FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

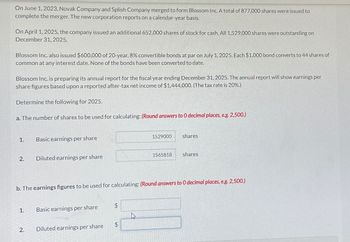

Transcribed Image Text:On June 1, 2023, Novak Company and Splish Company merged to form Blossom Inc. A total of 877,000 shares were issued to

complete the merger. The new corporation reports on a calendar-year basis.

On April 1, 2025, the company issued an additional 652,000 shares of stock for cash. All 1,529,000 shares were outstanding on

December 31, 2025.

Blossom Inc. also issued $600,000 of 20-year, 8% convertible bonds at par on July 1, 2025. Each $1,000 bond converts to 44 shares of

common at any interest date. None of the bonds have been converted to date.

Blossom Inc. is preparing its annual report for the fiscal year ending December 31, 2025. The annual report will show earnings per

share figures based upon a reported after-tax net income of $1,444,000. (The tax rate is 20%.)

Determine the following for 2025.

a. The number of shares to be used for calculating: (Round answers to O decimal places, e.g. 2,500.)

1.

2.

1.

Basic earnings per share

2.

Diluted earnings per share

Basic earnings per share

b. The earnings figures to be used for calculating: (Round answers to O decimal places, e.g. 2,500.)

Diluted earnings per share

$

1529000

$

1565818

shares

shares

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Similar questions

- i need Part Barrow_forwardThe following information was available for the year ended December 31, 2019: Net income Average total assets Dividends per share Earnings per share Market price per share at year-end $ 50,000 600,000 1.40 5.00 70,00 The dividend payout ratio for 2019 was 報 灣 券 11111 157arrow_forwardQuestion 1- Texas Instruments (TXN) (please include your Excel spreadsheet file!) Actual data for Texas Instruments common stock! Suppose on December 31, 2011 you purchased TXN stock at $29.11 per share. You hold TXN until December 31, 2021 when you sold it at $188.47 per share. During this holding period, you received the following annual dividends per share. Year Annual DPS Year Annual DPS 2012 $0.72 2017 $2.12 2013 $1.07 2018 $2.63 2014 $1.24 2019 $3.21 2015 $1.40 2020 $3.72 2016 $1.64 2021 $4.21 Using the above TXN stock data and using Excel spreadsheet, determine the average annual return for your TXN investment. Question 2 TXN stock price on December 31, 2020 was $162.70 per share. Calculate the 2021 annual "holding period return" (HPR). Show all work. Question 3 Using the table above, determine the average annual growth rate for TXN dividends per share for the period 2012-2021. Show formula, input, & calculation. Excel is optional.arrow_forward

- which of the below ratios can I use the attached file to calculate? return on total assets return on common stockholder's equity dividend payout ratio price-earnings ratioarrow_forwardCompute the following ratios for both companies for the current year, and decide which company’s stock better fits your investment strategy. Debt Ratio Earning per share of common stocks Price/earning ration Dividend payoutarrow_forwardConsider the following partial income statements and balance sheets for Lillard Corp. For the year ended December 31, Net income Less income attributable to noncontrolling 5,700 interests Net income attributable to Lillard Corp. 100,400 107,300 Lillard Corp. shareholders' equity Noncontrolling interests Total equity What is Lillard's return on equity for 2024? 11.7% O 11.5% 12.3% 11.9% 2024 2023 108,000 113,000 11.1% 7,600 Dec. 31, 2024 Dec. 31, 2023 861,000 888,000 32,400 30,600 893,400 918,600arrow_forward

- A. Find the net proceeds of the stocks on the table below. Expenses Name of Stock Shares Held Selling Price per Share (Commission, taxes and Fees) Net Proceeds 1. Food Corporation 2. Property Holdings 3. Power Corporation 4.Transportation Corporation 100 P1,040.00 P2,640.00 250 P500.00 P1,720.00 80 P1,480.00 P1,880.00 300 P320.00 P2,240.00arrow_forwardI need help with this question to understand the topicarrow_forwardSheridan Corporation had the following information in its financial statements for the year ended 2025 and 2026: Common cash dividends for the year 2026 Net income for the year 2026 Market price of stock, 12/31/26 Common stockholders' equity, 12/31/25 Common stockholders' equity, 12/31/26 Outstanding shares, 12/31/26 Preferred dividends for the year 2026 $21500 O $17.99 O $15.10 O $18.67 O $18.88 128000 25 2240000 2800000 148300 31100 What is book value per share for Sheridan Corporation for the year ended 12/31/2026?arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education