FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

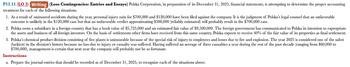

Transcribed Image Text:P12.11 (LO 3) Writing (Loss Contingencies: Entries and Essays) Polska Corporation, in preparation of its December 31, 2025, financial statements, is attempting to determine the proper accounting

treatment for each of the following situations.

1. As a result of uninsured accidents during the year, personal injury suits for $700,000 and $120,000 have been filed against the company. It is the judgment of Polska's legal counsel that an unfavorable

outcome is unlikely in the $120,000 case but that an unfavorable verdict approximating $500,000 (reliably estimated) will probably result in the $700,000 case.

2. Polska owns a subsidiary in a foreign country that has a book value of $5,725,000 and an estimated fair value of $9,500,000. The foreign government has communicated to Polska its intention to expropriate

the assets and business of all foreign investors. On the basis of settlements other firms have received from this same country, Polska expects o receive 40% of the fair value of its properties as final settlement.

3. Polska's chemical product division consisting of five plants is uninsurable because of the special risk of injury to employees and losses due to fire and explosion. The year 2025 is considered one of the safest

(luckiest) in the division's history because no loss due to injury or casualty was suffered. Having suffered an average of three casualties a year during the rest of the past decade (ranging from $60,000 to

$700,000), management is certain that next year the company will probably not be so fortunate.

Instructions

a. Prepare the journal entries that should be recorded as of December 31, 2025, to recognize each of the situations above.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cocoa Corporation is preparing its December 31, 2023 financial statements. On March 1, the company settled a lawsuit for which it had accrued a contingent liability (loss) of $1,600,000. The amount of the settlement was $1,750,000. The financial statements were issued on March 10, 2024. Which of the following is correct regarding the settlement of the lawsuit? Question 9Answer a. The additional loss of $150,000 will be reported in the 2024 financial statements. b. No contingent liability will be reported on the 2023 Balance Sheet since the suit has been settled. c. This is not a recognized subsequent event because this information about the settlement was not known at year-end. Therefore, no adjustment is required. d. Cocoa should make an adjusting entry to adjust the estimated loss to the actual amount. Net income for 2023 will decrease by $150,000 (ignoring taxes).arrow_forward2arrow_forwardplease helparrow_forward

- Payable to Company Founder Jensen Inc. has a $500,000 note payable due to its founder, Jen Jensen. Ms. Jensenis recently deceased and has no heirs that Jensen Inc.’s executive team is aware of. The company has asked for yourhelp to determine whether it is appropriate to derecognize the liability from its financial statements.Required:1. Respond to Jensen Inc. Describe the applicable guidance requirements, including excerpts as needed to supportyour response.2. Next, explain how you located the relevant guidance, including the search method used and which section yousearched within the appropriate topicarrow_forwardSawyer and Sawyer, CPAs, audited the financial statements of Rattler Corporation that were included in Rattler’s Form 10-K, which was filed with the SEC. Subsequently, Rattler Corporation went bankrupt and the stockholders of the corporation brought a class-action lawsuit against management, Sawyer and Sawyer, and the corporation’s board of directors and attorneys for misstatements of the financial statements. Assume that the jury in the case decides that responsibility for $5 million in losses should be allocated as follows: Management 70% Board of directors 20 Auditors 5 Attorneys 5 100% Under what securities act would the stockholders initiate this lawsuit? Assuming that all the defendants in the case are financially able to pay their share of the losses, calculate the amount of losses that would be allocated to Sawyer and Sawyer. Assuming that management had no financial resources, describe how Sawyer and Sawyer’s share of the losses might be increased.arrow_forwardi have completed this in excel but would like to compare my answersarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education