FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

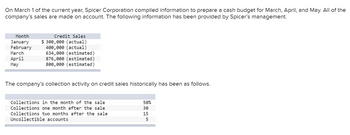

Transcribed Image Text:On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the

company's sales are made on account. The following information has been provided by Spicer's management.

Month

January

February

March

April

May

Credit Sales

$ 300,000 (actual)

400,000 (actual)

634,000 (estimated)

876,000 (estimated)

800,000 (estimated)

The company's collection activity on credit sales historically has been as follows.

Collections in the month of the sale

Collections one month after the sale

Collections two months after the sale

Uncollectible accounts

50%

30

15

տ

Transcribed Image Text:Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its

cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter.

Compute Spicer's budgeted cash balance at the ends of March, April, and May.

Cash balance on March 31

Cash balance on April 30

Cash balance on May 31

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Trapp Co. was organized on August 1 of the current year. Projected sales for the next three months are as follows: August $100,000 September 185,000 October 225,000 The company expects to sell 40% of its merchandise for cash. Of the sales on account, one third are expected to be collected in the month of the sale and the remainder in the following month. Prepare a schedule indicating cash collections of accounts receivable for August, September, and October. For each month's sales on account, enter the collection months in chronological order. Trapp Co. Schedule of Collections of Accounts Receivable For Three Months Ending October 31, 20xX August September October August sales on account: Collected in August Collected in September September sales on account: Collected in September Collected in October October sales on account: Collected in October Totalsarrow_forwardPapst Company is preparing its cash budget for the month of May. The following information is available concerning its accounts receivable (based on sales made to customers on open account): Actual credit sales for March Actual credit sales for April Estimated credit sales for May Estimated collections in the month of sale Estimated collections in the first month after the month of sale Estimated collections in the second month after the month of sale Estimated provision for bad debts (made in the month of sale) $225,000 $ 293,000 $ 438,000 25% 60% 10% 5% The firm writes off all uncollectible accounts at the end of the second month after the month of sale. Required: Determine for Papst Company for the month of May: 1. The estimated cash receipts from accounts receivable collections. 2. The gross amount of accounts receivable at the end of the month (after appropriate write-off of uncollectible accounts). 3. The net amount of accounts receivable at the end of the month. 4. Recalculate…arrow_forwardAaron's chairs is in the process of preparing a production costbudget for August. Actual costs in July for 120 chairs were:Materials cost $4,730Labor cost 2,940Rent 1,500Depreciation 2,500Other fixed costs 3,200Materials and labor are the only variable costs. If productionand sales are budgeted to change to 120 chairs in August,how much is the expected total variable cost on the Augustbudget?arrow_forward

- Sonoma Housewares Inc. Cash Budget For the Three Months Ending July 31 May June July Estimated cash receipts from: Cash sales $ $ Collection of accounts receivable Total cash receipts $ Estimated cash payments for: Manufacturing costs Selling and administrative expenses Capital expenditures Other purposes: Income tax Dividends Total cash payments Cash increase or (decrease) $ bala at beginning Cash balance at end of month Minimum cash balance Excess (deficiency) $arrow_forwardIllumination Corporation operates one central plant that has two divisions, the Flashlight Division and the Night Light Division. The following data apply to the coming budget year Budgeted costs of operating the plant for 2,000 to 3,000 hours: Fixed operating costs per year Variable operating costs Budgeted long-run usage per year Flashlight Division Night Light Division Practical capacity $500,000 OA. $500,000 B. $625.000 OC. $600,000 D. $650,000 $500 per hour 2,000 hours 1,000 hours 4,000 hours Assume that practical capacity is used to calculate the allocation rates Actual usage for the year by the Flashlight Division was 1,500 hours and by the Night Light Division was 800 hours If a dual-rate cost-allocation method is used, what amount of operating costs will be budgeted for the Night Light Division?arrow_forwardThe controller of Optimum wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2021: June 30, 2021, cash balance Dividends were declared on June 15* $130,000 44, 000 83,600 13,000 198,000 122,400 47,000 70, 000 Cash expenditures to be paid in July for operating expenses Depreciation expense Cash collections to be received Merchandise purchases to be paid in cash Equipment to be purchased for cash Optimum wishes to maintain a minimum cash balance of *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: 1. Prepare a cash budget for the month ending July 31, 2021, indicating how much, if anything, Optimum will need to borrow to meet its minimum cash requirement. (Leave no cells blank - enter "O" wherever required).arrow_forward

- The accountant for Baird's Dress Shop prepared the following cash budget. Baird's desires to maintain a cash balance of $24,000 at the end of each month. Funds are assumed to be borrowed and repaid on the last day of each month. Interest is charged at the rate of 1 percent per month. Required a. Complete the cash budget by filling in the missing amounts. b. Determine the amount of net cash flows from operating activities Baird's will report on the third quarter pro forma statement of cash flows. c. Determine the amount of net cash flows from financing activities Baird's will report on the third quarter pro forma statement of cash flows. Complete this question by entering your answers in the tabs below. Req A Req B and C Complete the cash budget by filling in the missing amounts. Note: Any shortages or repayments should be indicated with a minus sign. Round your answers to the nearest whole dollar amount. Cash Budget July August September Section 1: Cash receipts Beginning cash balance…arrow_forwardDetermine the anticipated total cash receipts for the month of January for Madison Co. in preparing a Cash Budget, given the following info: Accounts Receivable balance as of January 1 $296,000.00 Budgeted Sales for January = $860,000.00 Madison Co. assumes all monthly sales are on account. And that 75% of the sales on account will be collected in the month of the sale, and that the remainder will be collected the following month. $688,000.00 $812,000.00 $941,000.00 O $468,000.00arrow_forwardThe following information was taken from Pharoah Company cash budget for the month of July: Beginning cash balance $155000 Cash receipts 149000 Cash disbursements 211000 If the company has a policy of maintaining an end of the month cash balance of $155000, the amount the company would have to borrow isarrow_forward

- The following data are from the budget of Ritewell Publishers. Half the company's sales are transacted on a cash basis. The other half are paid for with a 1-month delay. The company pays all of its credit purchases with a 1-month delay. Credit purchases in January were $140, and total sales in January were $290. TT February March $ 420 April Total sales $ 440 $ 400 125 135 115 Cash purchases Credit purchases Labor and administrative purchases Taxes, interest, and dividends Capital expenditures 95 85 95 85 85 85 65 65 65 210 Complete the following cash budget. (Leave no cells blank. Enter '0' when necessary. Negative amounts should be indicated by a minus sign.) February March Aprit Sources of cash Collections on current sales Collections on amounts receivable Total sources of cash 0 $ Uses of cash Payments of accounts payable Cash purchases o searcharrow_forwardThe controller of Ultramint Company wishes to improve the company's control system by preparing a monthly cash budget. The following information relates to the month ending July 31, 2008. June 30, 2008 cash balance ... Dividends to be declared on July 15* Cash expenditures to be paid in July for operating expenses Amortization expense.... Cash collections to be received ... $ 90,000 24,000 73,600 9,000 178,000 112,400 41,000 50,000 Merchandise purchases to be paid in cash Equipment to be purchased for cash. …….. Ulramint Company wishes to maintain a minimum cash balance of .... *Dividends are payable to shareholders of record on declaration date, 30 days after declaration. Required: Prepare a cash budget for the month ended July 31, 2008, indicating how much, if anything, Ultramint will need to borrow to meet its minimum cash requirement.arrow_forwardSubject - account Please help me. Thankyou.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education