Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:Operating cash inflows A firm is considering renewing its equipment to meet increased demand for its product. The cost of equipment modifications is $1.98 million plus $112,000 in installation costs. The firm will depreciate the equipment modifications under MACRS, using a 5-year recovery

period (see table). Additional sales revenue from the renewal should amount to $1.27 million per year, and additional operating expenses and other costs (excluding depreciation and interest) will amount to 45% of the additional sales. The firm is subject to a tax rate of 21%. (Note: Answer the

following questions for each of the next 6 years.)

a. What net incremental earnings before depreciation, interest, and taxes will result from the renewal?

b. What net incremental operating profits after taxes will result from the renewal?

c. What net incremental operating cash inflows will result from the renewal?

a. The net incremental profits before depreciation and tax are $

(Round to the nearest dollar.)

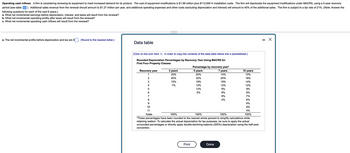

Data table

(Click on the icon here in order to copy the contents of the data table below into a spreadsheet.)

Rounded Depreciation Percentages by Recovery Year Using MACRS for

First Four Property Classes

Recovery year

1

10 years

10%

18%

14%

12%

9%

8%

7%

6%

6%

6%

4%

100%

100%

100%

100%

*These percentages have been rounded to the nearest whole percent to simplify calculations while

retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual

unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year

convention.

2345 600 g

7

8

9

10

11

Totals

3 years

33%

45%

15%

7%

Percentage by recovery year*

7 years

14%

5 years

20%

32%

25%

19%

18%

12%

12%

12%

9%

5%

9%

Print

Done

9%

4%

- X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Required information A potential investment has a cost of $395,000 and a useful life of 5 years. Annual cash sales from the investment are expected to be $255,338 and annual cash operating expenses are expected to be $100,588. The expected salvage value at the end of the investment's life is $50,000. The company has a before-tax discount rate of 17%. Required: Calculate the following. (Round dollar amounts to the nearest whole dollar and IRR to one decimal place (i.e. .055 = 5.5%). Enter negative amounts with a minus sign.) Annual PMT of the investment FV of the investment NPV of the investment IRR of the investment 0000 $arrow_forwardTerminal cash flow: Replacement decision Russell Industries is considering replacing a fully depreciated machine that has a remaining useful life of 10 years with a newer, more sophisticated machine. The new machine will cost $207,000 and will require $29,200 in installation costs. It will be depreciated under MACRS using a 5-year recovery period (see the table for the applicable depreciation percentages). A $26,000 increase in net working capital will be required to support the new machine. The firm's managers plan to evaluate the potential replacement over a 4-year period. They estimate that the old machine could be sold at the end of 4 years to net $14,000 before taxes; the new machine at the end of 4 years will be worth $73,000 before taxes. Calculate the terminal cash flow at the end of year 4 that is relevant to the proposed purchase of the new machine. The firm is subject to a 21% tax rate. The terminal cash flow for the replacement decision is shown below: (Round to the nearest…arrow_forwardDetermine Cash Flows Natural Foods Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 6,200 units at $46 each. The new manufacturing equipment will cost $120,900 and is expected to have a 10-year life and a $9,300 residual value. Selling expenses related to the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor $7.80 Direct materials 25.60 Fixed factory overhead-depreciation 1.80 Variable factory overhead 3.90 Total $39.10 Determine the net cash flows for the first year of the project, Years 2–9, and for the last year of the project. Use the minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answers to the nearest dollar. Natural Foods Inc. Net Cash Flows Year 1 Years 2-9 Last Year Initial…arrow_forward

- Calculating initial cash flow DuPree Coffee Roasters, Inc., wishes to expand and modernize its facilities. The installed cost of a proposed computer-controlled automatic-feed roaster will be $139,000. The firm has a chance to sell its 4-year-old roaster for $35,200. The existing roaster originally cost $59,400 and was being depreciated using MACRS and a 7-year recovery period (see the table). DuPree is subject to a 21% tax rate. a. What is the book value of the existing roaster? b. Calculate the after-tax proceeds of the sale of the existing roaster. c. Calculate the change in net working capital using the following figures: Anticipated Changes in Current Assets and Current Liabilities Accruals Inventory Accounts payable Accounts receivable Cash - $19,300 +49,300 +40,900 + 69,400 0 a. The remaining book value of the existing roaster is $. (Round to the nearest dollar.) b. The after-tax proceeds of the sale of the existing roaster will be $. (Round to the nearest dollar.) c. The change…arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $10,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,500,000 per year for each of the next 8 years. In year 8 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 8 the investment cash inflow totals $3,500,000. Calculate the project's NPV using a discount rate of 9 percent. If the discount rate is 9 percent, then the project's NPV is $ (Round to the nearest dollar.)arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $10,500,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3,500,000 per year for each of the next 9 years. In year 9 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 9 the investment cash inflow totals $4,500,000. Calculate the project's NPV using a discount rate of 8 percent. If the discount rate is 8 percent, then the project's NPV is $. (Round to the nearest dollar.) Carrow_forward

- Determine cash flows Kauai Tools Inc. is planning to invest in new manufacturing equipment to make a new garden tool. The new garden tool is expected to generate additional annual sales of 9,300 units at $30 each. The new manufacturing equipment will cost $110,800 and is expected to have a 10-year life and a $8,500 residual value. Selling expenses related to the new product are expected to be 4% of sales revenue. The cost to manufacture the product includes the following on a per-unit basis: Direct labor Direct materials Fixed factory overhead-depreciation Variable factory overhead Total Determine the net cash flows for the first year of the project, Years 2-9, and for the last year of the project. Use the minus sign to indicate cash outflows. Do not round your intermediate calculations but, if required, round your final answers to the nearest dollar. Kauai Tools Inc. Net Cash Flows Line Item Description Initial investment Operating cash flows: $5.10 16.70 1.10 2.60 $25.50 Year 1 Years…arrow_forwardOperating cash inflows Strong Tool Company has been considering purchasing a new lathe to replace a fully depreciated lathe that would otherwise last 5 more years. The new lathe is expected to have a 5-year life and depreciation charges of $2,220 in Year 1; $3,552 in Year 2; $2,109 in Year 3; $1,332 in both Year 4 and Year 5; and $555 in Year 6. The firm estimates the revenues and expenses (excluding depreciation and interest) for the new and the old lathes to be as shown in the following table. The firm is subject to a 40% tax rate on ordinary income. a. Calculate the operating cash inflows associated with each lathe. (Note: Be sure to consider the depreciation in year 6.) b. Calculate the operating cash inflows resulting from the proposed lathe replacement. c. Depict on a time line the incremental operating cash inflows calculated in part b. a. Calculate the operating cash inflows associated with the new lathe below: (Round to the nearest dollar.) Year Revenue Expenses (excluding…arrow_forward2. Incremental costs - Initial and terminal cash flow Consider the case of Marston Manufacturing Company: Marston Manufacturing Company is considering a project that requires an investment in new equipment of $3,780,000. Under the new tax law, the equipment is eligible for 100% bonus depreciation at t = 0 so the equipment will be fully depreciated at the time of purchase. Marston estimates that its accounts receivable and inventories need to increase by $720,000 to support the new project, some of which is financed by a $288,000 increase in spontaneous liabilities (accounts payable and accruals). The company's tax rate is 25%. The after-tax cost of Marston’s new equipment is . Marston’s initial net investment outlay is . Suppose Marston’s new equipment is expected to sell for $600,000 at the end of its four-year useful life, and at the same time, the firm expects to recover all of its net operating working capital (NOWC) investment. Remember, that under the…arrow_forward

- Cash Payback Period, Net Present Value Analysis, and Qualitative Considerations The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new equipment will cost $72,000. The manager believes that the new investment will result in direct labor savings of $18,000 per year for 10 years. Present Value of an Annuity of $1 at Compound Interest Year 6% 10% 12% 15% 20% 1 0.943 0.909 0.893 0.870 0.833 2 1.833 1.736 1.690 1.626 1.528 3 2.673 2.487 2.402 2.283 2.106 4 3.465 3.170 3.037 2.855 2.589 5 4.212 3.791 3.605 3.353 2.991 6 4.917 4.355 4.111 3.785 3.326 7 5.582 4.868 4.564 4.160 3.605 8 6.210 5.335 4.968 4.487 3.837 9 6.802 5.759 5.328 4.772 4.031 10 7.360 6.145 5.650 5.019 4.192 a. What is the payback period on this project?fill in the blank 1 years b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar. Net present value…arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9,500,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3.500.000 per year for each of the next 7 years. In year 7 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.9 million. Thus, in year 7 the investment cash inflow totals $4,400,000 Calculate the project's NPV using a discount rate of percent If the discount rate is 8 percent, then the projects NPV is 3 (Round to the nearest dollar)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education