Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

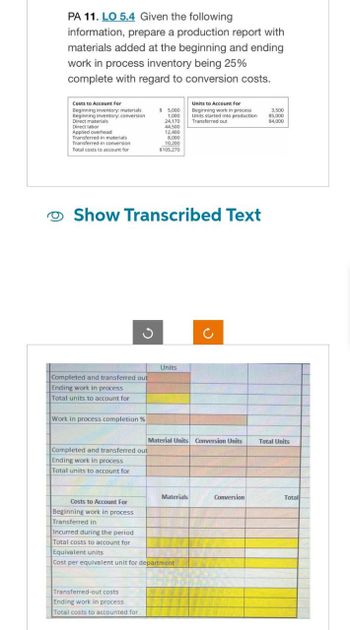

Transcribed Image Text:PA 11. LO 5.4 Given the following

information, prepare a production report with

materials added at the beginning and ending

work in process inventory being 25%

complete with regard to conversion costs.

Costs to Account For

Beginning inventory: materials

Beginning inventory: conversion

Direct materials

Direct labor

Applied overhead

Transferred-in materials

$ 5,000

1,000

24,170

44,500

12,400

8,000

10,200

Transferred-in conversion

Total costs to account for

$105,270

Units to Account For

Beginning work in process

Units started into production

Transferred out

3,500

85,000

84,000

Show Transcribed Text

C

Completed and transferred out

Ending work in process

Units

2

Total units to account for

Work in process completion %

Material Units Conversion Units

Total Units

Completed and transferred out

Ending work in process

Total units to account for

Costs to Account For

Beginning work in process

Transferred in

Incurred during the period

Materials

Conversion

Total

Total costs to account for

Equivalent units

Cost per equivalent unit for department

Transferred-out costs

Ending work in process

Total costs to accounted for

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- PAS. LO 5.3 Materials are added at the beginning of a production process, and ending work in process inventory is 30% complete with respect to conversion costs, Use the information provided to complete a production cost report using the weighted-average method. Costs to Account For Units to Account For Beginning inventory: materials Beginning inventory: conversion Direct materilal Direct labor $ 10,000 19,000 50,000 75,000 37,248 $191,248 5,000 20,000 19,000 Beginning work in process Units started into production Transferred out Applied overhead Total costs to account forarrow_forwardA) what is the equivalent units of production for materials? B) what is the equivalent units of production for conversion ?arrow_forward6 Compute the conversion cost per equivalent unit for the Production department using the weighted-average method. Beginning work in process inventory Units started and completed Units completed and transferred out Ending work in process inventory Production cost information for the Production department follows. Beginning work in process Direct materials. Conversion Costs added this period Direct materials Conversion $ 93,500 107,000 Units 18,000 90,000 108,000 30,000 $ 253,000 291,160 $ 200,500 $544,160 Direct Materials Percent Complete 100% 100% Conversion Percent Complete 40% 60%arrow_forward

- Use the following data from a company using a process costing system to answer the question below. Conversion cost per equivalent unit for materials $2.50 Cost per equivalent unit for conversion $3.75 Beginning inventory costs $1, 200 Equivalent units for beginning inventory conversion 2, 400 Equivalent Units started and completed for both materials and conversion 10,000 Compute cost of good manufactured A. $10, 200 B. $72, 700 C. $71,500 D. $62, 500arrow_forwardQ. 2arrow_forwardQuestion Content Area Compute conversion costs given the following data: direct materials, $376,200; direct labor, $200,400; factory overhead, $179,400 and selling expenses, $48,400. a. $555,600 b. $131,000 c. $756,000 d. $379,800arrow_forward

- What is the total costs of work in process at December 31, 2021 in Department C? P40,932.58 P46,035.41 P42,352.58 P22,097.00arrow_forwardC) what's is the cost per equivalent unit for materials ? ( round your answer to 2 decimal places.) D) what is the cost equivalent unit for conversion? (Round your answer to 2 decimal places.) E) what is the cost of units transferred out? (Round your cost per equivalent unit to 2 decimal places.)arrow_forwardQuestion 15 The assembly division of Quality Time Pieces, Inc. uses the FIFO method of process costing. Consider the following data for May 2020: Physical units Direct Materials Conversion Costs Beginning WIP 100 $459,888 $142,570 Started in May 2020 510 Completed during May 2020 450 Total costs added during May 2020 $3,237,000 $1,916,000 Degree of completion: Beginning WIP: direct materials 80%; conversion costs 35% Degree of completion: Ending WIP: direct materials 80%; conversion costs 40% What would be the cost of units completed and transferred out using FIFO method? Group of answer choices $4,065,000 $4,667,140 $1,088,000 $4,207,570arrow_forward

- Sd Sub: accountingarrow_forwardProblem 2. Cena company employs Weighted Average process costing system in the assembly department and FIFO process costing system in the finishing department concerning its only product which undergoes production in assembly department and finishing department. The following data for the year ended December 31, 2020 are provided: ASSEMBLY DEPARTMENTUnits Cost January 1, 2020 December 31, 2020January 1, 2020December 31, 2020100,000 units – 40% completed as to conversion costCost of Direct material – P3M Cost of Direct labor – P5MCost of Factory Overhead – P2M 150,000 units – 80% completed ? as to conversion costFINISHING DEPARTMENTUnits Cost Units started during the year 400,000 units DM cost added during 2020 – P12MDL cost added during 2020 – P15MFOH cost added during 2020 – P13M 50,000 units – 70% incomplete conversion costCost of Transferred in – P10M Cost of Direct material – P6M Cost of Direct labor – P1MCost of Factory Overhead – P3M 30,000 units – 10%…arrow_forwardam. 24.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning