Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Solve

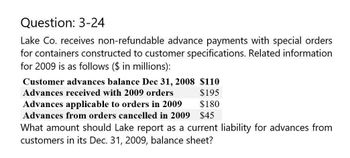

Transcribed Image Text:Question: 3-24

Lake Co. receives non-refundable advance payments with special orders

for containers constructed to customer specifications. Related information

for 2009 is as follows ($ in millions):

Customer advances balance Dec 31, 2008 $110

Advances received with 2009 orders

Advances applicable to orders in 2009

$195

$180

Advances from orders cancelled in 2009 $45

What amount should Lake report as a current liability for advances from

customers in its Dec. 31, 2009, balance sheet?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- M Corp. receives advance payments with special orders for containers constructed to customer specifications. Related information for 2022 is as follows ($ in millions): Customer advances balance, Dec. 31, 2021 $ 100 Advances received with 2022 orders 204 Advances applicable to orders shipped in 2022 189 Advances from orders canceled in 2022 53 What amount should M Corp. report as a current liability for advances from customers in its December 31, 2022, balance sheet? Multiple Choice $62 million. $0. $304 million. $115 million.arrow_forwardBrief Exercise 8-4 (Part Level Submission) At the end of 2019, Sheffield Corp. has accounts receivable of $739,200 and an allowance for doubtful accounts of $67,900. On January 24, 2020, the company learns that its receivable from Megan Gray is not collectible, and managernent authorizes a write-off of $6,500. > (a) v (b) X Your answer is incorrect. Try again. What is the cash realizable value of the accounts receivable (1) before the write-off and (2) after the write-off? Before Write-Off After WWrite-Off Cash realizable value 671100 671100 SHOW LIST OF ACCOUNTSarrow_forwardProblem 6-6 (AICPA Adapted) On January 1, 2021, Remarkable Company had the following account balances: Note receivable from sale of an idle building Note receivable from an officer 7,500,000 2,000,000 The P7,500,000 note receivable is dated May 1, 2020, bears interest at 9% and represents the balance of the consideration received from the sale of an idle building to Solid Company. Principal payments of P2,500,000 plus interest are due annually beginning May 1, 2021. Solid Company made the first principal and interest payment on May 1, 2021. The P2,000,000 note receivable is dated December 31, 2018, bears interest at 8% and is due on December 31, 2023. The note is due from the president of Remarkable Company. Interest is payable annually on December 31 and all interest payments were made through December 31, 2021. On July 1, 2021, Remarkable Company sold a parcel of land to Boom Company for P4,000,000 under an installment sale contract. Boom Company made a P1,200,000 cash down payment…arrow_forward

- Problem 6-6 (AICPA Adapted) On January 1, 2021, Remarkable Company had the following account balances: Note receivable from sale of an idle building Note receivable from an officer 7,500,000 2,000,000 The P7,500,000 note receivable is dated May 1, 2020, bears interest at 9% and represents the balance of the consideration received from the sale of an idle building to Solid Company. Principal payments of P2,500,000 plus interest are due annually beginning May 1, 2021. Solid Company made the first principal and interest payment on May 1, 2021. The P2,000,000 note receivable is dated December 31, 2018, bears interest at 8% and is due on December 31, 2023. The note is due from the president of Remarkable Company. Interest is payable annually on December 31 and all interest payments were made through December 31, 2021. On July 1, 2021, Remarkable Company sold a parcel of land to Boom Company for P4,000,000 under an installment sale contract. Boom Company made a P1,200,000 cash down payment…arrow_forwardSh11arrow_forwardAnswer 1 to 4arrow_forward

- Problem 4-10 (AICPA Adapted) Rapture Company had the following information for eurrent year relating to accounta receivable: 13000 50000 4.750.000 125.000 Accounts receivable, January 1 Credit eales Collectiona from customers, excluding recovery Accounta written off Collection of accounta written off in prior year. customer credit waa not reestablished Eatimated uncollectible receivables per aging at December 31 25.000 165 000 What is the balance of accounta receivable, before allowane for doubtful accounts, on December 317 a. 1,825,000 b. 1,850,000 c. 1,950,000 d. 1,990,000arrow_forwardPlease answer question correctlyarrow_forwardp33arrow_forward

- Problem 10. The balance in Kalanchoe Co.'s accounts payable account at December 31, 2021 was P1,350,000 before any necessary adjustments relating to the following: • Goods were in transit to Kalanchoe from a vendor on December 31, 2021. The invoice cost was P75,000. The goods were shipped FOB shipping point on December 29, 2021 and were received on January 2, 2022. • Goods shipped FOB destination on December 31, 2021 from a vendor to Kalanchoe were received on January 6, 2022. The invoice cost was P37,500. • On December 27, 2021, Kalanchoe wrote and recorded checks totaling P60,000 which were mailed on January 10, 2022. In Kalanchoe's December 31, 2021 statement of financial position, how much should be the accounts payable?arrow_forwardProblem 7: Purple Company showed the following balances on December 31, 2019: 2,000,000 (60,000) Accounts receivable Allowance for doubtful accounts The following transactions transpired during the year 2020: a. On May 1, received a P300,000, six month, 12% interest bearing note from MN, a customer, in settlement of account. b. On June 30, Purple Company factored P400,000, of its accounts receivable to a finance company. The finance company charged a factoring fee of 5% of the accounts factored and withheld 20% of the amounts factored. c. On August 1, discounted the MN note at the bank at 15%. d. On November 1, MN defaulted on the P300,000 note. Purple Company paid the bank the total amount due plus a P12,000. protest fee and other bank charges. e. On December 31, Purple Company assigned P600,000 of its accounts receivable to a bank under a non-notification basis. The bank advanced 80% less a service fee of 5% of the accounts assigned. Purple Company signed a promissory note for the…arrow_forwardThe Delivery Equipment account of Freedom Company showed the following details for 2022:Delivery Equipment01.01.22 Balance 1,500,00001.15 5,000 08.30 225,00009.30 535,000 10.31 180,000 Your examination disclosed the following:a. The P5,000 charged to the Delivery Equipment account on January 15, 2022 represents paymentof LTO registration fees for the company’s delivery equipment for the year 2022.b. The company bought a second-hand delivery truck on September 30 for P535,000, whichincludes P35,000 worth of comprehensive insurance for one year effective October 1, 2022.c. The company wrote-off a fully depreciated truck with an original cost of P225,000 on August 30;further verification disclosed that this truck is still being used by the company.d. The credit of P180,000 on October 31 represents proceeds from sale of one truck costingP350,000, which is 50% depreciated as of December 31, 2021.e. There is only one entry made to the Accumulated Depreciation account during 2022, a debit…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning