EBK CFIN

6th Edition

ISBN: 9781337671743

Author: BESLEY

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Quick answer of this accounting questions

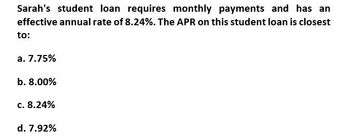

Transcribed Image Text:Sarah's student loan requires monthly payments and has an

effective annual rate of 8.24%. The APR on this student loan is closest

to:

a. 7.75%

b. 8.00%

c. 8.24%

d. 7.92%

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Consider a student loan of $10,000 at a fixed APR of 6% for 4 years. a. Calculate the monthly payment. b. Determine the total amount paid over the term of the loan. c. Of the total amount paid, what percentage is paid toward the principal and what percentage is paid for interest. a. The monthly payment is $. (Do not round until the final answer. Then round to the nearest cent as needed.)arrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $6400 at 7.9% interest; student graduates 3 years and 9 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo → Karrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $6400 at 7.9% interest; student graduates 3 years and 9 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $. Round to two decimal places, if necessary. X Ś Esarrow_forward

- For the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $6600 at 7.5% interest; student graduates 3 years and 9 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X ooarrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $8800 at 6.3% interest; student graduates 2 years and 7 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $ places, if necessary. Round to two decimal X oo Karrow_forwardFor the given student loan, find the interest that accrues in a 30-day month, then find the total amount of interest that will accrue before regular payments begin, again using 30-day months. $8800 at 6.3% interest; student graduates 2 years and 7 months after loan is acquired; payments deferred for 6 months after graduation. Part: 0 / 2 Part 1 of 2 The interest that accrues in a 30-day month is $. Round to two decimal places, if necessary. X Śarrow_forward

- Need help with this accounting questionarrow_forwardUse the chart and find the months minimum payment.arrow_forwardyou were just informed of the interest rate on your student loan. it is started as 0.2% per month. determine nominal interest rate r per month. the nominal interest rate r is ..... %arrow_forward

- A student borrows $6000 at 10% for 6 months to pay tuition. The total amount due after 6 months is $ Find the total amount due using simple interest.arrow_forwardFind apr of the loan given the amount of the loan, number and type of payments and the add on interest rate. Loan amount $6000, 3 yearly payments ;rate 8% the annual percentage rate is?arrow_forwardThis months minimum payment if the principal is $27,300. The annual rate is 12% and the method for calculating minimum monthly payment is finance charge + $30 + 3.5% of principal.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you