FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Calculate diluted earnings per share. (Round answer to 2 decimal places, e.g. 15.25.)

Diluted earnings per share

$

LA

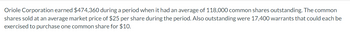

Transcribed Image Text:Oriole Corporation earned $474,360 during a period when it had an average of 118,000 common shares outstanding. The common

shares sold at an average market price of $25 per share during the period. Also outstanding were 17,400 warrants that could each be

exercised to purchase one common share for $10.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- OM, Inc. was organized on January 1, 20X5. The firm was authorized to issue 1,000,000 shares of $3 par value common stock. During 20X5, OM had the following transactions relating to stockholders' equity: Issued 50,000 shares of common stock at $7 per share. Issued 30,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. What is the total amount recorded in the Common Stock account at the end of 20X5? Select one: a. $240,000 b. $160,000 c. $80,000 d. $-0- e. $590,000arrow_forwardThe balance sheet for Crutcher Corporation reported 200,000 shares outstanding, 300,000 sharesauthorized, and 20,000 shares in treasury stock. Compute the maximum number of new shares thatCrutcher could issuearrow_forwardXYZ Corporation has issued 575,999 shares of common stock and 100,000 shares of cumulative preferred stock. Annual dividends on the cumulative preferred stock are $4 per share. Last year, dividends of $2.50 per share were paid to preferred stockholders. This year the company has $1,990,000 net income and the board of directors decide to distribute 60% of net income as dividends. If you own 300 shares of common stock in XYZ Corporation, what will the total amount of your annual dividend be? Round your final answer to the nearest dollar.arrow_forward

- McVie Corporation's stock has a par value of $2. The company has the following transactions during the year: Feb. 28 Issued 310,000 shares at $5 per share. Jun. 7 Issued 95,000 shares in exchange for equipment with a clearly determined value of $212,000. Sep. 19 Purchased 2,400 shares of treasury stock at $8 per share. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Feb. 28 Jun. 7 Sep. 19arrow_forwardCaswell Corporation is authorized to issue 10,000 shares of common stock on December 31. It sells 8,000 shares at $16 per share. Required: Record the sale of the common stock, given the following independent assumptions: 1. The stock has a par value of $10 per share.arrow_forwardOM, Inc. was organized on January 1, 20X7. The firm was authorized to issue 1,000,000 shares of $2 par value common stock. During 20X7, OM had the following transactions relating to stockholders' equity: Issued 20,000 shares of common stock at $7 per share. Issued 40,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. What is the total amount recorded in the Common Stock account at the end of 20X7?arrow_forward

- Milo Co. had 795,000 shares of common stock outstanding as of January 1. On May 1, they issued 145,000 shares of common stock. On September 1, Milo Co. purchased 61,000 shares of treasury stock. On November 1, they issued 59,000 shares of common stock. Calculate the weighted average shares outstanding for the year.arrow_forwardPronghorn Corporation purchased from its stockholders 5,400 shares of its own previously issued stock for $275,400. It later resold 2,160 shares for $54 per share, then 2,160 more shares for $49 per share, and finally 1,080 shares for $43 per share. Prepare journal entries for the purchase of the treasury stock and the three sales of treasury stock. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Account Titles and Explanation I (To record purchase from stockholders.) (To record sales of shares at $54 per share.) (To record sales of shares at $49 per share.) Debit Creditarrow_forwardEnscoe Enterprises, Incorporated (EEI) has 280,000 shares authorized, 250,000 shares issued, and 20,000 shares of treasury stock. At this point, EEI has $2,120,000 of assets. $280,000 liabilities, $540,000 of common stock, and $1,300,000 of retained earnings. Further, assume that the market value of EEI's common stock is $10 per share. Requiredarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education