FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

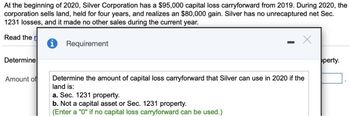

Transcribed Image Text:At the beginning of 2020, Silver Corporation has a $95,000 capital loss carryforward from 2019. During 2020, the

corporation sells land, held for four years, and realizes an $80,000 gain. Silver has no unrecaptured net Sec.

1231 losses, and it made no other sales during the current year.

Read the r

Determine

Amount of

i

Requirement

X

Determine the amount of capital loss carryforward that Silver can use in 2020 if the

land is:

a. Sec. 1231 property.

b. Not a capital asset or Sec. 1231 property.

(Enter a "0" if no capital loss carryforward can be used.)

perty.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Clay LLC placed in service machinery and equipment (seven-year property) with a basis of $3,480,000 on June 6, 2023. Assume that Clay has sufficient income to avoid any limitations. Calculate the maximum depreciation expense including §179 expensing (ignoring any possible bonus depreciation). (Use MACRS Table 1.) Note: Round final answer to the nearest whole number. Multiple Choice O $1,160,000 $497,292 $924,375 $985,839 None of the choices are correct.arrow_forward15. Blue Company sold machinery for $45,000 on December 23, 2021. The machinery had been acquired on April 1, 2019, for $69,000 and its adjusted basis was $34,200. The § 1231 gain, § 1245 recapture gain, and § 1231 loss from this transaction are: a.$0 § 1231 gain, $0 § 1245 recapture gain, $14,800 § 1231 loss. b.$0 § 1231 gain, $10,800 § 1245 recapture gain, $34,200 § 1231 loss. c.$0 § 1231 gain, $34,200 § 1245 recapture gain, $0 § 1231 loss. d.$0 § 1231 gain, $10,800 § 1245 recapture gain, $0 § 1231 loss.arrow_forwardUramilabenarrow_forward

- On January 1, 2021, Moo Company sold an asset with a carrying amount of P6,000,000 to Boo Company for P8,000,000. The asset had a fair value of P7,500,000 and a remaining useful life of six years. The asset was immediately leased back to Moo Company for a term of four years and annual rentals of P1,500,000 payable every yearend. The transfer qualified for as a sale and the lease was accounted for as a finance lease with an implicit interest rate of 12%. How much is the 2021 net income/loss of Moo Company relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the 2021 net income/loss of BooCompany relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the carrying amount of Moo Company's asset as of yearend 2021? How much is the 2022 net income/loss of Moo Company relating to the sale and leaseback transaction? [Indicate whether it is a gain or loss] How much is the 2022 net income/loss of Boo…arrow_forwardDineshbhaiarrow_forwardDuring 2020, Sienar Systems, Inc purchased Correalian Drives, Inc. (one of its suppliers) using the assets method. As a part of this business, it was determined the company purchased 1,200,000 of Goodwill. a. How much is the book to tax difference with this purchase in 2020 and is it temporary or permanent?arrow_forward

- EB Corporation, a C corporation, purchases a warehouse on August 1, 2007, for $ 1 MILLION Straight-line depreciation is taken in the amount of $411, 750 before the property is sold on June 12, 2023, for $1.2 MIL. What is the amount and character of the gain recognized by EB on the sale of the realty?arrow_forwardRenata Corporation purchased equipment in 2020 for $275,200 and has taken $123,840 of regular MACRS depreciation. Renata Corporation sells the equipment in 2022 for $165,120. What is the amount and character of Renata's gain or loss? Renata Corporation has a gain of $ § 1245 recapture X of which $ X is treated as ordinary income due toarrow_forwardPT Adista owns land that was purchased in cash on January 2, 2018 at a cost of IDR 1,000,000,000. Requested: a. PT Adista decided to use the revaluation model for the land (which is a fixed asset). On December 31, 2018, the company recognized a revaluation surplus of the land amounting to Rp 100,000,000. If on December 31, 2019 it is known that the fair value of the land is IDR 1,060,000,000, make a journal entry that is recorded by PT Astina regarding the land in 2019. b. Describe how the accounting treatment differs between the fixed asset revaluation model and the fair value model of investment property.arrow_forward

- please help me resolve correctlyarrow_forwardAt the beginning of 2021, Blossom Co. purchased an asset for $2300000 with an estimated useful life of 5 years and an estimated salvage value of $160000. For financial reporting purposes the asset is being depreciated using the straight-line method; for tax purposes the double-declining-balance method is being used. Blossom Co.’s tax rate is 20% for 2021 and all future years.At the end of 2021, which of the following deferred tax accounts and balances is reported on Blossom’s balance sheet? Account Balance Deferred tax liability $85600 Deferred tax liability $98400 Deferred tax asset $98400 Deferred tax asset $85600arrow_forwardTurtle Corporation is a calendar year C Corporation formed in 2017. Turtle purchased a motel property in June 2020 for $11,000,000. The motel land value represented $2,500,000 of the $11,000,000 purchase price. What is the allowable depreciation deductions on the hotel for 2020 and 2021? A. $118,235 in 2020 and $217,940 in 2021 B. $153,010 in 2020 and $282,040 in 2021 C. $167,450 in 2020 and $309.060 in 2021 D. $309,060 in 2020 and $167,450 in 2021arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education