FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Present value of $1

Periods

4%

6%

8%

10%

12%

14%

1

0.96154

0.94340

0.92593

0.90909

0.89286

0.87719

2

0.92456

0.89000

0.85734

0.82645

0.79719

0.76947

3

0.88900

0.83962

0.79383

0.75131

0.71178

0.67497

4567899

0.85480

0.79209

0.73503

0.68301

0.63552

0.59208

0.82193

0.74726

0.68058

0.62092

0.56743

0.51937

0.79031

0.70496

0.63017

0.56447

0.50663

0.45559

0.75992

0.66506

0.58349

0.51316

0.45235

0.39964

0.73069

0.62741

0.54027

0.46651

0.40388

0.35056

0.70259

0.59190

0.50025

0.42410

0.36061

0.30751

10

0.67556

0.55839

0.46319

0.38554

0.32197

0.26974

Present value of an annuity of $1

Periods

4%

6%

8%

10%

12%

14%

1

0.96154

0.94340

0.92593

0.90909

0.89286

0.87719

2

1.88609

1.83339

1.78326

1.73554

1.69005

1.64666

3

2.77509

2.67301

2.57710

2.48685

2.40183

2.32163

45678

3.62990

3.46511

3.31213

3.16987

3.03735

2.91371

4.45182

4.21236

3.99271

3.79079

3.60478

3.43308

5.24214

4.91732

4.62288

4.35526

4.11141

3.88867

6.00205

5.58238

5.20637

4.86842

4.56376

4.28830

6.73274

6.20979

5.74664

5.33493

4.96764

4.63886

9

7.43533

6.80169

6.24689

5.75902

5.32825

4.94637

10

8.11090

7.36009

6.71008 6.14457

5.65022

5.21612

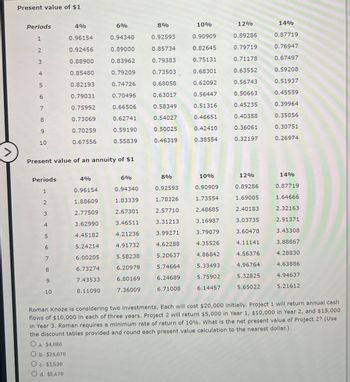

Roman Knoze is considering two investments. Each will cost $20,000 initially. Project 1 will return annual cash

flows of $10,000 in each of three years. Project 2 will return $5,000 in Year 1, $10,000 in Year 2, and $15,000

in Year 3. Roman requires a minimum rate of return of 10%. What is the net present value of Project 2? (Use

the discount tables provided and round each present value calculation to the nearest dollar.)

O a. $4,080

O b. $24,070

c. $2,530

O d. $5,670

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You choose to invest your $3,110 income tax refund check (rather than spend it!) in an account earning 5% compounded annually. How much will the account be worth in 30 years? (Use the Table provided.) (Round your answer to the nearest cent.) Worth OVi 5: acerarrow_forwardUse the following Annuity Table for question Future Value of Ordinary Annuity of 1 Period 5% 6% 8% 10% 12% 1 1.00000 1.00000 1.00000 1.00000 1.00000 2 2.005000 2.06000 2.08000 2.10000 2.12000 3 3.15250 3.18360 3.24640 3.31000 3.37440 4 4.31013 4.37462 4.50611 4.64100 4.77933 5 5.52563 5.63709 5.86660 6.10510 6.35285 6 6.80191 6.97532 7.33592 7.71561 8.11519 7 8.14201 8.39384 8.92280 9.48717 10.08901 8 9.54911 9.89747 10.63663 11.43589 12.29969 9 11.02656 11.49132 12.48756 13.57948 14.77566 10 12.57789 13.18079 14.48656 15.93743 17.54874 Present Value of an Ordinary Annuity of 1 Period 5% 6% 8% 10% 12% 1 .95238 .94340 .92593 .90909 .89286 2 1.85941 1.83339 1.78326 1.73554 1.69005 3 2.72325 2.67301…arrow_forwardSolve the following problem using elther Table 11-1 or Table 11-2 from your text. When necessary, create new table factors. (Round new table factors to five decimal places, round dollars to the nearest cent and percents to the nearest hundredth of a percent) George Invests $12,875, at 6% interest, semiannually for 8 years. Calculate the compound amount for his investment. O $7,785.64 O $19,055.00 O $20,520.82 O $20,660.64arrow_forward

- Grove Media plans to acquire production equipment for $845,000 that will be depreciated for tax purposes as follows: year 1, $329,000; year 2, $189,000; and in each of years 3 through 5, $109,000 per year. A 10 percent discount rate is appropriate for this asset, and the company's tax rate is 20 percent. Use Exhibit A.8 and Exhibit A.9. Required: a. Compute the present value of the tax shield resulting from depreciation. b. Compute the present value of the tax shield from depreciation assuming straight-line depreciation ($169,000 per year). Complete this question by entering your answers in the tabs below. Required A Required B Compute the present value of the tax shield resulting from depreciation. Note: Round PV factor to 3 decimal places. Present value of the tax shieldarrow_forwardUse Table 12-1 to solve. Suppose a certain manufacturer deposits $7,000 at the beginning of each 3 month period for 8 years in an account paying 8% interest compounded quarterly. (Round your answers to the nearest cent.) (a) How much (in $) will be in the account at the end of the 8 year period? $ 315767 (b) What is the total amount (in $) of interest earned in this account? $ 91767arrow_forwardPresent Value $ 400 2,091 33,105 32,800 Years Interest Rate 12 % 10 % 15% 22 % Future Value $ 1,255 3,850 388,620 202,748arrow_forward

- On Joe Martin's graduation from college, Joe's uncle promised him a gift of $11,400 in cash or $740 every quarter for the next 5 years after graduation. Assume money could be invested at 8% compounded quarterly. (Use Table 13.2.) a. Calculate the present value of options. (Do not round intermediate calculations. Round your answers to the nearest cent.) Present value Option 1 Option 2 b. Which offer is better for Joe? O Option 2 O Option 1arrow_forwardComplete the following using present value. (Use the Table provided.) (Do not round intermediate calculations. Round the "Rate used" to the nearest tenth percent. Round the "PV factor" to 4 decimal places and final answer to the nearest cent.) On PV Table 12.3 PV of amount Amount Period Length of time desired at Rate Compounded Rate used PV factor used desired at used end of period end of period $4 7,200 10 years 3% semiannually er 96 %24arrow_forwardJanine is 40 and has a good job at a biotechnology company. Janine estimates that she will need $953,000 in her total retirement nest egg by the time she is 65 in order to have retirement income of $25,500 a year. (She expects that Social Security will pay her an additional $18,500 a year.) She currently has $5,000 in an IRA, an important part of her retirement nest egg. She believes her IRA will grow at an annual rate of 8 percent, and she plans to leave it untouched until she retires at age 65. How much will Janine's IRA be worth when she needs to start withdrawing money from it when she retires? Use Exhibit 1-A. (Round time value factor to 3 decimal places and answer to 2 decimal places.) Future value of IRAarrow_forward

- Complete the following using compound future value. (Use the Table provided.) Time 6 months Principal $ 15,000 Rate Compounded 6% Semiannually Amount Interestarrow_forwardCarter Company is considering a project with an initial investment of $600,500 that is expected to produce cash inflows of $131,000 for ten years. Carter's required rate of return is 16%. E (Click on the icon to view Present Value of $1 table.) (Click on the icon to view Present Value of Ordinary Annuity of $1 table.) 14. What is the NPV of the project? 15. What is the IRR of the project? Is this an acceptable project for Carter? 16. 14. What is the NPV of the project? (Enter the factor amount to three decimal places, X.XXX. Round the present value of the annuity to the nearest whole dollar. Use parentheses or a minus sign for a negative net present value.) Annuity PV Factor (i=16%, n=10) Net Cash Present Years Inflow Value 1- 10 Present value of annuity Investment Net present valuearrow_forwardMaria invests $4,900, at 6% interest, compounded quarterly for one year. Use Table 11-1 to calculate the annual percentage yield (APY) for her investment (as a %). Note: "Annual percentage yield" is also known as "effective interest rate." (Round your answer to two decimal places.) %arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education