Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

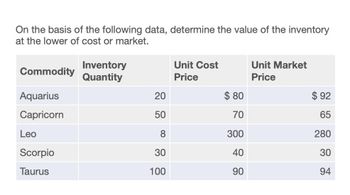

Transcribed Image Text:On the basis of the following data, determine the value of the inventory

at the lower of cost or market.

Inventory

Commodity Quantity

Unit Cost

Price

Unit Market

Price

Aquarius

20

$ 80

$92

Capricorn

50

70

65

Leo

8

300

280

Scorpio

30

40

30

Taurus

100

90

94

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Use the weighted-average (AVG) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forwardExplain the dollar-value LIFO method of inventory valuation.arrow_forwardCalculate a) cost of goods sold, b) ending inventory, and c) gross margin for A76 Company, considering the following transactions under three different cost allocation methods and using perpetual inventory updating. Provide calculations for weighted average (AVG).arrow_forward

- In rimes of rising prices, the inventory cost method that will yield the highest cost of goods sold is (a) LIFO. (b) weighted-average. (c) FIFO. (d) none of the above.arrow_forwardCompare the calculations for gross margin for B76 Company, based on the results of the perpetual inventory calculations using FIFO, LIFO, and AVG.arrow_forwardUse the last-in, first-out (LIFO) cost allocation method, with perpetual inventory updating, to calculate (a) sales revenue, (b) cost of goods sold, and c) gross margin for A75 Company, considering the following transactions.arrow_forward

- On the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) A13Y 144 $22 $27 TX24 274 11 7 Determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9.arrow_forwardOn the basis of the following data: Product InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) Model A 42 $74 $90 Model B 45 181 202 Model C 29 166 171 Model D 12 130 112 Model E 24 159 158 Determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. Inventory at the Lower of Cost or Market Product Total Cost Total Market Lower of Total Cost or Total Market A $ $ $ B C D E Total $ $ $arrow_forwardLower-of-Cost-or-Market InventoryOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Assemble the data in the form illustrated in Exhibit 9. ProductInventoryQuantityUnitCost PriceUnitMarket Value per Unit(Net Realizable Value)Model A300$140$125Model B50090112Model C1506059Model D800120115Model E400140145 Inventory at the Lower of Cost or MarketProductTotal CostTotal MarketLower of Total Cost or Total MarketA$$$B C D E Total$$$arrow_forward

- On the basis of the data shown below: Inventory Cost per Market Value per Unit Item Quantity Unit (Net Realizable Value) МX62 80 $42 $40 05T4 155 20 23 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9. $ 6,925 xarrow_forwardOn the basis of the following data, determine the value of the inventory at the lower of cost or market. Apply lower of cost or market to each inventory item, as shown in Exhibit 9. Market Value per Unit (Net Realizable Value) Cost per Inventory Quantity Item Unit JFW1 6,330 $10 $11 SAW9 1,140 36 34arrow_forwardLower-of-Cost-or-Market Method On the basis of the data shown below: Item InventoryQuantity Cost perUnit Market Value per Unit(Net Realizable Value) IA17 80 $39 $42 O5T4 150 20 16 Determine the value of the inventory at the lower of cost or market by applying lower of cost or market to each inventory item, as shown in Exhibit 9. $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781305653535Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning

Corporate Financial AccountingAccountingISBN:9781337398169Author:Carl Warren, Jeff JonesPublisher:Cengage Learning  Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Corporate Financial Accounting

Accounting

ISBN:9781305653535

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Corporate Financial Accounting

Accounting

ISBN:9781337398169

Author:Carl Warren, Jeff Jones

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781337119207

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...

Finance

ISBN:9781285190907

Author:James M. Wahlen, Stephen P. Baginski, Mark Bradshaw

Publisher:Cengage Learning

Financial & Managerial Accounting

Accounting

ISBN:9781285866307

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning