FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

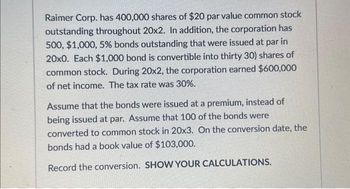

Transcribed Image Text:Raimer Corp. has 400,000 shares of $20 par value common stock

outstanding throughout 20x2. In addition, the corporation has

500, $1,000, 5% bonds outstanding that were issued at par in

20x0. Each $1,000 bond is convertible into thirty 30) shares of

common stock. During 20x2, the corporation earned $600,000

of net income. The tax rate was 30%.

Assume that the bonds were issued at a premium, instead of

being issued at par. Assume that 100 of the bonds were

converted to common stock in 20x3. On the conversion date, the

bonds had a book value of $103,000.

Record the conversion. SHOW YOUR CALCULATIONS.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Firm LM's debt-to-total-assets ratio (D/TA) is 25 percent, whereas Firm QR's D/TA ratio is 50 percent. LM has $800,000 in assets, $60,000 EBIT, and 15,000 shares of stock outstanding, and it pays 8 percent interest. QR has $400,000 in assets, $70,000 EBIT, and 25,000 shares of stock outstading, and it pays 10 percent interest. The marginal tax rate for both firms is 40 percent. Calculate each firm's EPS and ROE (ROE = Net income/Equity). Discuss your results.arrow_forwardOriole Corporation earned $474,360 during a period when it had an average of 118,000 common shares outstanding. The common shares sold at an average market price of $25 per share during the period. Also outstanding were 17,400 warrants that could each be exercised to purchase one common share for $10.arrow_forwardAggregate Mining Corporation was incorporated five years ago. It is authorized to issue 500,000 shares of $100 par value 10% preferred stock. It is also authorized to issue 750,000 shares of $1 par value common stock. It has issued only 40,000 of the common shares and none of the preferred shares. In its sixth year, the corporation has the following transactions: Mar. 1 Declares a cash dividend of $2 per share. Mar. 30 Pays the cash dividend. Jul. 10 Declares a 5% stock dividend when the stock is trading at $20 per share. Aug. 5 Issues the stock dividend. Prepare the journal entries to record the transactions. If an amount box does not require an entry, leave it blank. Mar. 1 fill in the blank 2 fill in the blank 3 fill in the blank 5 fill in the blank 6 Mar. 30 fill in the blank 8 fill in the blank 9 fill in the blank 11 fill in the blank 12 Jul. 10 fill in the blank 14 fill in the blank 15 fill in the blank 17 fill in the blank 18…arrow_forward

- Three different plans for financing an $18,000,000 corporation are under consideration by its organizers. Under each of the following plans, the securities will be issued at their par or face amount, and the income tax rate is estimated at 40% of income: Please see the attachment for details: Instructions1. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $2,100,000.2. Determine the earnings per share of common stock for each plan, assuming that the income before bond interest and income tax is $1,050,000.3. Discuss the advantages and disadvantages of each plan.arrow_forwardKahlua Company had 100,000 shares of common stock outstanding on January 1st. On September 30th, Kahlua sold 48,000 shares of common stock for cash. Kahlua had 10,000 shares of convertible preferred stock outstanding throughout the year. Each preferred stock is $100 par, 6%, and is convertible into 3 shares of common stock. Kahlua also had 500, 8%, convertible bonds outstanding throughout the year. Each $1,000 bond is convertible into 30 shares of common stock. The bonds were issued at par. Net income for the year was $300,000 and the tax rate is 40%. The preferred dividends were paid during the year.Basic earnings per share reported by Kahlua Company for the year is closest to:-$2.14-$2.68-$2.06-$2.36 Diluted earnings per share reported by Kahlua Company for the year is closest to:-$2.14-$2.68-$2.06-$2.36arrow_forwardsarasota corporation has 9% convertible bonds outstanding. it recorded interest expense (net of income taxes) Oven $6,300 on these bonds during the year. The bonds are convertible into 2500 shares of common stock. compute the impact of these convertible bonds on Sarasota diluted earnings per share.arrow_forward

- Jennifer Corporation has issued 300,000 shares of $3 par value common stock. It authorized 600,000 shares. The paid-in capital in excess of par on the common stock is $380,000. The corporation has reacquired 15,000 shares at a cost of $50,000 and is currently holding those shares. Treasury stock was reissued in prior years for $72,000 more than its cost. The corporation also has 4,000 shares issued and outstanding of 8%, $100 parvalue preferred stock. It authorized 10,000 shares. The paid-in capital in excess of par on the preferred stock is $25,000. Retained earnings is $610,000. Prepare the stockholders' equity section of the balance sheet.arrow_forwardA corporation began be issuing 1 million share of $1 common stock. The proceeds from this common stock issuance was $10,000,000. The corporation issued a first-mortgage bond for $25,000,000. It was issued at par value, the coupon interest rate is 5% and the life is 10 years. The corporation established a line of credit with a commercial bank and immediately borrowed $2,000,000 from this line of credit. This amount is to be repaid in 6 months. Construct a partial classified balance sheet in good form based on the transactions above.arrow_forwardPlease help mearrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education