FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

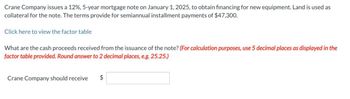

Transcribed Image Text:Crane Company issues a 12%, 5-year mortgage note on January 1, 2025, to obtain financing for new equipment. Land is used as

collateral for the note. The terms provide for semiannual installment payments of $47,300.

Click here to view the factor table

What are the cash proceeds received from the issuance of the note? (For calculation purposes, use 5 decimal places as displayed in the

factor table provided. Round answer to 2 decimal places, e.g. 25.25.)

Crane Company should receive $

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- please help me dont give answer in image formatarrow_forwardCullumber Company borrowed $313,000 on January 1, 2022, by issuing a $313,000, 10% mortgage note payable. The terms call for annual installment payments of $54,000 on December 31. (a) Prepare the journal entries to record the mortgage loan and the first two installment payments. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit ILOR Credarrow_forwardCrane Taco Company receives a $94,500, 6-year note bearing interest of 8 % (paid annually) from a customer at a time when the discount rate is 10%. Click here to view the factor table. What is the present value of the note received by Crane? (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answer to 2 decimal places, e.g. 25.25.) Present value of note received e Textbook and Media Save for Later $ Attempts: unlimited Submit Answerarrow_forward

- Sunland Company borrowed $760,000 on December 31, 2019, by issuing an $760,000, 9% mortgage note payable. The terms call for annual installment payments of $118,423 on December 31. (a) Your answer is correct. Prepare the journal entries to record the mortgage loan and the first two installment payments. (Round answers to O decimal places, e.g. 15,250. Credit account titles are automatically indented when amount is entered. Do not indent manually. Record journal entries in the order presented in the problem. List all debit entries before credit entries.) Date Dec. 31, 2019 ec. 31, 2020 Account Titles and Explanation Cash Mortgage Payable Interest Expense Mortgage Payable Cash Debit 760,000 68400 50023 Credit 760,000 118423arrow_forwardD1.arrow_forward1. a) the amt of interest pd in cash every payment period, 1. b) the amt of amorization to be recorded at each interest payment date.(use the straight -line methodarrow_forward

- Detwiler Orchard issues a $558,020, 10%, 15-year mortgage note to obtain needed financing for a new lab. The terms call for semiannual payments of $36,300 each.Prepare the entries to record the mortgage loan and the first installment payment. (Credit account titles are automatically indented when amount is entered. Do not indent manually. Round answers to 0 decimal places e.g. 8,970.) Account Titles and Explanation Debit Credit (To record mortgage loan)arrow_forwardBase Line Co. receives $250,000 when it issues a $250,000, 8%, mortgage note payable to finance the construction of a building at December 31, 2016. The terms provide for annual installment payments of $40,000 on December 31. Instructions Prepare the mortgage payment schedule and journal entries to record the mortgage loan and the first two installment payments. In this order Date | Particulars | Debit $ | Credit $ and in a text filearrow_forwardDurango, Inc. borrowed $20,000 on October 1, 2020. Durango will not make any payments on this loan until October 1, 2023, and at that time Durango will owe $26,000. What will be the amounts shown on Durango's annual financial statements at December 31, 2022? O Interest expense of $2,000 and interest payable of $4,500 Interest expense of $4,500 and interest payable of $4,500 O Interest expense of $4,500 and interest payable of $1,500 Interest expense of $2,000 and interest payable of $1,500 O None of the abovearrow_forward

- 7) On December 1, 2022, Olympia Hot Yoga issued a note payable to Columbia Bank for $45,000 with an annual interest rate of 6% and a term of six months (due May 31, 2023). What is the amount of interest expense recognized by Olympia Hot Yoga in 2022? What is the amount of interest expense recognized by Olympia Hot Yoga in 2023? What is the total amount Olympia Hot Yoga will pay to Columbia Bank on the maturity date?arrow_forwardJanuary 1, 2024, Paradise Partners decides to upgrade recreational equipment at its resorts. The company is contemplating whether to purchase or lease the new equipment. Use PV of $1 and PVA of $1. (Use appropriate factor(s) from the tables provided.) Required: 1. The company can purchase the equipment by borrowing $233,000 with a 21-month, 12% Installment note. Payments of $12.356.17 are due at the end of each month, and the first installment is due on January 31, 2024. Record the Issuance of the installment note payable for the purchase of the equipment. 2. The company can sign a 21-month lease for the equipment by agreeing to pay $9.492.50 at the end of each month, beginning January 31, 2024. At the end of the lease, the equipment must be returned. Assuming a borrowing rate of 12%, record the lease. 3. As of January 1, 2024, does the installment note or the lease have a greater effect on increasing the company's amount of reported debt, and by how much? 4. Suppose the equipment has…arrow_forwardCash Accounts Receivable Prepaid Expenses Equipment Accumulated Depreciation Accounts Payable Notes Payable Common Stock Retained Earnings Dividends Fees Earned Wages Expense Rent Expense Utilities Expense Stockton Company Adjusted Trial Balance December 31 Depreciation Expense Miscellaneous Expense Determine the net income (loss) for the period. a. net income $1,390 b. net loss $1,390 c. net loss $2,276 d. net income $2,276 6,633 2,769 745 15,877 886 3,419 817 401 234 102 31,883 12,201 1,458 5,896 1,000 4,079 7,249 31,883arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education