FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

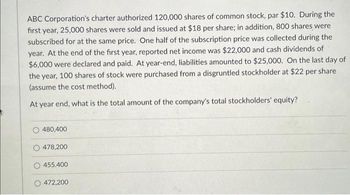

Transcribed Image Text:ABC Corporation's charter authorized 120,000 shares of common stock, par $10. During the

first year, 25,000 shares were sold and issued at $18 per share; in addition, 800 shares were

subscribed for at the same price. One half of the subscription price was collected during the

year. At the end of the first year, reported net income was $22,000 and cash dividends of

$6,000 were declared and paid. At year-end, liabilities amounted to $25,000. On the last day of

the year, 100 shares of stock were purchased from a disgruntled stockholder at $22 per share

(assume the cost method).

At year end, what is the total amount of the company's total stockholders' equity?

480,400

478,200

455.400

472,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is from the 2024 annual report of Kaufman Chemicals, Incorporated: Statements of Comprehensive Income Net income Other comprehensive income: Change in net unrealized gains on AFS investments, net of tax of $31, ($19), and $21 in 2024, 2023, and 2022, respectively Other Total comprehensive income ($ in millions) Shareholders' equity: Common stock Additional paid-in capital Retained earnings Accumulated other comprehensive income Total shareholders' equity Accumulated other comprehensive income, 2023 Kaufman reports accumulated other comprehensive income in its balance sheet as a component of shareholders' equity as follows: Accumulated other comprehensive income, 2024 2024 $395 9,383 8,463 138 $ 18,379 ($ in millions) Years Ended December 31 2023 2024 2022 $818 $ 673 $988 44 (2) $ 1,030 2023 (27) (3) $788 $395 9,383 7,907 96 $ 17,781 Required: 3. From the information provided, determine how Kaufman calculated the $138 million accumulated other comprehensive income in 2024.…arrow_forwardCaswell Corporation is authorized to issue 10,000 shares of common stock on December 31. It sells 8,000 shares at $16 per share. Required: Record the sale of the common stock, given the following independent assumptions: 1. The stock has a par value of $10 per share.arrow_forwardIn a recent annual report, Rosh Corporation disclosed that 60,800,000 shares of common stock have been authorized. At the beginning of the fiscal year, a total of 36,436,357 shares had been issued and the number of shares in treasury stock was 7,251,269. During the year, 562,765 additional shares were issued, and the number of treasury shares increased by 3,074,188. Determine the number of shares outstanding at the end of the year. Note: Amounts to be deducted should be indicated by a minus sign. Computation of Shares Outstanding Issued shares Treasury stock Shares outstandingarrow_forward

- OM, Inc. was organized on January 1, 20X7. The firm was authorized to issue 1,000,000 shares of $2 par value common stock. During 20X7, OM had the following transactions relating to stockholders' equity: Issued 20,000 shares of common stock at $7 per share. Issued 40,000 shares of common stock at $8 per share. Reported a net income of $100,000. Paid dividends of $50,000. What is the total amount recorded in the Common Stock account at the end of 20X7?arrow_forwardKk.348. Incentive Corporation was authorized to issue 12,000 shares of common stock, each with a $1 par value. During its first year, the following selected transactions were completed: Issued 5,300 shares of common stock for cash at $23 per share. Issued 1,300 shares of common stock for cash at $26 per share. Required: Complete the table below, indicating the account, amount, and direction of the effect for the above transactions. (Enter any decreases to account balances with aarrow_forwardTr402arrow_forward

- Texas Gun Stores Inc was authorized to issue 65,000 $5.50 non-cumulative preferred shares and an unlimited number of common shares. The company's fiscal year end is December 31. During 1975, their first year of operations, the following selected transactions occurred: January 3 Issued 11,000 common shares at $7.50 each for cash. May 3 8,000 preferred shares and 9,000 common shares were issued at $22.00 and $9.00 respectively, for cash. October 14 1,600 common shares were issued in exchange for a van with a fair value of $32,000. December 15 The company declared the required cash dividend on the preferred shares and a $2 per common share cash dividend payable on January 30, 1976 to the shareholders of record of January 20, 1976. Required: Prepare journal entries to record the above 1975 transactions.arrow_forwardNorth Wind Aviation received its charter during January authorizing the following capital stock:Preferred stock: 8 percent, par $10, authorized 20,000 shares.Common stock: par $1, authorized 50,000 shares. The following transactions occurred during the first year of operations in the order given: Issued a total of 41,000 shares of the common stock for $16 per share. Issued 11,000 shares of the preferred stock at $17 per share. Issued 3,100 shares of the common stock at $21 per share and 1,100 shares of the preferred stock at $17. Net income for the first year was $49,000, but no dividends were declared. Required: Prepare the stockholders’ equity section of the balance sheet at December 31. please avoid solutions in image format thank youarrow_forwardWingra Corporation was organized in March. It is authorized to issue 550,000 shares of $100 par value 10% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. In its first year, the corporation has the following transactions: Mar. 1 Issued 20,000 shares of preferred stock at $115 per share. Mar. 2 Issued 150,000 shares of common stock at $13 per share. Apr. 10 Issued 15,000 shares of common stock for equipment valued at $198,000. The stock is currently trading at $12 per share, and is a more reliable indicator of the value of the equipment. Jun. 12 Issued 12,000 shares of common stock at $15 per share. Aug. 5 Issued 1,000 shares of preferred stock at $112 per share. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Mar. 1 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 fill in the blank 8 fill in the blank 9 Mar.…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education