FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

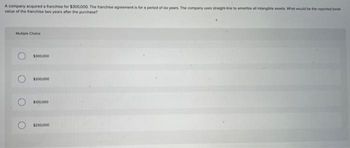

Transcribed Image Text:A company acquired a franchise for $300,000. The franchise agreement is for a period of six years. The company uses straight-line to amortize al intangible assets. What would be the reported book

value of the franchise two years after the purchase?

Multiple Choice

O

$300,000

$200,000

$100,000

$250,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Required: Assuming that ABC plans to sell the asset by the end of the fifth year, compute the following: 4. Cost of illiquidity 5. Intrinsic value 6. Net benefit of buying the assearrow_forwardSmitty Inc. wishes to use the revaluation model for this property: Before Revaluation • Building Gross Value 120,000 • Building Accumulated Depreciation 40,000 • Net carrying value 80,000 The fair value for the property is $150,000. Assuming this is the first year of using the revaluation model, what amount would be booked to the Building account, if Smitty chooses to use the elimination method to record the revaluation? $30,000 Debit $40,000 Debit None of the above. $70,000 Debit $150,000 Debitarrow_forwardSale of Plant Asset Raine Company has a machine that originally cost $58,000. Depreciation has been recorded for four years using the straight-line method, with a $5,000 estimated salvage value at the end of an expected ten-year life. After recording depreciation at the end of four years, Raine sells the machine. Determine the gain or loss in each scenario if the machine sold for: Scenario Gain, Loss, or Neither Amount a. $37,000 cash 0 b. $36,800 cash 0 c. $28,000 cash 0arrow_forward

- Problem An asset used in a four-year project falls in the five-year MACRS class for tax purposes. The asset has an acquisition cost of $6,100,000 and will be sold for $1,300,000 at the end of the project. If the tax rate is 27%, what is the after-tax salvage value of the asset? MACRS Depreciation: 2 3 4 5 6 7 8 3 year class 33.33% 44.45% 14.81% 7.41% 5 year class 20.00% 32.00% 19.20% 11.52% 11.52% 5.76% 7 year class 14.29% 24.49% 17.49% 12.49% 8.93% 8.92% 8.93% 4.46%arrow_forwardDepreciation and Rate of Return Burrell Company purchased a machine for $11, 000 on January 2, 2019. The machine has an estimated service life of 5 years and a zero estimated residual value. The asset earns income before depreciation and income taxes of $5,500 each year. The tax rate is 25%. Required: Compute the rate of return earned (on the average net asset value) by the company each year of the asset's life under the straight - line and the double declining - balance depreciation methods. Assume that the machine is the company's only asset. Straight - line method. If required, round to one decimal place. 2019 fill in the blank 1% 2020 fill in the blank 2% 2021 fill in the blank 3% 2022 fill in the blank 4% 2023 fill in the blank 5% Double - declining - balance depreciation method. Round to two decimal places. Round your intermediate dollar value calculations to the nearest whole number. 2019 fill in the blank 6% 2020 fill in the blank 7% 2021 fill in the blank 8% 2022 fill in the…arrow_forwardTurpen Corporation purchased a large forest for $13,000,000 on January 1, 2023. Turpen Corporation estimates that 4,000,000 board feet (BF) of Sumber can be harvested, After 10 years, Turpen Corporation will sell the land and expects it to be worth $3,000,000 Required al Prepare the journal entry to record the purchase of the forest Do not enter dollar.sions.or.commes in the input boxes Date: Account Title and Explanation Debit Record the purchase of the forest b) Calculate the depletion rate for each board foot to be extracted Round your answers to 2 decimal places. Unit Cost Der board foot = Dec 31 c) During the current year, the company harvested and sold 500,000 board feet. Prepare the journal entry to record the harvesting on December 31, 2023 Bound your answers to the nearest whole number. Date Account Title and Explanation Record depletion for the year • Credit Debit Creditarrow_forward

- Natural Resources The Hollister Company acquires a silver mine at the cost of $2,100,000 on January 1. Along with the purchase price Hollister pays additional costs associated with development of $50,000, Hollister expects the mine will have a salvage value of $300,000 once all the silver has been mined. Best estimates are that the mine contains 250,000 tons of ore. Required a: Prepare the entry to record the purchase of the silver mine. b. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined and all the ore is sold, c. Prepare the December 31 year-end adjusting entry to record depletion is 60,000 tons of ore are mined but only 15,000 tons of the are are sold Description Credit 4 # Purchase of silver mine # = To record depletion on silver mine Siver inventory To record depletion on silver mine Debitarrow_forwardxyz company purchased an equipment for $15,000 cash and signed a note for 5 equal payments of $10,000 at the end of each year for 5 years. The implied interest rate is 6%. At the time of acquisition, what amount would the equipment be recorded at?arrow_forwardProblem J: On January 1, 2021, the Reddick Company purchased a mining right for P30,000,000. The mine's recoverable ore reserves are estimated to be 4,000,000 tons. Following the extraction of all ore, the company will be obligated by law to return the land to its original state. The present value of the restoration cost is P2,000,000. The company estimated that the property may be sold for P5,000,000. At a cost of P6,000,000, roads were built and other development costs were invested to aid in the extraction and transportation of the mined ore in early 2021. 200,000 tons of ore were extracted and sold in 2021. A new study conducted by a new mining engineer on December 31, 2022, revealed that 5,000,000 tons of ore were available for mining. 225,000 tons of ore were mined and sold in 2022. How much depletion expense should be recognized in 2022?arrow_forward

- Book value and taxes on sale of assets Troy Industries purchased a new machine 4 year(s) ago for $82,000. It is being depreciated under MACRS with a 5-year recovery period using the schedule. Assume 21% ordinary and capital gains tax rates. a. What is the book value of the machine? b. Calculate the firm's tax liability if it sold the machine for each of the following amounts: $98,400; $57,400; $13,940; and $9,800. a. The remaining book value is $ (Round to the nearest dollar.) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes Recovery year 1 2 3 4 10 years 10% 18% 14% 12% 9% 8% 7% 6% 6% 6% 4% 100% 100% 100% 100% *These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or…arrow_forwardPlease do not give solution in image format thankuarrow_forwardQuestion: Explain to Alice how Hazelton would account for the restoration if the restoration costs differed from the recorded liability in three years. By way of explanation, prepare the journal entry to record the payment of the retirement obligation in three years assuming that the actual restoration costs were $4.7 million.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education