Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accurate answer

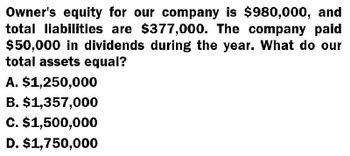

Transcribed Image Text:Owner's equity for our company is $980,000, and

total liabilities are $377,000. The company paid

$50,000 in dividends during the year. What do our

total assets equal?

A. $1,250,000

B. $1,357,000

C. $1,500,000

D. $1,750,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- What do our total assets equal?arrow_forwardAssuming a business entity has a total asset of 25,000,000 its total liabilities is 1/3 of the said amount. How much is the equity? 16,000,000,00 16,666,666.67 13,333,333.33 13,000,000.00arrow_forwardA corporation has $91,000 in total assets, $30, 500 in total liabilities, and a $18,600 credit balance in retained earnings. What is the balance in the contributed capital accounts? Multiple Choice $79, 100 $49, 100 $60,500 $41,900arrow_forward

- Net income for the year was ?arrow_forwardThe balance sheet of ATLF, Inc. reports total assets of $1,950,000 and $2,050,000 at the beginning and end of the year, respectively. Net income and sales for the year are $150,000 and $1,000,000, respectively. What is ATLF's profit margin? Select one: a. 10% Ob. 8% O c. 7.5% O d. 15% e. 12%arrow_forward1. During 2021, Target Corporation had: Revenue of $623,000 Cost of Goods Sold of $250,000 Operating expenses of $68,000 Interest expense of $4,000 Depreciation Expense of $13,000During the year Starzine Corporation paid: 50% of net income in dividends 21% in corporate taxes a. Prepare a multi-step income statement on Sheet 1 of your spreadsheet. Include the dividend and additions to Retained Earnings below the income statement.b. Calculate Target's Operating Cash Flow beneath the Income Statement.2. The following data refers to the 2021 year-end account balances for Target. However, the Retained Earnings balance is as of 12/31/2020. The accounts are listed in alphabetical order.$Accounts Payable 25,000 Accounts Receivable 16,000 Accumulated Depreciation 175,000Cash 44,000 Common Stock 120,000 Fixed Assets (gross) 390,000 Inventory 135,000 Long Term Debt 111,000 Retained Earnings (2020) 51,992 Salary Payable 11,000arrow_forward

- 1. During 2021, Target Corporation had: Revenue of $623,000 Cost of Goods Sold of $250,000 Operating expenses of $68,000 Interest expense of $4,000 Depreciation Expense of $13,000 During the year Target Corporation paid: 50% of net income in dividends 21% in corporate taxes a. Prepare a multi-step income statement on Sheet 1 of your spreadsheet. Include the dividend and additions to Retained Earnings below the income statement. b. Calculate Target's Operating Cash Flow beneath the Income Statement. 2. The following data refers to the 2021 year-end account balances for Target. However, the Retained Earnings balance is as of 12/31/2020. The accounts are listed in alphabetical order. $ Accounts Payable 25,000 Accounts Receivable 16,000 Accumulated Depreciation 175,000 Cash 44,000 Common Stock 120,000 Fixed Assets (gross) 390,000…arrow_forwardCoronado Ltd. had sales revenue of £ 550,800 in 2022. Other items recorded during the year were: Cost of goods sold £ 336,600 Selling expenses 122,400 Income tax 25,500 Increase in value of employees 15,300 Administrative expenses 10,200 Prepare an income statement for Coronado for 2022. Coronado has 100,000 shares outstanding. (Round earnings per share to 2 decimal places, e.g. 1.48.) CORONADO LTDIncome Statementchoose the accounting period enter an income statement item £ enter a pound amount enter an income statement item enter a pound amount select a summarizing line for the first part enter a total amount for the first part enter an income statement item £ enter a pound amount enter an income statement item enter a pound amount enter a subtotal of the two previous amounts select a summarizing line for the second part enter a total amount for two parts enter an…arrow_forwardMaxwell Corporation reports the following results: Gross income from operations Dividends received from 18%-owned domestic corporation Expenses Maxwell's dividends-received deduction is [Subject:- General Account] $ 80,000 60,000 1,00,000arrow_forward

- Chambliss Corp.'s total assets at the end of last year were $265,000 and its EBIT was 62,500. What was its basic earning power (BEP)? Select the correct answer. a. 22.88% b. 24.28% c. 23.58% d. 24.98% e. 22.18%arrow_forwardWhat is price printing company's return on assets? General accountingarrow_forwardWhat is the return on total assets of this general accounting question?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning