adjustments Debit Credit 875 650 115arrow_forwardWhat is the adjusted trial balance?arrow_forwardM4-14 through M4-17 (Algo) Reporting an Income Statement, Reporting a Statement of Retained Earnings, Reporting a Balance Sheet and Recording Closing Journal Entries [LO 4-4, LO 4-5] Skip to question [The following information applies to the questions displayed below.] The Sky Blue Corporation has the following adjusted trial balance at December 31. Debit Credit Cash $ 1,260 Accounts Receivable 2,300 Prepaid Insurance 2,600 Notes Receivable (long-term) 3,300 Equipment 13,500 Accumulated Depreciation $ 3,200 Accounts Payable 5,720 Salaries and Wages Payable 1,150 Income Taxes Payable 3,200 Deferred Revenue 660 Common Stock 2,700 Retained Earnings 1,120 Dividends 330 Sales Revenue 44,730 Rent Revenue 330 Salaries and Wages Expense 22,200 Depreciation Expense 1,600 Utilities Expense 4,520 Insurance Expense 1,700 Rent Expense 6,300 Income Tax Expense 3,200 Total $ 62,810 $ 62,810 M4-17 (Algo)…arrow_forward

- At December 31, 2024, Crane Industries reports the following selected accounts from the unadjusted trial balance for its first year of operations: Accounts payable Accounts receivable Account Cash Cost of goods sold Interest receivable Interest revenue Merchandise inventory Notes receivable, due April 10, 2025 Prepaid insurance Sales Sales returns and allowances Short-term investments Unearned revenue (a) Date Account Titles Dec. 31 Debit $686,000 39,200 1,715,000 1,100 318,500 44,100 7,840 98,000 49,000 Credit $343,000 2,200 3,596,600 Prepare the journal entry to record the bad debt expense on December 31, 2024, assuming the credit manager estimates that 4% of the accounts receivable will become uncollectible. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List debit entry before credit entry.) 24,500 Debit Creditarrow_forwardThe first two closing entries to the Income Summary account indicate a debit of $53,000 and a credit of $64,000. The third closing entry would be: Multiple Choice debit Capital $11,000; credit Income Summary $11,000 debit Income Summary $11,000; credit Capital $11,000 debit Drawing $11,000; credit Income Summary $11,000 debit Income Summary $11,000; credit Drawing $11,000arrow_forwardCurrent Attempt in Progress Kingbird, Inc's trial balance at the end of its first month of operations reported the following accounts and amounts with normal balances: Cash Prepaid insurance Accounts receivable Accounts payable Notes payable Common stock Dividends Revenues Expenses $18240 O $35910 O $37050 O $36480 O $37620 570 2850 2280 3420 5700 570 25080 14250 Total credits on Kingbird, Inc's trial balance arearrow_forward

- 23. Prepare closing entries rom the following end-of period spreadsheet. Austin Entergrises Fadof Peried Spreadsheet For the Year Eaded December JI Adnted Trial Balance Credit Income Statement Debt Balance Sheet Deb 26.500 7000 Account Titie Crede Debit Crede 26,500 7,000 1,000 18300 Cash Accounts Receivable Supplies Equipment Accumalated Depr 18.500 5.000 5.000 Accoures Payabie Wages Payable Common Stock Retained arnings Dividends Eees Earmed Wages Eapense Rest Esgeme Depreciation Eapense Toals Net omeLo) 11,000 100 6.000 2.000 1000 1,000 6.000 2.000 2.000 2,000 59.500 59.500 19,000 7.000 3.00 19000 7000 3.300 .500 .500 29,500 20.0 59.500 5.000 25,000 20.000arrow_forwardI need help with this practice problem. Put the balances from the adjusted trial balance into the T accountsCreate properly formatted income statement and balance sheet for the year and the balance sheet as of 12/31.Create the closing entries.Post the results of the closing entries into the T accountDraw off balances for the T accounts.Create the post-closing trial balancearrow_forwardUse the following Adjusted Trial Balance. Adjusted Trial Balance Debit Credit Cash $16,500 Accounts Receivable 18,200 Supplies 2,000 Prepaid Insurance 2,300 Equipment 14,000 Accounts Payable $14,200 Unearned Fee Revenue 4,300 Common Stock 31,000 Service Fee Revenue 21,500 Salaries Expense 12,000 Rent Expense 6,000 $71,000 $71,000 Prepare a classified Balance Sheet. Balance Sheet December 31, 2019 Assets Current Assets: Total Current Assets Property, Plant, and Equipment: Total Assets Liabilities Current Liabilities: Total Current Liabilities Stockholders' Equity $ Total Stockholders' Equity Total Liabilities and Stockholders' Equityarrow_forward

- Use the May 31 fiscal year-end information from the following ledger accounts (assume that all accounts have normal balances). M. Muncel, Capital Dated May 31 M. Muncel, Withdrawals Date May 31 Services Revenue Date May 31 Depreciation Expense Date May 31 PR G2 PR G2 PR G2 PR G2 Debit Debit Debit Debit General Ledger Account Number 301 Salaries Expense Credit Balance 84,000 Account Number 302 Credit Balance 50,000 Account Number 403 Credit Balance 148,008 Account Number 603 Credit Balance 15,000 Date May 31 Insurance Expense Date May 31 Rent Expense Date May 31 Income Summary Date PR G2 PR G2 PR G2 PR Debit Debit Debit Debit Account Number 622 Credit Balance 42,000 Account Number 637 Credit Balance 3,900 Account Number 640 Credit Balance 8,400 Account Number 901 Balance Credit (a) Prepare closing journal entries from the above ledger accounts. (b) Post the entries from Requirement (a) to the General Ledger accounts below. Use the transaction number from Requirement (a) as the date.arrow_forwardUse the following T-accounts to prepare the four journal entries required to close the books: T-Accounts. Accounts Receivable debit balance 45,500. Fees Earned Revenue credit balance 60,000. Commission expense debit balance 7,200. Supplies Expense debit balance 5,500. Wages Expense debit balance 42,000. Dividends debit balance 3,500. Retained Earnings credit balance 51,000.arrow_forwardQuestion: Journalize the required returns! Include excel formula in your answerarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education