FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

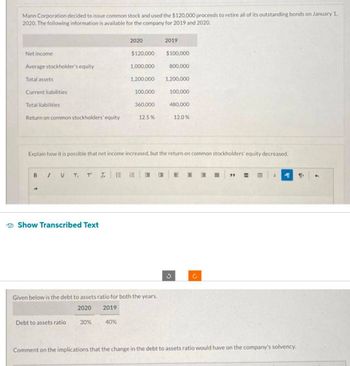

Transcribed Image Text:Mann Corporation decided to issue common stock and used the $120,000 proceeds to retire all of its outstanding bonds on January 1,

2020. The following information is available for the company for 2019 and 2020.

Net income

Average stockholder's equity

Total assets

Current liabilities

Total liabilities

Return on common stockholders' equity

В / у T, T I.

Show Transcribed Text

Debt to assets ratio

2020

30%

$120,000

40%

100,000

1,000,000

1,200,000 1,200,000

360,000

Given below is the debt to assets ratio for both the years.

2020

2019

12.5%

2019

Explain how it is possible that net income increased, but the return on common stockholders' equity decreased.

$100,000

800,000

100,000

480,000

12.0%

J

E H 3

C

EEE

MT 1

Comment on the implications that the change in the debt to assets ratio would have on the company's solvency.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,425,000, $145,000 in the common stock account, and $2,700,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,630,000, $155,000 in the common stock account and $3,000,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $96,500 and the company paid out $150,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,010,000, and the firm reduced its net working capital investment by $130,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32.arrow_forwardPlease answer in good accounting form. Thankyou What is the retained earnings balance ending December 31, 2021?arrow_forward(Figures in $ millions) Assets 2021 2022 Liabilities and Shareholders' Equity 2021 2022 Current assets $ 310 $ 420 Current liabilities $ 210 $ 240 Net fixed assets 1,200 1,420 Long-term debt 830 920 Required: a&b. What was shareholders’ equity at the end of 2021 and 2022? c. If Newble paid dividends of $100 million in 2022 and made no stock issues, what must have been net income during the year? d. If Newble purchased $300 million in fixed assets during 2022, what must have been the depreciation charge on the income statement? e. What was the change in net working capital between 2021 and 2022? f. If Newble issued $200 million of new long-term debt, how much debt must have been paid off during the yeararrow_forward

- Rogers corporation reported basic earnings per share of $1.25 for the year ended December 31, 2019. Rogers had 8000 shares of cumulative, non-convertible $100 par, 12% preferred stock outstanding during all of 2019. The company began 2019 with 200,000 shares of common stock outstanding and ended the year with 400,000 share of common stock outstanding, due to issuing 200,000 shares on july 1, 2019. determine rodgers net income for 2019?arrow_forwardSunland Rental Corporation had the following balances in its shareholders' equity accounts at January 1, 2021: Accumulated other comprehensive income (loss) Contributed surplus-reacquisition of common shares Retained earnings Common shares (25,000 shares) Feb. 2 Sunland had the following transactions and events during 2021: Apr. 17 Oct. 29 $ (26,000) Dec. 31 559,000 1,600,000 625.000 Repurchased 1.200 shares for $57,600. Declared and paid cash dividends of $71,000. Issued 1,900 shares for $106,000 cash. Reported comprehensive income of $415,000, which included other comprehensive income of $31.000.arrow_forwardThe Gangnam Company began operations in January 2019 and reported the following results for each of its three years of operations. 2019 – P520,000 loss; 2020 – P80,000 loss; 2021 – P1,600,000 profit At December 31, 2020, Gangnam Company’s capital accounts were as follows: 8% Cumulative Preference Share Capital, P100 par, 50,000 shares authorized, issued and outstanding- P5,000,000; Ordinary Share Capital, P10 par, 1,000,000 shares authorized, 750,000 shares issued and outstanding- P7,500,000 Gangnam Company has never paid a cash or bonus issue and there has been no change in its capital accounts since it began operations in 2019. The corporation law permits dividends only from retained earnings.What is the book value of the ordinary share at December 31, 2020 assuming that the preference share has a liquidating value of P106 per share?arrow_forward

- 6arrow_forwardThe December 31, 2021, balance sheet of Chen, Incorporated, showed long-term debt of $1,460,000, $152,000 in the common stock account, and $2,770,000 in the additional paid-in surplus account. The December 31, 2022, balance sheet showed long-term debt of $1,700,000, $162,000 in the common stock account and $3,070,000 in the additional paid-in surplus account. The 2022 income statement showed an interest expense of $100,000 and the company paid out $157,000 in cash dividends during 2022. The firm's net capital spending for 2022 was $1,080,000, and the firm reduced its net working capital investment by $137,000. What was the firm's 2022 operating cash flow, or OCF? Note: A negative answer should be indicated by a minus sign. Do not round intermediate calculations and round your answer to the nearest whole number, e.g., 32. Operating cash flow Prev 9 of 10 ▬▬▬ ‒‒‒ Next >arrow_forwardRancho Cucamonga, Inc. presents the following excerpts from its December 31, 2020 balance sheet: Long-Term Liabilities: Note payable, 8% $200,000 Bonds payable, 10% 1,000,000 Shareholders’ Equity Common stock, par 50,000 Additional paid-in-capital, common stock 350,000 Total contributed capital 400,000 Retained earnings 250,000 Total shareholders’ equity 650,000 The accounting department also conveys the following information: Risk-free rate of return - 3% Risk premium - 4.05% Tax rate – 30% Requirement: Compute Rancho Cucamonga’s weighted average cost of capital.arrow_forward

- Do not use Aiarrow_forwardJakarta Corporation decided to issue common stock and used the $120,000 proceeds to retire all of its outstanding bonds on January 1, 2021. The following information is available for the company for 2020 and 2021. 2021 2020 Net income $120,000 $100,000 Average stockholders' equity 1,000,000 800,000 Total assets 1,200,000 1,200,000 Current liabilities 100,000 100,000 Total liabilities 360,000 480,000 Instructions(1) Compute the return on common stockholders' equity for both years.(2) Explain how it is possible that net income increased, but the return on common stockholders' equity decreased.(3) Compute the debt to assets ratio for both years, and comment on the implications of this change in the company's solvency.arrow_forwardTamarisk Corporation's adjusted trial balance contained the following accounts at December 31, 2020: Retained Earnings $126,000, Common Stock $765,600, Bonds Payable $109,700, Paid-in Capital in Excess of Par-Common Stock $208,700, Goodwill $59,300, Accumulated Other Comprehensive Loss $154,700, and Noncontrolling Interest $34,200. Prepare the stockholders' equity section of the balance sheet.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education