FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Journalize the transactions.

Post to the

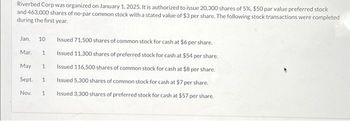

Transcribed Image Text:Riverbed Corp was organized on January 1, 2025. It is authorized to issue 20,300 shares of 5%, $50 par value preferred stock

and 463,000 shares of no-par common stock with a stated value of $3 per share. The following stock transactions were completed

during the first year.

Jan. 10 Issued 71,500 shares of common stock for cash at $6 per share.

Issued 11,300 shares of preferred stock for cash at $54 per share.

Issued 116,500 shares of common stock for cash at $8 per share.

Issued 5,300 shares of common stock for cash at $7 per share.

Issued 3,300 shares of preferred stock for cash at $57 per share.

Mar.

1

May 1

Sept. 1

Nov. 1

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Indicate the accounts increased or decreased to record the above stock transactions.arrow_forwardHow to journalize the purchase of bonds.arrow_forwardOn January 1, 2022, the stockholders' equity section of Bramble Corporation shows common stock ($6 par value) $1,800,000; paid-in capital in excess of par $1,050,000; and retained earnings $1,230,000. During the year, the following treasury stock transactions occurred. Mar. 1 Purchased 51,000 shares for cash at $15 per share. 1 Sold 12,000 treasury shares for cash at $17 per share. Sold 10,000 treasury shares for cash at $14 per share. July Sept. 1arrow_forward

- On January 1, 2022, the stockholders' equity section of Bridgeport Corporation shows common stock ($4 par value) $1,200,000; paid- in capital in excess of par $1,000,000; and retained earnings $1,240,000. During the year, the following treasury stock transactions occurred. 1 Purchased 50,000 shares for cash at $15 per share. July 1 Sold 11,000 treasury shares for cash at $17 per share. Sept. 1 Sold 9,500 treasury shares for cash at $14 per share. Mar. (a) Journalize the treasury stock transactions. (List all debit entries before credit entries. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forwardClassify the following users of information as: Internal Users, External Trading Partner, External Stakeholder Internal Revenue Service Inventory control manager Board of directors Customers Lending institutions Securities and Exchange Commission Stockholders Chief executive officer Suppliers Bondholdersarrow_forwardComment on the level of detail necessary for operations management, middle management, and stockholders.arrow_forward

- Describe the accounting for bonds payable, including bonds issued at face amount, bonds issued at a discount, and bonds issued at a premium? Describe how bonds are reported on the balance sheet? Describe how the times interest earned ratio is used to evaluate a company’s financial condition? Describe the advantages and disadvantages of the corporate form of business ownership? Describe the characteristics of corporate stock, the classes of stock, and the accounting entries for stock issuance? Search entries or author .arrow_forwardWrite a short note on Securities and Exchange Commission.arrow_forwardTreasury stock should be reported in the financial statements of a corporation as a(n) Oa. investment Ob. liability Oc. current asset Od. deduction from stockholders' equityarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education