FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

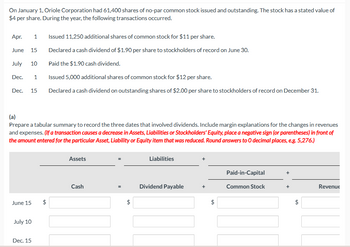

Transcribed Image Text:On January 1, Oriole Corporation had 61,400 shares of no-par common stock issued and outstanding. The stock has a stated value of

$4 per share. During the year, the following transactions occurred.

Issued 11,250 additional shares of common stock for $11 per share.

Declared a cash dividend of $1.90 per share to stockholders of record on June 30.

Paid the $1.90 cash dividend.

Issued 5,000 additional shares of common stock for $12 per share.

Dec. 15 Declared a cash dividend on outstanding shares of $2.00 per share to stockholders of record on December 31.

Apr. 1

June 15

July 10

Dec.

(a)

Prepare a tabular summary to record the three dates that involved dividends. Include margin explanations for the changes in revenues

and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity, place a negative sign (or parentheses) in front of

the amount entered for the particular Asset, Liability or Equity item that was reduced. Round answers to O decimal places, e.g. 5,276.)

June 15

July 10

1

Dec. 15

$

Assets

Cash

$

Liabilities

Dividend Payable

$

Paid-in-Capital

Common Stock

+

+

$

Revenue

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Italian Stallion has the following transactions during the year related to stockholders' equity. February 1 Issues 5,700 shares of no-par common stock for $16 per share. May 15 Issues 400 shares of $10 par value, 11% preferred stock for $13 per share. October 1 Declares a cash dividend of $1.10 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Required: Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardOn January 1, Icecap had 7,900 shares of $2 par common stock issued and outstanding. The following transactions occurred during the year. April 15: Declared a cash dividend of $0.80 per share to stockholders of record on May 31. July 10: Paid the $0.80 cash dividend. A Prepare the entry to declare the dividends. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter o for the amounts) Date Account Titles and Explanation Apr. 15 Cash Dividends Dividends Payable (To record declaration of cash dividend) Debit Date Account Title Credit B. Prepare the entry to pay the dividend. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. List debit entry before credit entry. If no entry is required, select "No Entry" for the account tities and enter O for the amounts.)arrow_forwardOn January 1, the board of directors of Zion, Inc. declare a 10% stock dividend. On this date, there were 10,000 shares of $1 par value stock issued and outstanding and the market value was $5 per share. On March 15, the date of payment, Zion issued the stock. The entry necessary on March 15 would include a (credit/debit) to Common Stock Dividends distributable for O debit; $5,000 O debit; $1,000 O credit; $5,000 O credit; $1,000arrow_forward

- Dwight Corporation in its first year of operations had the following stock transactions. Record each transaction in the journal provided. Mar 3 Issued 10,000 shares of common stock, $1 par value, for cash of $50,000. Apr 12 Issued 500 shares of preferred stock, $10 par value, for cash of $12,500. Jul 8 Issued 2,000 shares of preferred stock, $10 par value, in exchange for land valued at $60,000.arrow_forwardPlease Do not Give image formatarrow_forwardOn January 1, Pharoah Company had 87000 shares of $10 par value common stock outstanding. On May 7, the company declared a 5% stock dividend to stockholders of record on May 21. Market value of the stock was $16 on May 7. The stock was distributed on May 24. The entry to record the transaction of May 24 would include aarrow_forward

- On October 10, the stockholders' equity section of Sherman Systems appears as follows. Common stock-$10 par value, 90,000 shares authorized, issued, and outstanding Paid-in capital in excess of par value, common stock Retained earnings Total stockholders' equity 1. Prepare journal entries to record the following transactions for Sherman Systems. a. Purchased 6,800 shares of its own common stock at $43 per share on October 11. b. Sold 1,450 treasury shares on November 1 for $49 cash per share. c. Sold all remaining treasury shares on November 25 for $42 cash per share. 2. Prepare the stockholders' equity section after the October 11 treasury stock purchase. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare journal entries to record the following transactions for Sherman Systems. a. Purchased 6,800 shares of its own common stock at $43 per share on October 11. b. Sold 1,450 treasury shares on November 1 for $49 cash per share. c. Sold all…arrow_forwardOn April 2 a corporation purchased for cash 7,000 shares of its own $10 par common stock at $28 per share. It sold 4,000 of the treasury shares at $31 per share on June 10. The remaining 3,000 shares were sold on November 10 for $24 per share. a. Journalize the entries for the purchase (treasury stock is recorded at cost). If an amount box does not require an entry, leave it blank. Apr. 2 b. Journalize the entries for the sale of the stock. If an amount box does not require an entry, leave it blank. June 10 Nov. 10arrow_forwardPlease do not give image formatarrow_forward

- Current Attempt in Progress On January 1, Ivanhoe Corporation had 91,000 shares of no-par common stock issued and outstanding. The stock has a stated value of $6 per share. During the year, the following occurred. Apr. 1 Issued 21,000 additional shares of common stock for $17 per share. June 15 July 10 Dec. 1 (a) 15 Declared a cash dividend of $1 per share to stockholders of record on June 30. Paid the $1 cash dividend. Issued 2,500 additional shares of common stock for $18 per share. Declared a cash dividend on outstanding shares of $2.30 per share to stockholders of record on December 31. Prepare the entries to record these transactions. (If no entry is required, select "No entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Creditarrow_forwardOn January 1, Vermont Corporation had 49,400 shares of $11 par value common stock issued and outstanding. All 49,400 shares had been issued in a prior period at $22 per share. On February 1, Vermont purchased 910 shares of treasury stock for $24 per share and later sold the treasury shares for $19 per share on March 1. The journal entry to record the purchase of the treasury shares on February 1 would include a debit to a loss account for $1,820. credit to a gain account for $1,820. credit to Treasury Stock for $21,840. debit to Treasury Stock for $21,840. MacBook Proarrow_forwardSelected transactions completed by Equinox Products Inc. during the fiscal year ended December 31, 20Y8, were as follows: Record on journal page 10: Jan. 3 Issued 15,000 shares of $20 par common stock at $30, receiving cash. Feb. 15 Issued 4,000 shares of $80 par preferred 5% stock at $100, receiving cash. May 1 Issued $500,000 of 10-year, 5% bonds at 104, with interest payable semiannually. 16 Declared a quarterly dividend of $0.50 per share on common stock and $1.00 per share on preferred stock. On the date of record, 100,000 shares of common stock were outstanding, no treasury shares were held, and 20,000 shares of preferred stock were outstanding. 26 Paid the cash dividends declared on May 16. Jun. 8 Purchased 8,000 shares of treasury common stock at $33 per share. 30 Declared a $1.00 quarterly cash dividend per share on preferred stock. On the date of record, 20,000 shares of preferred stock had been issued. Jul. 11 Paid the cash dividends to the preferred…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education