FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

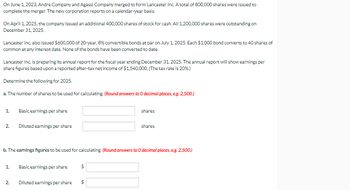

Transcribed Image Text:On June 1, 2023, Andre Company and Agassi Company merged to form Lancaster Inc. A total of 800,000 shares were issued to

complete the merger. The new corporation reports on a calendar-year basis.

On April 1, 2025, the company issued an additional 400,000 shares of stock for cash. All 1,200,000 shares were outstanding on

December 31, 2025.

Lancaster Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 40 shares of

common at any interest date. None of the bonds have been converted to date.

Lancaster Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per

share figures based upon a reported after-tax net income of $1,540,000. (The tax rate is 20%.)

Determine the following for 2025.

a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.)

1.

2.

Basic earnings per share

N

Diluted earnings per share

1. Basic earnings per share

2.

b. The earnings figures to be used for calculating: (Round answers to O decimal places, e.g. 2,500.)

Diluted earnings per share

$

$

69

shares

shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On June 1, 2018, Indigo Company and Sweet Company merged to form Pharoah Inc. A total of 870,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis.On April 1, 2020, the company issued an additional 543,000 shares of stock for cash. All 1,413,000 shares were outstanding on December 31, 2020.Pharoah Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2020. Each $1,000 bond converts to 38 shares of common at any interest date. None of the bonds have been converted to date.Pharoah Inc. is preparing its annual report for the fiscal year ending December 31, 2020. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,613,000. (The tax rate is 20%.)Determine the following for 2020. a) - Basic Earnings per share - Diluted Earnings per share b) the earnings used to calculate: - Basic Earnings per share - Diluted Earnings per sharearrow_forwardDogarrow_forwardOn June 1, 2023, Novak Company and Splish Company merged to form Blossom Inc. A total of 877,000 shares were issued to complete the merger. The new corporation reports on a calendar-year basis. On April 1, 2025, the company issued an additional 652,000 shares of stock for cash. All 1,529,000 shares were outstanding on December 31, 2025. Blossom Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 44 shares of common at any interest date. None of the bonds have been converted to date. Blossom Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per share figures based upon a reported after-tax net income of $1,444,000. (The tax rate is 20%.) Determine the following for 2025. a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.) 1. 2. 1. Basic earnings per share 2. Diluted earnings per share Basic earnings per share b.…arrow_forward

- Kress Products' corporate charter authorized the firm to sell 800,000 shares of $10 par common stock. At the beginning of 2019, Kress sold 262,900 shares and reacquired 1,650 of those shares. The reacquired shares were held as treasury stock. During 2019, Kress sold an additional 16,300 shares and purchased 3,100 more treasury shares. Required: Determine the number of issued and outstanding shares at December 31, 2019. Issued shares shares Outstanding shares sharesarrow_forwardOn January 1, 2024, the Moody Company entered into a transaction for 100% of the outstanding common stock of Osorio Company. To acquire these shares, Moody issued $400 in long- term liabilities and also issued 40 shares of common stock having a par value of $1 per share but a fair value of $10 per share. Moody paid $20 to lawyers, accountants, and brokers for assistance in bringing about this acquisition. Another $15 was paid in connection with stock issuance costs. Prior to these transactions, the balance sheets for the two companies were as follows: Cash Receivables Inventories Land Buildings (net) Equipment (net) Accounts payable Long-term liabilities. Common stock ($1 par) Common stock ($20 par) Additional paid-in capital Retained earnings Note: Parentheses indicate a credit balance. Multiple Choice O $1,760 In Moody's appraisal of Osorio, three assets were deemed to be undervalued on the subsidiary's books: Inventory by $10, Land by $40, and Buildings by $60. Compute the amount of…arrow_forwardOn January 1, 2022, Mojito Corporation purchased 20% (20,000 shares) of the outstanding stock of Dulcinea Corporation for $153,000. During 2022, Dulcinea Corporation paid total dividends of $45,000 and earned $80,000 in net income. At the end of 2022, Dulcinea Corporation’s stock had a fair market value of $155,000. Required: Prepare the journal entries that Mojito would make during 2022 assuming that they do NOT have significant influence over Dulcinea as a result of their stock ownership (i.e. fair value method). Prepare the journal entries that Mojito would make during 2022 assuming that they do have significant influence over Dulcinea as a result of their stock ownership (i.e. equity method).arrow_forward

- On June 30, 2023, Wisconsin, Incorporated, issued $158,250 in debt and 19,400 new shares of its $10 par value stock to Badger Company owners in exchange for all of the outstanding shares of that company. Wisconsin shares had a fair value of $40 per share. Prior to the combination, the financial statements for Wisconsin and Badger for the six-month period ending June 30, 2023, were as follows (credit balances in parentheses): Items Wisconsin Badger Revenues $ (1,001,000) $ (362,000) Expenses 690,000 247,000 Net income $ (311,000) $ (115,000) Retained earnings, 1/1 $ (869,000) $ (204,000) Net income (311,000) (115,000) Dividends declared 111,750 0 Retained earnings, 6/30 $ (1,068,250) $ (319,000) Cash $ 92,250 $114,000 Receivables and inventory 482,000 183,000 Patented technology (net) 935,000 293,000 Equipment (net) 713,000 695,000 Total assets $2,222,250 $1,285,000 Liabilities $ (524,000) $ (496,000) Common stock (360,000) (200,000) Additional paid-in capital (270,000) (270,000)…arrow_forwardWhispering Ltd. began its latest fiscal year on January 1, 2020, with 12,000 common shares outstanding. On April 1, Whispering sold 3,300 additional common shares. The company declared and issued a 20% stock dividend on June 1. On July 1, Whispering repurchased and cancelled 220 common shares. An additional 3,750 common shares were issued on September 1. On November 1, Whispering declared and issued a 2-for-one stock split. On December 1, Whispering issued an additional 120 shares. Following the fiscal year, Whispering declared and issued a 3-for-one stock split on February 1, 2021. The company issued its 2020 financial statements on March 10, 2021.Calculate the weighted average number of common shares that Whispering should use for calculating its EPS numbers for 2020. Weighted average number of common shares Enter your answer in accordance to the question statement shares Please show how to calculatearrow_forwardDuring its first year of operations, Cupola Fan Corporation issued 30,000 of $1 par Class B shares for $385,000 on June 30, 2024. Share issue costs were $1,500. One year from the issue date (July 1, 2025), the corporation retired 10% of the shares for $39,500. Required: 1. to 4. Prepare the journal entries to record the issuance of the shares, the declaration of a $2 per share dividend on December 1, 2024, the payment of the dividend on December 31, 2024, and the retirement of the shares. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education