FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Earnings Per Share

<<

LA

+A

$

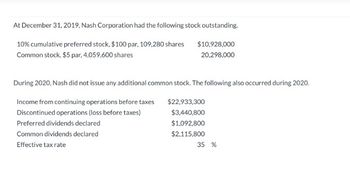

Transcribed Image Text:At December 31, 2019, Nash Corporation had the following stock outstanding.

10% cumulative preferred stock, $100 par, 109,280 shares

$10,928,000

Common stock, $5 par, 4,059,600 shares

20,298,000

During 2020, Nash did not issue any additional common stock. The following also occurred during 2020.

Income from continuing operations before taxes

$22,933,300

Discontinued operations (loss before taxes)

$3,440,800

$1,092,800

$2,115,800

Preferred dividends declared

Common dividends declared

Effective tax rate

35 %

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At January 1, 2020, Teal Company’s outstanding shares included the following. 276,000 shares of $50 par value, 6% cumulative preferred stock 940,000 shares of $1 par value common stock Net income for 2020 was $2,512,000. No cash dividends were declared or paid during 2020. On February 15, 2021, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2020.On April 1, 2020, 408,000 shares of common stock were sold for $10 per share, and on October 1, 2020, 112,000 shares of common stock were purchased for $21 per share and held as treasury stock.Compute earnings per share for 2020. Assume that financial statements for 2020 were issued in March 2021. (Round answer to 2 decimal places, e.g. $2.55.) Earnings per share $arrow_forwardAt December 31, 2021 and 2020, P Co. had 50,000 shares of common stock and 5,000 shares of 5%, $100 par value cumulative preferred stock outstanding. No dividends were declared on either the preferred or common stock in 2021 or 2020. Net income for 2021 was $500,000. For 2021, basic earnings per common share amounted to:arrow_forwardAt January 1, 2020, Wildhorse Company's outstanding shares included the following. 300,000 shares of $50 par value, 7% cumulative preferred stock 959,000 shares of $1 par value common stock 4 Net income for 2020 was $2,565,000. No cash dividends were declared or paid during 2020. On February 15, 2021, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2020. On April 1, 2020, 476,000 shares of common stock were sold for $10 per share, and on October 1, 2020, 102,000 shares of commor stock were purchased for $20 per share and held as treasury stock. Compute earnings per share for 2020. Assume that financial statements for 2020 were issued in March 2021. (Round answer to 2 decimal places, e.g. $2.55.) Earnings per share Asintance Issarrow_forward

- On January 1, 2020, Kingbird Corporation had $2,090,000 of $10 par value common stock outstanding that was issued at par and retained earnings of $1,180,000. The company issued 220,000 shares of common stock at $12 per share on July 1. On December 15, the board of directors declared a 15% stock dividend to stockholders of record on December 31, 2020, payable on January 15, 2021. The market value of Kingbird Corporation stock was $15 per share on December 15 and $16 per share on December 31. Net income for 2020 was $515,000. (a1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation July 1 Cash Dec. 15 く…arrow_forwardOn January 1, 2020, Windsor Corporation had $2,000,000 of $10 par value common stock outstanding that was issued at par and retained earnings of $1,040,000. The company issued 235,000 shares of common stock at $12 per share on July 1. On December 15, the board of directors declared a 15% stock dividend to stockholders of record on December 31, 2020, payable on January 15, 2021. The market value of Windsor Corporation stock was $15 per share on December 15 and $16 per share on December 31. Net income for 2020 was $535,000. (a1) Journalize the issuance of stock on July 1 and the declaration of the stock dividend on December 15. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation July 19 Dec 15 Debitarrow_forwardAt December 31, 2018, Western Corporation had 40,000 shares outstanding of $90 par value common stock. The shares were originally issued for $252 per share. On January 1, 2019, Pacific split its common stock 3 for 1 with a corresponding reduction in the stock's par value. After the split, the balance of the common stock paid-in-capital account is: 1. $18,000,000 2. $10,080,000 3. $10,800,000 4. $ 3,600,000arrow_forward

- At December 31, 2024, Oriole Corporation had the following stock outstanding. 10% cumulative preferred stock, $100 par, 109,261 shares Common stock, $5 par, 4,099,840 shares Income from continuing operations before taxes Discontinued operations (loss before taxes) Preferred dividends declared Common dividends declared During 2025, Oriole did not issue any additional common stock. The following also occurred during 2025. Effective tax rate $10,926,100 20,499,200 Earnings Per Share $24,649,800 3,399,100 1,092,610 2,322,900 35% Compute earnings per share data as it should appear in the 2025 income statement of Oriole Corporation. (Round answers to 2 decimal places, e.g. 1.48.)arrow_forwardAssume TRI reported income from operations of $2,477,760 (inclusive of a loss from discontinued operations of $391,200) in 2021. It did not declare any common dividends during the year. However it did declare and pay preferred dividends of $600,000 on December 20, 2021. It began the year with 132,000 common shares outstanding and issued 720,000 common shares on April 1. On June 15 a 20% stock dividend was declared and distributed. On November 1, it repurchased 144,000 shares and cancelled them. Determine the company’s basic EPS from continuing operations for the year. Select one: a. $4.76. b. $2.90. c. $3.17. d. $2.84. e. $3.40.arrow_forwardOn December 31, 2019, Shoreline Hotel Inc.., reported its shareholders' equity as follows: Common shares, no par value, authorized 200,000 shares issued and outstanding 120,000 shares $1,350,000 Retained earnings 700,000 Total shareholders' equity $2,050,000 On January 1, 2020, it declared a 10% stock dividend on its common shares when the market value of the common shares was $22 per share before market adjustment (ie: prior to ex-dividend value). What was the effect on Shoreline’s retained earnings as a result of the above transaction? Select one: a. $264,000 decrease . b. $135,000 decrease . c. $400,000 increase. d. $240,000 increase. e. None of the above answers.arrow_forward

- Sunland Rental Corporation had the following balances in its shareholders' equity accounts at January 1, 2021: Accumulated other comprehensive income (loss) Contributed surplus-reacquisition of common shares Retained earnings Common shares (25,000 shares) Feb. 2 Sunland had the following transactions and events during 2021: Apr. 17 Oct. 29 $ (26,000) Dec. 31 559,000 1,600,000 625.000 Repurchased 1.200 shares for $57,600. Declared and paid cash dividends of $71,000. Issued 1,900 shares for $106,000 cash. Reported comprehensive income of $415,000, which included other comprehensive income of $31.000.arrow_forwardBramble Corp. reported the following balances at December 31, 2021: common stock $408,000, paid-in Capital in Excess of Par- common stock $106,000, and retained earnings $242,000. During 2022, the following transactions affected stockholders' equity. 1. 2. 3. 4. Issued preferred stock with a par value of $128,500 for $209,000. Purchased treasury stock (common) for $36,500. Earned net income of $135,000. Declared and paid cash dividends of $52,500. Prepare the stockholders' equity section of Bramble Corp's December 31, 2022, balance sheet.arrow_forwardCurrent Attempt in Progress Your answer is incorrect. At January 1, 2020, Larkspur Company's outstanding shares included the following. 258,000 shares of $50 par value, 7% cumulative preferred stock 812,000 shares of $1 par value common stock Net income for 2020 was $2,521,000. No cash dividends were declared or paid during 2020. On February 15, 2021, however, all preferred dividends in arrears were paid, together with a 5% stock dividend on common shares. There were no dividends in arrears prior to 2020. On April 1, 2020, 408,000 shares of common stock were sold for $10 per share, and on October 1, 2020, 106,000 shares of common stock were purchased for $20 per share and held as treasury stock. Compute earnings per share for 2020. Assume that financial statements for 2020 were issued in March 2021. (Round answer to 2 decimal places, e.g. $2.55.) Earnings per share $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education