Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Accumulated other comprehensive income??

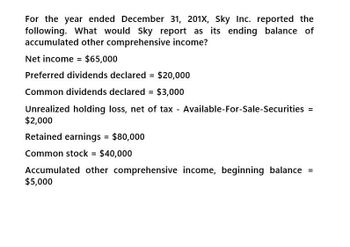

Transcribed Image Text:For the year ended December 31, 201X, Sky Inc. reported the

following. What would Sky report as its ending balance of

accumulated other comprehensive income?

Net income = $65,000

Preferred dividends declared = $20,000

Common dividends declared = $3,000

Unrealized holding loss, net of tax - Available-For-Sale-Securities =

$2,000

Retained earnings = $80,000

Common stock = $40,000

Accumulated other comprehensive income, beginning balance =

$5,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardOn January 1, 2019, Kittson Company had a retained earnings balance of 218,600. It is subject to a 30% corporate income tax rate. During 2019, Kittson earned net income of 67,000, and the following events occurred: 1. Cash dividends of 3 per share on 4,000 shares of common stock were declared and paid. 2. A small stock dividend was declared and issued. The dividend consisted of 600 shares of 10 par common stock. On the date of declaration, the market price of the companys common stock was 36 per share. 3. The company recalled and retired 500 shares of 100 par preferred stock. The call price was 125 per share; the stock had originally been issued for 110 per share. 4. The company discovered that it had erroneously recorded depreciation expense of 45,000 in 2018 for both financial reporting and income tax reporting. The correct depreciation for 2018 should have been 20,000. This is considered a material error. Required: 1. Prepare journal entries to record Items 1 through 4. 2. Prepare Kittsons statement of retained earnings for the year ended December 31, 2019.arrow_forwardAssume that as of January 1, 20Y8, Sylvester Con- suiting has total assets of $500,000 and total assets of $150,000. As of December 31, 20Y8, Sylvester has total liabilities of $200,000 and total stockholders’ equity of $400,000. (a) What was Sylvester’s stockholders’ equity as of January 1, 20Y8? (b) Assume that Sylvester did not pay any dividends during 20Y8. What was the amount of net income for 20Y8?arrow_forward

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardGiven the following year-end information, compute Greenwood Corporations basic and diluted earnings per share. Net income, 15,000 The income tax rate, 30% 4,000 shares of common stock were outstanding the entire year. shares of 10%, 50 par (and issuance price) convertible preferred stock were outstanding the entire year. Dividends of 2,500 were declared on this stock during the year. Each share of preferred stock is convertible into 5 shares of common stock.arrow_forwardFor the year ended December 31, 2025, Sheridan Inc. reported the following: Net income Preferred dividends declared Common dividends declared Unrealized holding loss, net of tax Retained earnings, beginning balance Common stock Accumulated other comprehensive income, beginning balance (net gains) $496000 $1121600 $1036000 $1079800 $1046200 75400 23400 10200 649000 353800 38100 What would Sheridan report as the ending balance of Retained Earnings?arrow_forward

- For the year ended December 31, 2025, Blossom Inc. reported the following: Net income Preferred dividends declared Common dividends declared Unrealized holding loss, net of tax Retained earnings, beginning balance Common stock Accumulated other comprehensive income, beginning balance (net gains) $308000 O $715400 O $686900 O $660100 Ⓒ$654500 50300 10600 5600 413000 201300 25500 What would Blossom report as the ending balance of Retained Earnings?arrow_forwardFor the year ended December 31, 2025, Carla Vista Inc. reported the following: $291000 49000 Net income Preferred dividends declared Common dividends declared Unrealized holding loss, net of tax Retained earnings, beginning balance Common stock Accumulated other comprehensive income. beginning balance (net gains) 9600 O $635400 O $688400 O $629800 O$660200 5600 403000 198800 25600 What would Carla Vista report as the ending balance of Retained Earnings?arrow_forwardN3.arrow_forward

- 6. For the year ended December 31, 2021, Haar Inc. reported the following: Net income $300,000 Preferred dividends declared 50,000 Common dividend declared 10,000 Unrealized holding loss, net of tax 5,000 Retained earnings, beginning balance 400,000 Common stock 200,000 Prepare a Statement of Retained Earnings for Haar for the year ended 12/31/2021.arrow_forwardPlease do not give image formatarrow_forwardThe following is from the 2021 annual report of Kaufman Chemicals, Inc.: Statements of Comprehensive Income Net income Other comprehensive income: Change in net unrealized gains on AFS investments, net of tax of $25, ($13), and $22 in 2021, 2020, and 2019, respectively Other Total comprehensive income Shareholders' equity: Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity Accumulated other comprehensive income, 2020 365 8,777 7,857 119 $17,118 Accumulated other comprehensive income, 2021 Years Ended December 31 2019 365 8,777 7,301 84 $16,527 ($ in millions) 2021 $922 38 (3) Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows: ($ in millions) 2021 2020 $957 2020 $752 (24) (1) $727 $607 Required: 4. From the information provided, determine how Kaufman calculated the $119 million accumulated other comprehensive income in 2021. (Negative…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning