FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

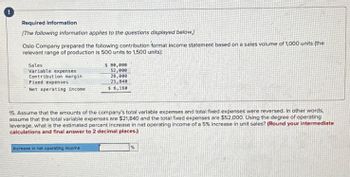

Transcribed Image Text:Required information

[The following information applies to the questions displayed below.)

Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the

relevant range of production is 500 units to 1,500 units):

Sales

Variable expenses

Contribution margin:

Fixed expenses

Net operating income:

$ 80,000

52,000

28,000

21,848

$ 6,160

15. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words,

assume that the total variable expenses are $21,840 and the total fixed expenses are $52,000. Using the degree of operating

leverage, what is the estimated percent increase in net operating income of a 5% increase in unit sales? (Round your intermediate

calculations and final answer to 2 decimal places.)

Increase in net operating income

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The contribution format income statement for Huerra Company for last year is given below. Total $1,006,000 603,600 Unit $ 50.30 30.18 402,400 20.12 322,400 16.12 Sales Variable expenses Contribution margin Fixed expenses Net operating income Income taxes @ 40% Net income 80,000 32,000 $ 48,000 4.00 1.60 $2.40 The company had average operating assets of $502,000 during the year. Required: 1. Compute the company's margin, turnover, and return on investment (ROI) for the period. For each of the following questions, indicate whether the margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI figure. Consider each question separately, starting in each case from the data used to compute the original ROI in (1) above. 2. Using Lean Production, the company is able to reduce the average level of inventory by $93,000. 3. The company achieves a cost savings of $7,000 per year by using less costly materials. 4. The company…arrow_forwardRequired information [The following information applies to the questions displayed below.] Hudson Company reports the following contribution margin income statement. HUDSON COMPANY Contribution Margin Income Statement For Year Ended December 31 Sales (11,600 units at $225 each) Variable costs (11,600 units at $180 each) Contribution margin Fixed costs Income $ 2,610,000 2,088,000 522,000 315,000 $ 207,000 1. Assume Hudson has a target income of $150,000. What amount of sales (in dollars) is needed to produce this target income? 2. If Hudson achieves its target income, what is its margin of safety (in percent)? (Round your answer to 1 decimal place.)arrow_forwardLast year’s contribution format income statement for Huerra Company is given below: Total Unit Sales $ 1,002,000 $ 50.10 Variable expenses 601,200 30.06 Contribution margin 400,800 20.04 Fixed expenses 316,800 15.84 Net operating income 84,000 4.20 Income taxes @ 40% 33,600 1.68 Net income $ 50,400 $ 2.52 The company had average operating assets of $491,000 during the year. Required: Compute last year’s margin, turnover, and return on investment (ROI). For each of the following questions, indicate whether last year’s margin and turnover will increase, decrease, or remain unchanged as a result of the events described, and then compute the new ROI. Consider each question separately. Using Lean Production, the company is able to reduce the average level of inventory by $100,000. The company achieves a cost savings of $10,000 per year by using less costly materials. The company purchases machinery and equipment that increase average operating assets by $125,000.…arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 85,000 Variable expenses 59,500 Contribution margin 25,500 Fixed expenses 20,400 Net operating income $ 5,100 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $20,400 and the total fixed expenses are $59,500. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forwardValaarrow_forwardRequired information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 60,000 39,000 Net operating income 21,000 14,700 $ 6,300 Required: 5. If sales decline to 900 units, what would be the net operating income? Note: Round "Per Unit" calculations to 2 decimal places.arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 15,000 Variable expenses 9,000 Contribution margin 6,000 Fixed expenses 3,120 Net operating income $ 2,880 14. Assume that the amounts of the company’s total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $3,120 and the total fixed expenses are $9,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? (Round your answer to 2 decimal places.)arrow_forward4 Womack Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (9,000 units) Variable expenses Contribution margin Fixed expenses Net operating income The margin of safety percentage is closest to: O 75% 1% O 6% O 24% $ 270,000 202,500 67,500 63,750 $3,750arrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 8,000 6,000 $ 2,000 Foundational 6-14 (Static) 14. Assume that the amounts of the company's total variable expenses and total fixed expenses were reversed. In other words, assume that the total variable expenses are $6,000 and the total fixed expenses are $12,000. Under this scenario and assuming that total sales remain the same, what is the degree of operating leverage? Degree of operating leveragearrow_forward

- Rovinsky Corp, a company that produces and sells a single product, has provided its contribution format income statement for November. Sales (5,700 units) $319,200 Variable Expenses 188,100 Contribution Margin 131,100 Fixed Expenses 106,500 Net Operating Income 24,600 Calculate the breakeven point in: a. sales units (round to the nearest whole unit) b. and sales dollarsarrow_forwardA manufacturer's contribution margin income statement for the year follows. Prepare a contribution margin income statement if the number of units sold (a) increases by 300 units and (b) decreases by 300 units. Sales ($12 per unit x 10,300 units) $123,600 Variable costs 72,100 Contribution margin 51,500 Fixed costs Income 41,000 $ 10,500 Sales Variable costs Contribution Margin Income Statement For Year Ended December 31 Contribution margin Fixed costs Income 10,600 units sold 10,000 units sold $ 127,200 $ 120,000 $ 41,000 41,000 *Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.arrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales $ 50,000 Variable expenses 27,500 Contribution margin 22,500 Fixed expenses 14,850 Net operating income $ 7,650 Required: 1. What is the contribution margin per unit? (Round your answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education