FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

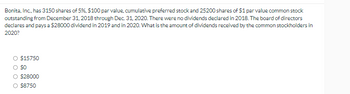

Transcribed Image Text:Bonita, Inc., has 3150 shares of 5%, $100 par value, cumulative preferred stock and 25200 shares of $1 par value common stock

outstanding from December 31, 2018 through Dec. 31, 2020. There were no dividends declared in 2018. The board of directors

declares and pays a $28000 dividend in 2019 and in 2020. What is the amount of dividends received by the common stockholders in

2020?

$15750

O $0

O $28000

O $8750

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- Ivanhoe, Inc. has $500,000, $0.50, no par value preferred shares (50,000 shares) and $1,000,000 of no par value common shares outstanding (80,000 shares). No dividends were paid or declared during 2018 and 2019. The company wants to distribute $308,000 in dividends on December 31, 2020. Calculate the amount of dividends to be paid to each group of shareholders (i.e. preferred and common), assuming the preferred shares are non-cumulative and non-participating. Preferred Common Total dividends $ $ Please help wiith solution steps in excelarrow_forwardSheffield Inc., has 2300 shares of 5%, $50 par value, cumulative preferred stock and 100000 shares of $1 par value common stock outstanding at December 31, 2019, and December 31, 2020. The board of directors declared and paid a $4000 dividend in 2019. In 2020, $21900 of dividends are declared and paid. What are the dividends received by the common stockholders in 2020? $5750 $11500 $14400 $7500arrow_forwardAt December 31, 2018, Western Corporation had 40,000 shares outstanding of $90 par value common stock. The shares were originally issued for $252 per share. On January 1, 2019, Pacific split its common stock 3 for 1 with a corresponding reduction in the stock's par value. After the split, the balance of the common stock paid-in-capital account is: 1. $18,000,000 2. $10,080,000 3. $10,800,000 4. $ 3,600,000arrow_forward

- Stanley Company has 18,000 outstanding shares of $25 par, 6.25% preferred stock, and 22,000 shares of $3 par value common stock. The Board of Directors declared and paid the following dividends: $20,000 in 2021, $30,000 in 2022, and $200,000 in 2023. 1. 2. Calculate the total amount of dividends allocated to both preferred and common shareholders in 2023 for the following type of preferred stock: noncumulative and participating. Show calculations and label answers (yellow highlight). Same as above except calculate the dividends allocated to both preferred and common shareholders in 2023 for the following type of preferred stock: cumulative and nonparticipating. Show calculations and label answers (yellow highlight).arrow_forwardOn December 31st, 2022 Czervik Construction had 60,000 shares of $50 par value common stock outstanding. On January 1st, 2020, Czervik issued 30,000 shares of $100 par value, 4% cumulative preferred stock. Czervik did not declare dividends in 2020. Czervik declared $220,000 of total dividends in 2021. Czervik declared $220,000 of total dividends in 2022. What was the amount of dividends received by common shareholders in 2022? Correct answer is $80,000 Please, explain every steparrow_forwardCan you please help me?arrow_forward

- XYZ CO. had 200 shares of common stock outstanding 12 31, 2020. July 1, 2021 xyz issued 52 shares for cash. On January 1, 2021 xyz issued 22 shares of convertible preferred stock. The preferred stock had a par value of shares $100 per share and paid 6% dividend. Each share of preferred stock is convertible into 9 shares of common. During 2021 xyz paid regular dividend on the preferred and common stock. Net income was 320 Calculate xyz basic and diluted earning per share 2021.arrow_forwardThe stockholders’ equity section of Maria Corporation at December 31, 2020, included the following: 6% preferred stock, $100 par value, cumulative,10,000 shares authorized, 8,000 shares issued and outstanding. $800,000 Common stock, $10 par value, 250,000 shares authorized,200,000 shares issued and outstanding $2,000,000 Dividends were not declared on the preferred stock in 2020 and are in arrears. On September 15, 2021, the board of directors of Maria Corporation declared dividends on the preferred stock for 2020 and 2021, to stockholders of record on October 1, 2021, payable on October 15, 2021. On November 1, 2021, the board of directors declared a $.50 per share dividend on the common stock, payable November 30, 2021, to stockholders of record on November 15, 2021. Prepare the journal entries that should be made by Maria Corporation on the dates indicated below: September 15, 2021 November 1, 2021 October…arrow_forwardNathan's Athletic Apparel has 1,700 shares of 5%, $100 par value preferred stock the company issued at the beginning of 2020. All remaining shares are common stock. The company was not able to pay dividends in 2020, but plans to pay dividends of $18,000 in 2021.Required:1. & 2. How much of the $18,000 dividend will be paid to preferred stockholders and how much will be paid to common stockholders in 2021, assuming the preferred stock is cumulative? What if the preferred stock were noncumulative? Please don't provide answer in image format thank youarrow_forward

- Splish Brothers Inc. has 10,800 shares of 8%, $100 par value, cumulative preferred stock outstanding at December 31, 2022. No dividends were declared in 2020 or 2021.If Splish Brothers wants to pay $395,000 of dividends in 2022, what amount of dividends will common stockholders receive? Dividends allocated to common stock $enter Dividends allocated to common stock in dollarsarrow_forwardVishalarrow_forwardAn excerpt from the financial records of Windle Inc. (Windle) at December 31, 2019, was as follows: Preferred shares, Series A, $5, cumulative, 60,000 shares issued and outstanding $ 6,000,000 Preferred shares, Series B, $6.50, non-cumulative, 40,000 shares issued and outstanding $ 4,000,000 Common shares, 1,800,000 shares issued and outstanding $25,400,000 The following common share transactions took place in 2020: April 1: Windle issued 200,000 common August 31: Windle repurchased and cancelled 60,000 common October 31: Windle issued 100,000 common shares. Additional information: Windle’s net income for the year ended December 31, 2020, was $17,600,000. Dividends on preferred shares in arrears and for the current year were declared in full on December 15, 2020 (dividends on preferred shares were in arrears and had last been declared in full on December 15, 2018). Windle is subject to tax at a rate of 30%, and reports under Required: Calculate Windle’s…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education