Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

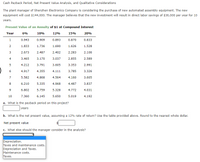

Transcribed Image Text:Cash Payback Period, Net Present Value Analysis, and Qualitative Considerations

The plant manager of Shenzhen Electronics Company is considering the purchase of new automated assembly equipment. The new

equipment will cost $144,000. The manager believes that the new investment will result in direct labor savings of $36,000 per year for 10

years.

Present Value of an Annuity of $1 at Compound Interest

Year

6%

10%

12%

15%

20%

1

0.943

0.909

0.893

0.870

0.833

2

1.833

1.736

1.690

1.626

1.528

2.673

2.487

2.402

2.283

2.106

4

3.465

3.170

3.037

2.855

2.589

4.212

3.791

3.605

3.353

2.991

4.917

4.355

4.111

3.785

3.326

5.582

4.868

4.564

4.160

3.605

8

6.210

5.335

4.968

4.487

3.837

6.

6.802

5.759

5.328

4.772

4.031

10

7.360

6.145

5.650

5.019

4.192

a. What is the payback period on this project?

years

b. What is the net present value, assuming a 12% rate of return? Use the table provided above. Round to the nearest whole dollar.

Net present value

c. What else should the manager consider in the analysis?

Depreciation.

Taxes and maintenance costs.

Depreciation and Taxes.

Maintenance costs.

Таxes.

3.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- If the net present value of A is +$60 and of B is +$30, then what is the net present value of the combined project?arrow_forwardI need to know the Cash payback period for each project, the Net present value, the annual rate of return for each project and finally I need the projects ranked best to worse (1, 2, 3) on their cashpayback, net present value, and annual return. Finally I need to know which is the best project. Question 1 of 1 > E Pharoah Company is considering three long-term capital investment proposals. Each investment has a useful life of 5 years. Relevant data on each project are as follows. Project Bono Project Edge Project Clayton Capital investment $172,000 $182,000 $202,000 Annual net income: Year 1 14,700 18,900 28,350 2 14,700 17,850 24,150 3 14,700 16,800 22,050 4 14,700 12.600 13,650 5 14,700 9,450 12,600 5 14,700 9,450 12,600 Total $73,500 $75,600 $100,800 Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year.)arrow_forwardThe economic service life of a project is best described as _____________________? a. Another term for the analysis period of a benefit-cost analysis.b. The number of years for which depreciation is on-going for an asset.c. The present worth of the project after taxes.d. The amount of time (usually in years) that an asset should be used to achieve thesmallest annual cost of operation.arrow_forward

- 1. Calvulate the internal rate of return(IRR) of each project and based on this criterion. Indicate which project you would recommend or acceptance.arrow_forward14. Consider the following possible returns over the next year on an asset Return probability -£40 0.5 £40 0.5 What is the variance of return of the asset.arrow_forwardConsider Supertech and Slowpoke. We find that the expected returns on these two securities are 17.5% and 5.5%, respectively. If the investor with $100 invests $60 in Supertech and $40 in Slowpoke, what is the expected return on a portfolio of these two securities are?arrow_forward

- In my accounting class I am learning to find accounting rate of return. To solve for this I subtracted net cash flow- the salvage value divided by the initial investment. Have I done something incorrect?arrow_forwardComparing all methods. Risky Business is looking at a project with the following estimated cash flow:. Risky Business wants to know the payback period, NPV, IRR, MIRR, and Pl of this project. The appropriate discount rate for the project is 10%. If the cutoff period is 6 years for major projects, determine whether the management at Risky Business will accept or reject the project under the five different decision models. What is the payback period for the new project at Risky Business? years (Round to two decimal places.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) Initial investment at start of project: $11,300,000 Cash flow at end of year one: $2,034,000 Cash flow at end of years two through six: $2,260,000 each year Cash flow at end of years seven through nine: $2,237,400 each year Cash flow at end of year ten: $1,721,077 HERY BU De DULU LUDIV Print (...) Diana - X Clear all Check answerarrow_forward1. A project requires an initial capital cost of (40 million ID). The investor expects the project will generate annual returns of (12 million ID), with expenditures about (4 million ID) annually. If you know that the economic life is (12) years, and the salvage value after the end of the economic life is (4 million ID). Considering that the less acceptable interest rate for the investor is (10%): A. Determining the economic feasibility for investing using the present worth method? B. What is the equivalent annual worth of this investment? C. Find the internal rate of return?arrow_forward

- You are considering the following project. What is the NPV of the project? WACC of the project: 0.10 Revenue growth rate: 0.05 Tax rate: 0.40 Revenue for year 1: 13,000 Fixed costs for year 1: 3,000 variable costs (% of revenue): 0.30 project life: 3 years Economic life of equipment: 3 years Cost of equipment: 20,000 Salvage value of equipment: 4,000 Initial investment in net working capital: 2,000arrow_forwardGarden-Grow Products is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.) Project cost of capital (r) Net investment in fixed assets (basis) Required new working capital Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate a. $31,573 b. $30,069 c. $36,550 d. $34,809 e. $33,152 10.0% $75,000 $15,000 33.333% $75,000 $25,000 25.0%arrow_forwardThe terminal cap rate used for valuation purposes in a DCF is fundamentally different than the discount rate used in that same DCF. The assumed sale of the property takes place at the end of your hold period, generally 10 years later in most models. The property is older and the market and the economy have changed. With that said, what do you believe to be the right approach for terminal cap rate selection in a DCF on a development project and why?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education