FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

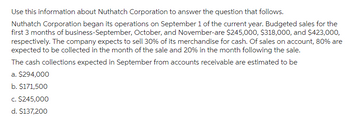

Transcribed Image Text:Use this information about Nuthatch Corporation to answer the question that follows.

Nuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the

first 3 months of business-September, October, and November-are $245,000, $318,000, and $423,000,

respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are

expected to be collected in the month of the sale and 20% in the month following the sale.

The cash collections expected in September from accounts receivable are estimated to be

a. $294,000

b. $171,500

c. $245,000

d. $137,200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following is the sales budget for Yellowhead Inc. for the first quarter of 2021: Sales January $200,000 February $220,000 March $243,000 Credit sales are collected as follows: 65% in the month of the sale, 20% in the month after the sale, and 15% in the second month after the sale. The accounts receivable balance at the end of the previous quarter was $84,000 ($54,000 of which was uncollected December sales). a. Calculate the sales for November. (Omit "$" sign in your response.) November sales b. Calculate the sales for December. (Round the final answer to 2 decimal places. Omit "$" sign in your response.) December sales $ c. Calculate the cash collections from sales for each month from January through March. (Do not round intermediate calculations. Round the final answers to 2 decimal places. Omit "$" sign in your response.) January February March Cash collections $ $ $arrow_forwardNuthatch Corporation began its operations on September 1 of the current year. Budgeted sales for the first three months of business-September, October, and November-are $241,000, $314,000, and $415,000, respectively. The company expects to sell 30% of its merchandise for cash. Of sales on account, 80% are expected to be collected in the month of the sale and 20% in the month following the sale. The cash collections expected in November from accounts receivable are projected to be: C a. $331,632 Ob. $232,400 O c. $188,440 Od. $276,360arrow_forwardGrit Company was formed on May 1, 2023. During May, 2023, the company reported sales on account of $750,000. During June, 2023, Grit Company reportes sales on account of $800,000. Anticipated collections patterns of accounts receivable indicate 40% will be collected in the month of sale, 10% in the next month, and the remainder in the following month. How much will appear on the cash receipts and disbursements budget prepared for June, 2023? $620,000 O $465,000 O $545,000 O $540,000arrow_forward

- Emerald Service anticipates the following sales revenue over a five-month period Its collection history indicates that credit sales are collected as follows E (Click the icon to view the sales data ) The company's sales are 40% cash and 60% credit O (Click the icon to view the collections data) How much cash will be collected in January? In February? In March? For the quarter in total? Complete the cash budget to determine how much cash will be collected in January, February, March and for the quarter in total. (Round your answers to the nearest whole dollar) Emerald Service Cash Collections Budget For the Months of January through March January Cash sales 6,080 Collection of credit sales 25% Month of sale 2,280 50% Month after 15% Two months after Total cash collectionsarrow_forwardSales are budgeted at $360,000 for November, $370,000 for December, and $350,000 for January. . Collections are expected to be 40% in the month of sale and 60% in the month following the sale. • The cost of goods sold is 60% of sales. • The company desires an ending merchandise inventory equal to 20% of the cost of goods sold in the following month. Payment for merchandise is made in the month following the purchase. • The November beginning balance in the accounts receivable account is $71,000. • The November beginning balance in the accounts payable account is $258,000. Required: a. Prepare a Schedule of Expected Cash Collections for November and December. b. Prepare a Merchandise Purchases Budget for November and December. Complete this question by entering your answers in the tabs below. Required A Required B Prepare a Schedule of Expected Cash Collections for November and December. Sales Schedule of Expected Cash Collections Accounts receivable November sales December sales Total…arrow_forwardRivers Company purchases merchandise on account. In general, Rivers pays 50% in the month of purchase and 50% in the following month. All payments in the month of purchase qualify for a 2% cash discount. First quarter budgeted purchases are: January $90,000 February $80,000 March $96,000 A. What are the total cash disbursements expected in February? B. What are the total cash disbursements expected in March? C. Now suppose that there is no cash discount for purchases made in the month of purchase. Now what are the total cash disbursements expected in February? In March?arrow_forward

- On March 1 of the current year, Spicer Corporation compiled information to prepare a cash budget for March, April, and May. All of the company's sales are made on account. The following information has been provided by Spicer's management. January February March Month Credit Sales $300,000 (actual) 400,000 (actual) 473,000 (estimated) April May 671,000 (estimated) 800,000 (estimated) The company's collection activity on credit sales historically has been as follows. Collections in the month of the sale Collections one month after the sale Collections two months after the sale Uncollectible accounts 50% 30 15 5 Spicer's total cash expenditures for March, April, and May have been estimated at $1,200,000 (an average of $400,000 per month). Its cash balance on March 1 of the current year is $500,000. No financing or investing activities are anticipated during the second quarter. Compute Spicer's budgeted cash balance at the ends of March, April, and May. Answer is complete but not entirely…arrow_forwardIn May 2022, the budget committee of Blue Spruce, Inc. assembles the following data in preparation of budgeted merchandise purchases for the month of June. 1. Expected sales: June $725,000, July $970,000. 2. Cost of goods sold is expected to be 80% of sales. 3. Desired ending merchandise inventory is 30% of the following month's cost of goods sold. 4. The beginning inventory at June 1 will be the desired amount. (a) Compute the budgeted merchandise purchases for June. BLUE SPRUCE, INC. Merchandise Purchases Budget $arrow_forwardGoldberg Company is a retail sporting goods store that uses an accrual accounting system. Facts regarding its operations follow: Sales are budgeted at $250,000 for December and $225,000 for January, terms 1/eom, n/60. Collections are expected to be 50% in the month of sale and 48% in the month following the sale. Two percent of sales are expected to be uncollectible and recorded in an allowance account at the end of the month of sale. Bad debts expense is included as part of operating expenses. Gross margin is 30% of gross sales. All accounts receivable are from credit sales. Bad debts are written off against the allowance account at the end of the month following the month of sale. Goldberg desires to have 80% of the merchandise for the following month’s sales on hand at the end of each month. Payment for merchandise is made in the month following the month of purchase. Other monthly operating expenses to be paid in cash total $25,000. Annual depreciation is $216,000, one-twelfth…arrow_forward

- jagdisharrow_forwardRoss Corporation makes all sales on account. The June 30th balance sheet balance in its accounts receivable is $400,000, of which $240,000 pertain to sales that were made during June. Budgeted sales for July are $1,250,000. Ross collects 70% of sales in the month of sale; 20% in the following month; and the final 10% in the second month after the sale. What is the budgeted balance of Ross's accounts receivable as of July 31?arrow_forwardA manufacturing company's sales budget indicates the following sales: January: $30,000; February: $20,000; March: $15,000. The company expects 80% of the sales to be on account. Credit sales are collected 30% in the month of the sale and 70% in the month following the sale. The total cash receipts collected during March will be $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education