Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

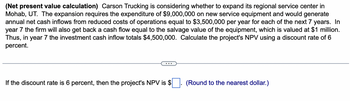

Transcribed Image Text:**(Net present value calculation)** Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $9,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3,500,000 per year for each of the next 7 years. In year 7, the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in year 7 the investment cash inflow totals $4,500,000. Calculate the project's NPV using a discount rate of 6 percent.

---

If the discount rate is 6 percent, then the project's NPV is $____. (Round to the nearest dollar.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- (Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $11,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $3,000,000 per year for each of the next 9 years. In year 9 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.9 million. Thus, in year 9 the investment cash inflow totals $3,900,000. Calculate the project's NPV using a discount rate of 10 percent. If the discount rate is 10 percent, then the project's NPV is S. (Round to the nearest dollar.)arrow_forward(Net present value calculation) Carson Trucking is considering whether to expand its regional service center in Mohab, UT. The expansion requires the expenditure of $11,000,000 on new service equipment and would generate annual net cash inflows from reduced costs of operations equal to $2,000,000 per year for each of the next 7 years. In year 7 the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $0.8 million. Thus, in year 7 the investment cash inflow totals $2,800,000. Calculate the project's NPV using a discount rate of 6 percent. If the discount rate is 6 percent, then the project's NPV is $nothing. (Round to the nearest dollar.)arrow_forwardPina Colada Manufacturing Company is considering three new projects, each requiring an equipment investment of $25,600. Each project will last for 3 years and produce the following cash flows. Year 1 2 3 AA BB $8,200 $11,100 $12,200 11,200 10,200 16,200 Total $34,600 (a) 11,100 11,100 Payback period $33,300 CC 10,200 The salvage value for each of the projects is zero. Pina Colada uses straight-line depreciation. Pina Colada will not accept any project with a payback period over 2.2 years, Pina Colada's minimum required rate of return is 12%. Click here to view PV tables. $33,600 Compute each project's payback period: (Round answers to 2 decimal places, e.g. 52.75.) AA years BB years CC yearsarrow_forward

- Stepwisearrow_forwardBeck Department Stores is considering two possible expansion plans. One proposal involves opening 5 stores in Indiana at the cost of $1,920,000. Under the other proposal, the company would focus on Kentucky and open 6 stores at a cost of $2,600,000. The following information is available: Required investment Estimated life Estimated residual life Estimated annual cash inflows over the next 8 years Required rate of return The net present value of the Kentucky proposal is closest to: Present Value of $1 Periods 7 8 9 10 11 12 6% 0.665 0.627 0.592 0.558 0.527 0.497 Present Value of Annuity of $1 6% Periods 7 - 8 9 10 11 12 A. $1,406,720 B. $4,006,720 OC. $1,374,400 OD. $1,342,080 5.582 6.210 6.802 7.360 7.887 8.384 8% 0.583 0.540 0.500 0.463 0.429 0.397 8% 5.206 5.747 6.247 6.710 7.139 7.536 10% 0.513 0.467 0.424 0.386 0.350 0.319 10% 4.868 5.335 5.759 6.145 6.495 6.814 12% 0.452 0.404 0.361 0.322 0.287 0.257 12% 4.564 4.968 5.328 5.650 5.938 6.194 C... Indiana proposal $1,920,000 8 years…arrow_forwardWhat is the bond, bond valuation, and interest rates of CVS in 2020?arrow_forward

- Oriole Corporation is considering adding a new product line. The cost of the factory and equipment to produce this product is $1,700,000. Company management expects net cash flows from the sale of this product to be $630,000 in each of the next eight years. If Oriole uses a discount rate of 11 percent for projects like this, what is the net present value of this project? (Round intermediate calculations to 5 decimal places, e.g. 0.42354. Round answer to O decimal places, e.g. 52.25. Enter negative amounts using negative sign e.g. -45.25.) NPV $ 36695.55 What is the internal rate of return? (Round answer to 2 decimal places, e.g. 52.50.) Internal rate of return %arrow_forwardCarson Trucking is considering whether to expand its regional service center in Moab, Utah. The expansion will require the expenditure of $10,000,000 on new service equipment and will generate annual net cash inflows by reducing operating costs by $2,500,000 per year for each of the next eight years. In year 8, the firm will also get back a cash flow equal to the salvage value of the equipment, which is valued at $1 million. Thus, in Year 8 the investment cash inflow will total $3,500,000. Calculate the project NPV using each of the following discount rates: A. 9 percent B. 11 percent C. 13 percent D. 15 percent in excelarrow_forwardBruno's Lunch Counter is expanding and expects operating cash flows of $27,900 a year for 4 years as a result. This expansion requires $66,000 in new fixed assets. These assets will be worthless at the end of the project. In addition, the project requires $4,200 of net working capital throughout the life of the project. What is the net present value of this expansion project at a required rate of return of 10 percent? Multiple Choice $27,493 $22,439 $26,046 $21,108 $24,309arrow_forward

- Byron Corporation is considering the purchase of a new piece of equipment. The cost savings from the equipment would result in an annual increase in net cash flow of $130,000. The equipment will have an initial cost of $475,000, a 5-year useful life, and an estimated salvage value of $84,000. If the company's cost of capital is 11%, what is the approximate net present value? (Future Value of $1. Present Value of $1. Future Value Annuity of $1. Present Value Annuity of $1) Note: Use the appropriate factors from the PV tables. Multiple Choice $(5,467) $214,000 $130,000 $55,321arrow_forwardA project requires an initial investment in equipment and machinery of $10 million. The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation) amounting to 1/3 of revenues. The tax rate is 40%. What is the net cash flow in year 1? Group of answer choices 3.40M 2.84M 0.84M 2.04Marrow_forwardNational Integrated Systems (NIS), a global provider of heating and air conditioning is planning a project whose data is provided below. The project’s equipment has a 3 year tax life after which its salvage value will be zero. The machinery will be depreciated on a straight line basis over three years. Revenues and other operating costs are expected to be constant over the project’s life. What is the project’s cash flow in Year 1? Equipment Cost = $130,000Depreciation rate = 33.33%Annual Sales Revenue= $120,000Operating Costs (ex Depreciation) = $50,000 Tax Rate = 35%arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education