FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

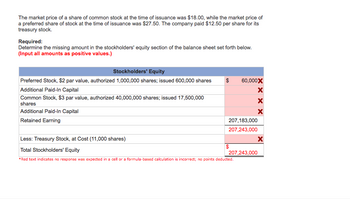

Transcribed Image Text:The market price of a share of common stock at the time of issuance was $18.00, while the market price of

a preferred share of stock at the time of issuance was $27.50. The company paid $12.50 per share for its

treasury stock.

Required:

Determine the missing amount in the stockholders' equity section of the balance sheet set forth below.

(Input all amounts as positive values.)

Stockholders' Equity

Preferred Stock, $2 par value, authorized 1,000,000 shares; issued 600,000 shares

Additional Paid-In Capital

Common Stock, $3 par value, authorized 40,000,000 shares; issued 17,500,000

shares

Additional Paid-In Capital

Retained Earning

207,183,000

207,243,000

Less: Treasury Stock, at Cost (11,000 shares)

Total Stockholders' Equity

*Red text indicates no response was expected in a cell or a formula-based calculation is incorrect; no points deducted.

60,000X

X

X

X

$

207,243,000

X

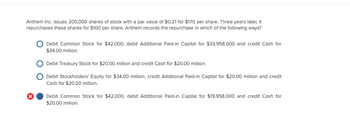

Transcribed Image Text:Anthem Inc. Issues 200,000 shares of stock with a par value of $0.21 for $170 per share. Three years later, it

repurchases these shares for $100 per share. Anthem records the repurchase in which of the following ways?

Debit Common Stock for $42,000, debit Additional Paid-in Capital for $33,958,000 and credit Cash for

$34.00 million.

Debit Treasury Stock for $20.00 million and credit Cash for $20.00 million.

Debit Stockholders' Equity for $34.00 million, credit Additional Paid-in Capital for $20.00 million and credit

Cash for $20.00 million.

Debit Common Stock for $42,000, debit Additional Paid-in Capital for $19,958,000 and credit Cash for

$20.00 million.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- The shares of stock sold to investors are Select one: a. Treasury shares. b. Authorized shares. c. Issued shares. d. Outstanding shares. A firm that sold one share of $1 par value common stock for $10 would Select one: a. Debit common stock for $1. b. Debit common stock for $10. c. Credit common stock for $1. d. Credit common stock for $10. For a bond issued at par, the cash received upon issue equals the present value of the bond’s Select one: a. Principal repayment minus the interest payments. b. Principal repayment and interest payments. c. Principal repayment. d. Interest payments.arrow_forwardneed correct and complete help please with workingarrow_forwardThe balance sheet caption for common stock is the following: Common stock, $5 par value, 2,920,000 shares authorized, 1,560,000 shares issued, 1,070,000 shares outstanding Calculate the dollar amount that will be presented opposite this caption. $?arrow_forward

- Calgate Company had the following shares outstanding and retained earnings at the end of the current year: Preferred shares, 4% (par value $15; outstanding, 10,300 shares) Common shares (outstanding, 33,000 shares) Retained earnings The board of directors is considering the distribution of a cash dividend to both groups of shareholders. No dividends were declared during the previous two years. Three independent cases are assumed: Case A: The preferred shares are non-cumulative; the total amount of dividends is $51,600. Case B: The preferred shares are cumulative; the total amount of dividends is $63,000. Case C: Same as case B, except the amount is $97,500. Required: 1. Compute the amount of dividends, in total and per share, that would be payable to each class of shareholders for each case. (Round "Per share" to 2 decimal places.) Case A: Total Per share Case B: Total Per share $ 154,500 615,000 296,000 Case C: Total Per share Preferred Shares Common Sharesarrow_forwardThe stockholders' equity section of Rakusin Corp. reflected the following in the capital stock subsection (all stock was issued on the same date): Common stock, par $10 $60,000 Additional paid-in-capital 15,000 What was the per-share selling price of the stock? $ _________arrow_forwardDengararrow_forward

- The following is the information on preferred stock issued by Huntington Power Co. Calculate the cost of preferred stock for the firm. Preferred Stock: Selling for $98. Dividends are $7 a share. a. 6.12% b. 5.45% c. 7.14% d. 9.57%arrow_forwardIn each case in the following table,attached, how many dollars of preferred dividends per share must be paid to preferred stockholders before common stock dividends are paid?arrow_forwardGordon Corporation reported the following equity section on its current balance sheet. The common stock is currently selling for OMR 11.50 per share. Common stock, OMR 5 par, 100,000 shares authorized, 40,000 shares issued OMR 200,000 Paid in capital in excess of par—common 120,000 Retained earnings 290,000 Total stockholders' equity OMR 610,000 If the company declared and issued 10% stock dividend? What will the number of issued shares Select one: a. 20,000 shares b. 44,000 shares c. 40,000 shares d. 4,000 sharesarrow_forward

- Thoughtful Comfort Specialists, Inc. reported the following stockholders' equity on its balance sheet at June 30, 2024: (Click the icon to view the partial balance sheet.) Read the requirements. Requirement 1. Identify the different classes of stock that Thoughtful Comfort Specialists has outstanding. Thoughtful has outstanding. common stock preferred stock preferred stock and common stock preferred stock and treasury stock Requirements 2. 1. Identify the different classes of stock that Thoughtful Comfort Specialists has outstanding. What is the par value per share of Thoughtful Comfort Specialists' preferred stock? 3. () Make two summary journal entries to record issuance of all the Thoughtful Comfort Specialists' stock for cash. Explanations are not required. 4. No preferred dividends are in arrears. Journalize the declaration of a $800,000 dividend at June 30, 2024, and the payment of the dividend on July 20, 2024. Use separate Dividends Payable accounts for preferred and common…arrow_forwardPina Colada Inc. issues 4,650 shares of $100 par value preferred stock for cash at $145 per share.Journalize the issuance of the preferred stock. what is the title or explanation? what is debit or credit ?arrow_forwardPrepare the journal entry to record Jevonte Company's issuance of 36,000 shares of its common stock assuming the shares have a: a. $2 par value and sell for $18 cash per share. b. $2 stated value and sell for $18 cash per share. View transaction list Journal entry worksheet 1 2 Record the issuance of 36,000 shares of common stock assuming the shares have a $2 par value and sell for $18 cash per share. Note: Enter debits before credits. Transaction Record entry General Journal Clear entry Debit Credit View general journalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education