FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

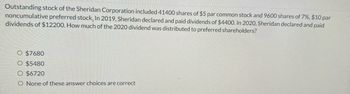

Transcribed Image Text:Outstanding stock of the Sheridan Corporation included 41400 shares of $5 par common stock and 9600 shares of 7%, $10 par

noncumulative preferred stock. In 2019, Sheridan declared and paid dividends of $4400. In 2020, Sheridan declared and paid

dividends of $12200. How much of the 2020 dividend was distributed to preferred shareholders?

O $7680

O $5480

O $6720

O None of these answer choices are correct

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sheffield Inc., has 2300 shares of 5%, $50 par value, cumulative preferred stock and 100000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $4000 dividend in 2019. In 2020, $21900 of dividends are declared and paid. What are the dividends received by the common stockholders in 2020? $5750 $11500 $14400 $7500arrow_forwardDedrick Inc. did not pay dividends in 2018 or 2019, even though 60,000 shares of its 7.5%, $50 par value cumulative preferred stock were outstanding during those years. The company has 900,000 shares of $2 par value common stock outstanding. Required: a. Calculate the annual dividend per share obligation on the preferred stock. (Round your answer to 2 decimal places.) b. Calculate the amount that would be received by an investor who has owned 3,100 shares of preferred stock and 29,000 shares of common stock since 2017 if a $0.40 per share dividend on the common stock is paid at the end of 2020. (Do not round intermediate calculations.) a. b. Annual dividend per share Total dividends received $ 3.75arrow_forwardOn December 31st, 2022 Czervik Construction had 60,000 shares of $50 par value common stock outstanding. On January 1st, 2020, Czervik issued 30,000 shares of $100 par value, 4% cumulative preferred stock. Czervik did not declare dividends in 2020. Czervik declared $220,000 of total dividends in 2021. Czervik declared $220,000 of total dividends in 2022. What was the amount of dividends received by common shareholders in 2022? Correct answer is $80,000 Please, explain every steparrow_forward

- Can you please help me?arrow_forwardSplish Brothers Inc. has 10,800 shares of 8%, $100 par value, cumulative preferred stock outstanding at December 31, 2022. No dividends were declared in 2020 or 2021.If Splish Brothers wants to pay $395,000 of dividends in 2022, what amount of dividends will common stockholders receive? Dividends allocated to common stock $enter Dividends allocated to common stock in dollarsarrow_forwardBABA Company has 2,000 shares of 5%, P100 par non-cumulative preference share outstanding at December 31, 2020. No dividends have been paid on this share for 2019 or 2020. Compute the dividends in arrears at December 31, 2020.a. 0b. 120,000c. 360,000d. 480,000arrow_forward

- Current Attempt in Progress Your answer is incorrect. At January 1, 2020, Larkspur Company's outstanding shares included the following. 258,000 shares of $50 par value, 7% cumulative preferred stock 812,000 shares of $1 par value common stock Net income for 2020 was $2,521,000. No cash dividends were declared or paid during 2020. On February 15, 2021, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2020. On April 1, 2020, 408,000 shares of common stock were sold for $10 per share, and on October 1, 2020, 106,000 shares of common stock were purchased for $20 per share and held as treasury stock. Compute earnings per share for 2020. Assume that financial statements for 2020 were issued in March 2021. (Round answer to 2 decimal places, e.g. $2.55.) Earnings per share $arrow_forwardNathan's Athletic Apparel has 1,100 shares of 6%, $100 par value preferred stock the company issued at the beginning of 2020. All remaining shares are common stock. The company was not able to pay dividends in 2020, but plans to pay dividends of $15,000 in 2021.1. & 2. How much of the $15,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2021, assuming the preferred stock is cumulative? What if the preferred stock were noncumulative?arrow_forwardOutstanding stock of the Nash's Trading Post, LLC included 30000 shares of $5 par common stock and 8000 shares of 5%, $10 par non-cumulative preferred stock. In 2019, Nash's declared and paid dividends of $3000. In 2020, Nash's declared and paid dividends of $9000. How much of the 2020 dividend was distributed to preferred shareholders? $5000. $7000. $4000. None of these answer choices are correct.arrow_forward

- At December 31, 2019, Coriander Corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 108,382 shares $10,838,200 Common stock, $5 par, 4,028,120 shares 20,140,600 During 2020, Coriander did not issue any additional common stock. The following also occurred during 2020. Income from continuing operations before taxes $23,047,100 Discontinued operations (loss before taxes) $3,399,700 Preferred dividends declared $1,083,820 Common dividends declared $2,390,900 Effective tax rate 35 % Compute earnings per share data as it should appear in the 2020 income statement of Coriander Corporation.arrow_forwardQuestion-based on, "Preferred shareholders". I have tried it but no luck so far. Any help would be appreciated.arrow_forwardQuestion-based on, "Distributed to preferred stockholders". I have tried it but no correct yet. Any help would be appreciated.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education