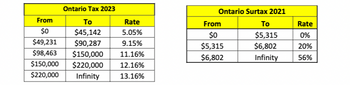

We know that there exists both provincial tax and surtax in Ontario. The provincial tax

brackets and the surtax rates are provided below:

Part A: How much income results in paying $5,315 as provincial tax? How much income

leads to a $6,802 provincial tax?

Part B: Since the presence of surtax makes the tax system unnecessarily complicated,

we decide to eliminate it. However, we don’t want to reduce the amount of tax that the

provincial government collects. Using the two thresholds in Part A, as a result of

eliminating surtax, how would you change the provincial tax table such that each

individual pays the same amount of tax as before elimination of surtax? Note that number

of tax brackets and the tax rate in each bracket would be modified. Assume there is no

tax credit.

Step by stepSolved in 2 steps

- The total tax on an income of $256,600 is: Select one: a. $96,194 b. $113,900 c. $112,944 d. $128,544 e. $83,324 ???arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 ernment Budget Fiscal Policy FILL IN THE BLANK UNIT TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% D) The average tax rate for someone making $120,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardFederal Income Tax Rates For the Year 2022 From To AmountTax Rate Maximum Cummulative 50,197 50,197 15.0% 50,197 100,392 50,195 20.5% 100,392 155,625 55,233 26.0% 155,625 221,708 66,083 29.0% 221,708 infinity 33.0% Tax 7,529.55 10,289.98 14,360.58 19,164.07 Tax 7,529.55 17,819.53 32,180.11 51,344.18 Using the above tax rates, what is the amount of federal tax owed on an income of 74587? Answer to two decimals. Do not use commas or $ signs.arrow_forward

- F7 A certain state uses the following progressive tax rate for calculating individual income tax: 7 ht©2003-2022 International Academy of Science. All Rights Reserved. F8 0-10,000 3% 10,001 - 50,000 5% 50,001 - 100,000 5.5% Calculate the state income tax owed on a $90,000 per year salary. tax = $[?] Round your answer to the nearest whole dollar amount. F9 Income Range ($) h 8 9. prtsc F10 home F11 Progressive Tax Rate . F12 + 11. delete Enter Backspace Num Lock CE 9:07. 11/5/20 +1_arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 FILL IN THE BLANK TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% B) The new marginal rate of tax for someone making a salary of $100,000 and gets an $8,000 salary increase. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardSubject: accountingarrow_forward

- h3arrow_forward2023 TAXABLE INCOME FIRST $53,359 OVER $53,359 TO $106,717 OVER $106,717 TO $165,430 OVER $ $165,430 TO $237,675 OVER $235,675 FILL IN THE BLANK TAX RATE 15.00% 20.50% 26.00% 29.32% 33.00% C) The total income tax burden if your salary is $85,000. type your text here Based on the Canadian Federal Income Tax Brackets for 2023 shown above, calculate and input the numeric answers to the questions below. Round off your answers to the nearest dollar. Do not use $, decimals or comma. For example, instead of $23,486.52, write 23487. For answers requiring a tax rate, enter only the numeric value with two decimal places, with "%" symbol. For example, 20.50%).arrow_forwardnku.2arrow_forward

- Chuck, a single taxpayer, earns $75,000 in taxable income and $10,000 in interest from an investment in City of Heflin bonds. (Use the U.S. tax rate schedule.) Required: a. If Chuck earns an additional $40,000 of taxable income, what is his marginal tax rate on this income? b. What is his marginal rate if, instead, he had $40,000 of additional deductions? (For all requirements, do not round intermediate calculations. Round percentage answers to 2 decimal places.) a. Marginal tax rate b. Marginal tax ratearrow_forward2021 Tax Rate Schedules Individuals Schedule X-Single If taxable income is over:But not over: The tax is: $ 9,950 $ 40,525 $ 86,375 $ 164,925 $ 209,425 $ 523,600 $ 10% of taxable income $ 9,950 $ 40,525 $ 86,375 $ 164,925 $ 209,425 $ 523,600 $995 plus 12% of the excess over $9,950 $4,664 plus 22% of the excess over $40,525 $14,751 plus 24% of the excess over $86,375 $33,603 plus 32% of the excess over $164,925 $47,843 plus 35% of the excess over $209,425 $157,804.25 plus 37% of the excess over $523,600 Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over:But not over: The tax is: $ 19,900 $ 81,050 $ 172,750 $ 329,850 $ 418,850 $ 628,300 $ 10% of taxable income $ 19,900 $ 81,050 $ 172,750 $ 329,850 $ 418,850 $ 628,300 $1,990 plus 12% of the excess over $19,900 $9,328 plus 22% of the excess over $81,050 $29,502 plus 24% of the excess over $172,750 $67,206 plus 32% of the excess $95,686 plus 35% of the excess over $418,850 $168,993.50 plus 37% of the…arrow_forwardNonearrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education