FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

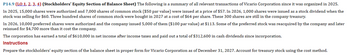

Transcribed Image Text:P14.9 (LO 1, 2, 3, 4) (Stockholders' Equity Section of Balance Sheet) The following is a summary of all relevant transactions of Vicario Corporation since it was organized in 2025.

In 2025, 15,000 shares were authorized and 7,000 shares of common stock ($50 par value) were issued at a price of $57. In 2026, 1,000 shares were issued as a stock dividend when the

stock was selling for $60. Three hundred shares of common stock were bought in 2027 at a cost of $64 per share. These 300 shares are still in the company treasury.

In 2026, 10,000 preferred shares were authorized and the company issued 5,000 of them ($100 par value) at $113. Some of the preferred stock was reacquired by the company and later

reissued for $4,700 more than it cost the company.

The corporation has earned a total of $610,000 in net income after income taxes and paid out a total of $312,600 in cash dividends since incorporation.

Instructions

Prepare the stockholders' equity section of the balance sheet in proper form for Vicario Corporation as of December 31, 2027. Account for treasury stock using the cost method.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Similar questions

- Listed below are the transactions that affected the shareholders’ equity of Branch-Rickie Corporation during the period 2024–2026. At December 31, 2023, the corporation’s accounts included: ($ in thousands) Common stock, 113 million shares at $1 par $ 113,000 Paid-in capital—excess of par 678,000 Retained earnings 920,000 November 1, 2024, the board of directors declared a cash dividend of $0.50 per share on its common shares, payable to shareholders of record November 15, to be paid December 1. On March 1, 2025, the board of directors declared a property dividend consisting of corporate bonds of Warner Corporation that Branch-Rickie was holding as an investment. The bonds had a fair value of $2.9 million, but were purchased two years previously for $2.5 million. Because they were intended to be held to maturity, the bonds had not been previously written up. The property dividend was payable to shareholders of record March 13, to be distributed April 5. On July 12,…arrow_forwardplease help asap pleasearrow_forwardVikrambhaiarrow_forward

- The shareholders' equity section of the balance sheet of TNL Systems Incorporated included the following accounts at December 31, 2023: Shareholders' Equity Common stock, 240 million shares at $1 par Paid-in capital-excess of par Paid-in capital-share repurchase Retained earnings Required: ($ in millions) $ 240 1,680 1 1,100 1. During 2024, TNL Systems reacquired shares of its common stock and later sold shares in two separate transactions. Prepare the entries for both the purchase and subsequent resale of the shares assuming the shares are (a) retired and (b) viewed as treasury stock. a. On February 5, 2024, TNL Systems purchased 6 million shares at $10 per share. b. On July 9, 2024, the corporation sold 2 million shares at $12 per share. c. On November 14, 2026, the corporation sold 2 million shares at $7 per share. 2. Prepare the shareholders' equity section of TNL Systems' balance sheet at December 31, 2026, comparing the two approaches. Assume all net income earned in 2024-2026…arrow_forwardOriole Corporation was organized on January 1, 2021. During its first year, the corporation issued 1,950 shares of $50 par value preferred stock and 105,000 shares of $10 par value common stock. At December 31, the company declared the following cash dividends: 2021, $5,000; 2022, $13,900; and 2023, $27,000.arrow_forwardOn January 1, 2020, the stockholders’ equity section of Skysong, Inc. shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,070,000; and retained earnings $1,220,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. July 1 Sold 10,500 treasury shares for cash at $17 per share. Sept. 1 Sold 9,000 treasury shares for cash at $14 per share.arrow_forward

- On December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forwardDeZurik Corporation had the following stockholders’ equity section in its June 30, 2022, balance sheet (in thousands, except share and per share amounts): June 30 (in thousands)2022 Paid-in capital: $4.0 Preferred stock, $ ? par value, cumulative, 60,000 shares authorized, 21,000 shares issued and outstanding $ 1,490 Common stock, $6 par value, 4,000,000 shares authorized, 840,000 shares issued, 750,000 shares outstanding Additional paid-in capital on common stock 5,320 Retained earnings Less: Treasury common stock, at cost, ? shares Total stockholders' equity $ 15,410 Required: Calculate the par value per share of preferred stock and determine the preferred stock dividend percentage. Calculate the amount that should be shown on the balance sheet for common stock at June 30, 2022. What was the average issue price of common stock shown on the June 30, 2022, balance sheet? How many shares of treasury stock does DeZurik Corporation own at June 30, 2022?…arrow_forwardPlease refer to image- thank you :)arrow_forward

- Grouper Ltd. has the following equity accounts at January 1, 2023. Preferred shares outstanding: 2,800 shares Common shares outstanding: 4,500 shares (a) $84,000 Average issue price $ 450,000 What was the average issue price of the preferred shares?arrow_forwardOn January 1, 2026, Sheridan Corp. had 491,000 shares of common stock outstanding. During 2026, it had the following transactions that affected the common stock account. February 1 March 1 May 1 June 1 October 1 (a) Issued 116,000 shares Issued a 10% stock dividend Acquired 96,000 shares of treasury stock Issued a 3-for-1 stock split Reissued 59,000 shares of treasury stock Your answer is incorrect. Determine the weighted-average number of shares outstanding as of December 31, 2026. The weighted-average number of shares outstandingarrow_forwardOn December 31, 2022, the equity accounts of Book Creations, Inc., contained the following balances: Common stock ($10 par, 100,000 shares authorized) 30,000 shares issued and outstanding $300,000 Retained earnings $476,600 For the year 2022, the corporation had net income before income taxes of $176,300, income taxes of $35,260, and net income after taxes of $141,040. The corporation’s tax rate is 20 percent.An expansion of the existing plant at a cost of $564,300 is planned. The corporation’s president, who owns 60 percent of the corporation’s common stock, estimates that the expansion would result in an increased net income of approximately $176,300 before interest and taxes. The financial vice president forecasts that the increase would be only $88,150. Management is considering two possibilities for financing: Issuance of 20,000 additional shares of common stock for $29 per share. Issuance of $564,300 face amount, 10-year, 6 percent bonds payable, secured by a…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education