FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Please provide correct answer these accounting question

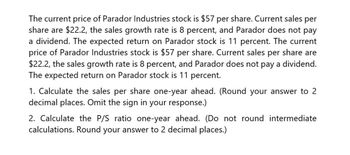

Transcribed Image Text:The current price of Parador Industries stock is $57 per share. Current sales per

share are $22.2, the sales growth rate is 8 percent, and Parador does not pay

a dividend. The expected return on Parador stock is 11 percent. The current

price of Parador Industries stock is $57 per share. Current sales per share are

$22.2, the sales growth rate is 8 percent, and Parador does not pay a dividend.

The expected return on Parador stock is 11 percent.

1. Calculate the sales per share one-year ahead. (Round your answer to 2

decimal places. Omit the sign in your response.)

2. Calculate the P/S ratio one-year ahead. (Do not round intermediate

calculations. Round your answer to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Give answer of this onearrow_forwardGet the Answer with calculationarrow_forwardConsider the case of Cute Camel Woodcraft Company: Cute Camel Woodcraft Company pays an annual dividend rate of 9.80% on its preferred stock that currently returns 13.13% and has a par value of $100.00 per share. The preferred stock issue does not mature, and computes its annual dividend as the product of its dividend rate and its par value. What is the current market value of Cute Camel's preferred stock? O $103.00 per share O $74.64 per share O $65.68 per share $80.61 per share Suppose that due to high inflation, interest rates rise and pull the preferred dividend yield to 19.04%. Then the value of Cute Camel's preferred stock will to This is because interest rates (and security returns) and security values are related.arrow_forward

- Hot Wings, Inc has an odd divdend policy. The company has just paid a dividend of $8.10 per share and has announced that it will increase the dividend by $6.10 per share for each of the next four years, and then never pay another dividend. Required: If you require a 13.50 percent return on the company's stock, how much will you pay for a share today?arrow_forwardMayo Inc.'s perpetual preferred stock sells for $97.50 per share, and it pays an $8.50 annual dividend. What is the company's cost of preferred stock for use in calculating the WACC? The question does not have a flotation cost. How would I solve the problem with this information?arrow_forwardDixon Corp has announced a per-share dividend of $5.25 for the year just ended. The company’s earnings and dividends per share are expected to grow at a steady rate of 4.50% for the foreseeable future. Each share of the company’s common stock is currently trading for $94. Estimate Dixon’s marginal cost of common equity. Dixon faces a marginal tax rate of 30%. 5.84% 10.34% 7.24% 13.54% 9.79%arrow_forward

- Clark equipment currently pays a common stock dividend of $3.50 per share. The common stock price is $60. Analysts have forecast that earnings and dividends will grow at an average annual rate of 6.8 percent for the foreseeable future. What is the marginal cost of retained earnings?arrow_forwardWells fargo is paying a dividend of $1.09 per share today. There are 225,000 shares outstanding with a market price of $31.17 per share prior to the dividend payment. Ignore taxes. Before the dividend, the company had earnings per share of $2.11. As a result of this dividend, the: A.) price-earnings ratio will be 14.26. B.) Earnings per share will increase to $3.20. C.) total value of the company will not change D.) retained earnings will increase by $245,250 E.) retained earnings will decrease by $225,000.arrow_forwardSentry Manufacturing paid a dividend yesterday of $5 per share (D0 = $5). The dividend is expected to grow at a constant rate of 0.076 per year. The price of Sentry Manufacturing's stock today is $34 per share. If Sentry Manufacturing decides to issue new common stock, flotation costs will equal $0.74 per share. Sentry Manufacturing's marginal tax rate is 0.31. Based on the above information, the cost of retained earnings is Instruction: Type your answer as a decimal, and round to three decimal placesarrow_forward

- Tokyo Steel's common stock currently is seeling for $56 per share. The most recent dividend paid to common stockholders was $2.40, and this dividend is expected to grow at a rate of 5 percent for as long as Tokyo is in business. If it issues new common stock, Tokyo will incur flotation costs equal to 10.0 percent. (a) What is the company's cost of retained earnings? (b) What is its cost of new common equity?arrow_forwardConnor Publishing's preferred stock pays a dividend of $1.50 per quarter, and it sells for $44.8 per share. What is its effective annual (not nominal) rate of return?arrow_forwardNonearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education