Cornerstones of Financial Accounting

4th Edition

ISBN: 9781337690881

Author: Jay Rich, Jeff Jones

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

General accounting

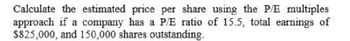

Transcribed Image Text:Calculate the estimated price per share using the P/E multiples

approach if a company has a P/E ratio of 15.5, total earnings of

$825,000, and 150,000 shares outstanding.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Rebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the market price per share for Rebert is 51.50. Required: 1. Compute the dollar amount of preferred dividends. 2. Compute the number of common shares. 3. Compute earnings per share. (Note: Round to two decimals.) 4. Compute the price-earnings ratio. (Note: Round to the nearest whole number.)arrow_forwardRebert Inc. showed the following balances for last year: Reberts net income for last year was 3,182,000. Refer to the information for Rebert Inc. above. Also, assume that the dividends paid to common stockholders for last year were 2,600,000 and that the market price per share of common stock is 51.50. Required: 1. Compute the dividends per share. 2. Compute the dividend yield. (Note: Round to two decimal places.) 3. Compute the dividend payout ratio. (Note: Round to two decimal places.)arrow_forwardPlease provide this question solution general accountingarrow_forward

- Renew Company has an earnings per share (EPS) of $3.50, a value per share of $35, and a market value of $36. Calculate the price/earnings (P/E) ratio.arrow_forwardPQR Co. has earnings of $2.66 per share. The benchmark PE for company is 19. What stock price (to two decimals) would you consider appropriate?arrow_forwardSanedrin Company has an earnings per share (EPS) of $4.50, a value per share of $45 and a market value of $38. Calculate the price/earnings ratio (P/E).arrow_forward

- A company in the same industry as Company XYZ has a price-to-earnings (P/E) ratio of 15. If Company XYZ's earnings per share (EPS) is $3, what is the estimated value of Company XYZ's stock based on the P/E multiple? a b C d $20 $30 $45 $50arrow_forwardNeed answer pleasearrow_forwardA company reports earnings per share on common stock of $2.00 when the market price of per share of common stock is $50.000. What is the company’s price-earnings ratio?arrow_forward

- A company has net income of $950,000; its weighted-average common shares outstanding are 190,000. Its dividend per share is $0.95, its market price per share is $98, and its book value per share is $91.00. Its price-earnings ratio equals: Multiple Choice 19.60. 7.00. 18.20. Nextarrow_forwardA company's stock is trading at $50 per share with a price-to-earnings (P/E) ratio of 20. What is the company's earnings per share (EPS)? a) $1.50 b) $2.00 c) $2.50 d) $3.00arrow_forwardThe company's price earnings ratio equalarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT