FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

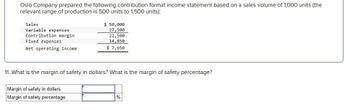

Transcribed Image Text:Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the

relevant range of production is 500 units to 1,500 units):

Sales

Variable expenses

Contribution margin

Fixed expenses

Net operating income

$ 50,000

27,500

22,500

14,850

$ 7,650

11. What is the margin of safety in dollars? What is the margin of safety percentage?

Margin of safety in dollars

Margin of safety percentage

%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income Foundational 6-11 (Static) $ 20,000 12,000 8,000 6,000 $ 2,000 11. What is the margin of safety in dollars? What is the margin of safety percentage? Answer is complete but not entirely correct. Margin of safety in dollars Margin of safety percentage %arrow_forwardRequired information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 65,000 45,500 19,500 14,040 $5,460 7. If the variable cost per unit increases by $1, spending on advertising increases by $1,550, and unit sales increase by 210 units, what would be the net operating income? Net operating incomearrow_forwardDetermine the margin of safety ratio from the following data (round to the nearest whole %): Sales $32 per unit Variable Cost $12 per unit Units Sold 750 units Fixed Costs $12,000arrow_forward

- Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 12,000 Degree of operating leverage 8,000 6,000 $ 2,000 Foundational 6-12 (Static) 12. What is the degree of operating leverage?arrow_forwardHaresharrow_forwardRequired information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 20,000 13,000 7,000 3,780 $ 3,220 11. What is the margin of safety in dollars? What is the margin of safety percentage? Margin of safety in dollars Margin of safety percentage %arrow_forward

- Please help mearrow_forwardOslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 90,000 49,500 9. What is the break-even point in dollar sales? 40,500 33,210 $ 7,290arrow_forwardAlpesharrow_forward

- ! Required information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): Sales Variable expenses Contribution margin Fixed expenses Net operating income Margin of safety in dollars Margin of safety percentage 11. What is the margin of safety in dollars? What is the margin of safety percentage? $ 20 $ 20,000 12,000 % 8,000 6,000 $ 2,000arrow_forwardRequired information [The following information applies to the questions displayed below.] Oslo Company prepared the following contribution format income statement based on a sales volume of 1,000 units (the relevant range of production is 500 units to 1,500 units): $ 15,000 9,000 6,000 3,120 Sales Variable expenses Contribution margin Fixed expenses Net operating income $ 2,880 6. If the selling price increases by $2 per unit and the sales volume decreales by 100 units, what would be the net operating income? $ 3,000 Net operating incomearrow_forwardRemmel Corporation has provided the following contribution format income statement. Assume that the following information is within the relevant range. Sales (6,000 units) Variable expenses Contribution margin Fixed expenses Net operating income $ 300,000 240,000 60,000 59,000 $ 1,000 If sales increase to 6,020 units, the increase in net operating income would be closest to: Multiple Choice ○ $1,000.00 ○ $200.00 ○ $800.00 ○ $3.33arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education