Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

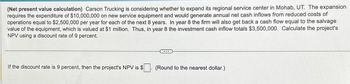

Transcribed Image Text:(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion

requires the expenditure of $10,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of

operations equal to $2,500,000 per year for each of the next 8 years. In year 8 the firm will also get back a cash flow equal to the salvage

value of the equipment, which is valued at $1 million. Thus, in year 8 the investment cash inflow totals $3,500,000. Calculate the project's

NPV using a discount rate of 9 percent.

If the discount rate is 9 percent, then the project's NPV is $

(Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Carson Trucking is considering wether to expand its regional service center. The exapnsion will require expensiture of $10,000,000 for new service equipment and will generate annual net cash inflows by reducing operating costs $ 2,500,000 per year for each of the next 8 years. In year 8, the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1,000,000. Thus in year 8, the total cash inflow is $3,500,000. Assuming an 11% discount rate, calculate the project's NPV: a. $3,500,000 b. $3,299,233 c. $2,500,000 d. $2,399,233arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9,500,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,000,000 per year for each of the next 6 years. In year 6 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.8 million. Thus, in 6 the investment cash inflow totals $2,800,000. Calculate the project's NPV using a discount rate of 6 percent. year If the discount rate is 6 percent, then the project's NPV is $ (Round to the nearest dollar.)arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3,500,000 per year for each of the next 7 years. In year 7 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 7 the investment cash inflow totals $4,500,000. Calculate the project's NPV using a discount rate of 6 percent. If the discount rate is 6 percent, then the project's NPV is $ (Round to the nearest dollar.)arrow_forward

- (Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $11,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3,000,000 per year for each of the next 9 years. In year 9 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.9 million. Thus, in year 9 the investment cash inflow totals $3,900,000. Calculate the project's NPV using a discount rate of 10 percent. If the discount rate is 10 percent, then the project's NPV is S. (Round to the nearest dollar.)arrow_forwardWhy are common sized financial statements useful? How do they differ from traditional financial statements in the way that they are calculated?arrow_forwardAmalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $11 million, $14 million, $16 million, and $9 million over the four years, respectively. It will require initial capital expenditures of $41 million dollars and an intitial investment in NWC of $24 million. The firm expects to generate a $11 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nwc investments. Assuming the firm requires a return of 10% for projects of this risk level, what is the project's IRR? Question 3 options: 9.59% 9.22% 8.95% 9.41% 9.69%arrow_forward

- Amalgamated Industries is considering a 4- year project. The project is expected to generate operating cash flows of $3 million, $16 million, $18 million, and $14 million over the four years, respectively. It will require initial capital expenditures of $35 million dollars and an initial investment in NWC of $6 million. The firm expects to generate a $6 million after tax salvage value from the sale of equipment when the project ends, and it expects to recover 100% of its nw investments. Assuming the firm requires a return of 15% for projects of this risk level, what is the project's IRR? A. 16.16% B. 16.47% C. 15.39% D. 16.00% E. 15.70%arrow_forwardCaspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.30 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.20 million per year and cost $1.77 million per year over the 10-year life of the project. Marketing estimates 12.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 24.00%. The WACC is 12.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $11,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,000,000 per year for each of the next 7 years. In year 7 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.8 million. Thus, in year 7 the investment cash inflow totals $2,800,000. Calculate the project's NPV using a discount rate of 6 percent. If the discount rate is 6 percent, then the project's NPV is $nothing. (Round to the nearest dollar.)arrow_forward

- Management of Braden Boats, Inc. is considering an expansion in the firm’s product line that requires the purchase of an additional $162,000 in equipment with installation costs of $19,000 and removal expenses of $2,000 (Note: the removal expenses are considered terminal cash flows and not associated with the installation of the new equipment). The equipment and installation costs will be depreciated over five years using straight-line depreciation. The expansion is expected to increase earnings before depreciation and taxes as follows: Years 1 and 2 Years 3 and 4 Year 5 $ 80,000 $ 60,000 $ 50,000 The firm’s income tax rate is 30 percent and the weighted-average cost of capital is 18 percent. Based on the net present value method of capital budgeting, should management undertake this project? Use Appendix B to answer the question. Use a minus sign to enter a negative value, if any. Round your answer to the nearest dollar. NPV: $ The firm make the investment.arrow_forwardMelton Manufacturing Ltd is considering two alternative investment projects. The first project calls for amajor renovation of the company’s manufacturing facility. The second involves replacing just a fewobsolete pieces of equipment in the facility. The company will choose one project or the other this year,but it will not do both. The cash flows associated with each project appear below and the firm discountsproject cash flows at 10%.Year Renovate Replace0 –$4,000,000 –$1,300,0001 2,000,000 1,000,0002 2,000,000 700,0003 2,000,000 300,0004 2,000,000 150,0005 2,000,000 150,000 Calculate the profitability index (PI) of each project and based on this criterion, indicate whichproject you would recommend for acceptance.arrow_forwardCaspian Sea Drinks is considering the production of a diet drink. The expansion of the plant and the purchase of the equipment necessary to produce the diet drink will cost $28.00 million. The plant and equipment will be depreciated over 10 years to a book value of $1.00 million, and sold for that amount in year 10. Net working capital will increase by $1.29 million at the beginning of the project and will be recovered at the end. The new diet drink will produce revenues of $9.46 million per year and cost $1.84 million per year over the 10-year life of the project. Marketing estimates 13.00% of the buyers of the diet drink will be people who will switch from the regular drink. The marginal tax rate is 22.00%. The WACC is 15.00%. Find the NPV (net present value). Submit Answer format: Currency: Round to: 2 decimal places.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education