Survey of Accounting (Accounting I)

8th Edition

ISBN: 9781305961883

Author: Carl Warren

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

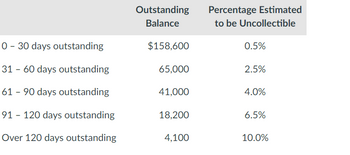

Balance required in allowance for expected credit losses account

Transcribed Image Text:Outstanding

Balance

Percentage Estimated

to be Uncollectible

0 30 days outstanding

$158,600

0.5%

-

31 60 days outstanding

65,000

2.5%

-

61 90 days outstanding

41,000

4.0%

91 120 days outstanding

18,200

6.5%

Over 120 days outstanding

4,100

10.0%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Nonearrow_forwardеВook Wind turbine capital investment analysis Central Plains Power Company is considering an investment in wind farm technology to reduce its use of natural gas. Initial installation costs are expected to be $1,200 per kilowatt-hour of capacity. The wind turbine has a capacity of generating megawatts per hour. A kilowatt-hour is 1,000 watts generated per hour and a megawatt hour is 1,000 kilowatts generated per hour. Annual operating information related to the wind turbine project was developed as follows: Wind capacity factor 25 %* Operating cost per wind turbine megawatt hour $10 Variable operating, fuel, and maintenance costs per natural gas megawatt hour $95 Days per year 365 *A factor that measures the reduction from full capacity due to the variability of wind a. Determine the initial investment cost of the wind turbine. $ 2,400,000 v b. Determine the annual cost savings from the wind turbine in replacing natural gas generation. Round to nearest whole dollar. c. Determine the…arrow_forwardReference Present Value of $1 12% 14% 16% 18% 20% Periods 1% 2% 3% 4% Period 1 0.990 0.980 0.971 0.962 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 5% 6% 8% 10% 0.952 0.943 0.926 0.909 0.893 0.877 0.862 0.847 0.833 0.980 0.961 0.943 0.925 0.907 0.890 0.857 0.826 0.797 0.826 0.797 0.769 0.743 0.718 0.694 0.971 0.942 0.915 0.889 0.864 0.840 0.794 0.751 0.712 0.675 0.641 0.609 0.579 0.961 0.924 0.888 0.855 0.823 0.792 0.735 0.683 0.636 0.592 0.552 0.516 0.482 0.951 0.906 0.863 0.822 0.784 0.747 0.681 0.621 0.567 0.519 0.476 0.437 0.402 0.942 0.888 0.837 0.790 0.746 0.705 0.630 0.564 0.507 0.456 0.410 0.370 0.335 0.933 0.871 0.813 0.760 0.711 0.665 0.583 0.513 0.452 0.400 0.354 0.314 0.279 Period 8 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 0.351 0.305 0.266 0.233 Period 9 0.914 0.837 0.766 0.703 0.645 0.592 0.500 0.703 0.645 0.592 0.500 0.424 0.361 0.308 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.463 0.386 0.322 0.270 0.227 0.191 0.162 Period 11…arrow_forward

- 2013 2014 Sales$4,500 $4,775 Depreciation7501050COGS24222430Interest180215Cash200400Accts Receivables200300Notes Payable100150Long-term debt29561850Net fixed assets80009200Accounts Payable50100Inventory18001600Dividends225275Tax rate35%35% 1. What is the cash flow from operating activities? 2. What is the cash flow from financing activities? What is the days sales in accounts receivable or the AR period?arrow_forwardAjax Corporation has hired Brad O'Brien as its new president. Terms included the company's agreeing to pay retirement benefits of $18,600 at the end of each semiannual period for 10 years. This will begin in 3,285 days. If the money can be invested at 8% compounded semiannually, what must the company deposit today to fulfill its obligation to Brad? (Please use the following provided Table and Table 12.3.) (Use 365 days a year. Do not round intermediate calculations. Round your answer to the nearest cent.) Deposit amount 124,779.35arrow_forwardNonearrow_forward

- Present value of $1 Periods 4% 6% 8% 10% 12% 14% 1 0.96154 0.94340 0.92593 0.90909 0.89286 0.87719 2 0.92456 0.89000 0.85734 0.82645 0.79719 0.76947 3 0.88900 0.83962 0.79383 0.75131 0.71178 0.67497 4567899 0.85480 0.79209 0.73503 0.68301 0.63552 0.59208 0.82193 0.74726 0.68058 0.62092 0.56743 0.51937 0.79031 0.70496 0.63017 0.56447 0.50663 0.45559 0.75992 0.66506 0.58349 0.51316 0.45235 0.39964 0.73069 0.62741 0.54027 0.46651 0.40388 0.35056 0.70259 0.59190 0.50025 0.42410 0.36061 0.30751 10 0.67556 0.55839 0.46319 0.38554 0.32197 0.26974 Present value of an annuity of $1 Periods 4% 6% 8% 10% 12% 14% 1 0.96154 0.94340 0.92593 0.90909 0.89286 0.87719 2 1.88609 1.83339 1.78326 1.73554 1.69005 1.64666 3 2.77509 2.67301 2.57710 2.48685 2.40183 2.32163 45678 3.62990 3.46511 3.31213 3.16987 3.03735 2.91371 4.45182 4.21236 3.99271 3.79079 3.60478 3.43308 5.24214 4.91732 4.62288 4.35526 4.11141 3.88867 6.00205 5.58238 5.20637 4.86842 4.56376 4.28830 6.73274 6.20979 5.74664 5.33493 4.96764…arrow_forward9arrow_forwardRevenue 11,600,000ExpensesSalaries & Wages 7,600,000Employer NIS Contribution 1,400,000Rent and Rates 2.400,000Interest 500,000Maintenance 120,000Depreciation 550,000Loss on Disposal of Vehicle 80,000Telephone 235,000Electricity 255,000General Expenses 700,000Donations 85,000Provision for Bad Debts 80,000Fines and Penalties 115,000Drawings 105,000 14,225,000Net Loss2,625,000 Notes to the Income Statement1. $55,000 of the drawings relate to Mrs. Shine and $50,000 to Mr. Rain2. Gross Salary for Mrs. Shine was $250,000 per month, and $200,000 for Mr. Rain. Bothpartners worked in the business during the year.3. The annual allowance was $450,000.4. The partners agreed to dispose of an old pick-up truck with a net book value of $350,000for $400,000. The pick-up had a tax written down value of $300,000.5. Donations of $60,000 were made to a local political party to fund its campaign. Theremainder was donated to an approved local children’s home.6. The partners could not determine if all…arrow_forward

- Please need answers for attached questions as excel formulas with explantion Thanks :Darrow_forwardNeed answer the accounting question please solve this problemarrow_forwardCompany C had the following investment. Help them determine the financial statement implications of the investment. Tax rate Estimated tax payment 21% 21,000 Investment cost and ending fair values for 20X1 and 20X2: 20X1 20X2 Cost Fair value Total gain 100,000 110,000 10,000 100,000 134,000 34,000 20X1 income statement information: Sales Expenses 1,670,200 1,536,600 Assuming the investement is short-term, what is the deferred taxes payable on the 20X1 balance sheet?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning