Financial Accounting Intro Concepts Meth/Uses

14th Edition

ISBN: 9781285595047

Author: Weil

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

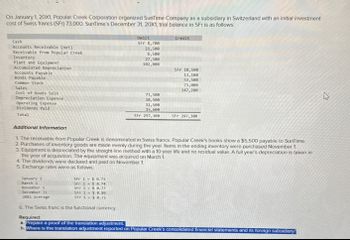

Transcribed Image Text:On January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment

cost of Swiss francs (SF) 73,000. SunTime's December 31, 20X1, trial balance in SFr is as follows:

Cash

Accounts Receivable (net)

Receivable from Popular Creek

Inventory

Plant and Equipment

Accumulated Depreciation

Accounts Payable

Bonds Payable

Common Stock

Sales

Cost of Goods Sold

Depreciation Expense

Operating Expense

Dividends Paid

Total

Additional Information

Debit

SFr 8,700

Credit

21,500

6,500

27,500

102,000

Sfr 10,500

13,100

53,500

73,000

147,200

73,500

10,500

31,500

15,600

SFP 297,300

SFP 297,300

=

1. The receivable from Popular Creek is denominated in Swiss francs. Popular Creek's books show a $5,500 payable to SunTime.

2. Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased November 1

3. Equipment is depreciated by the straight-line method with a 10-year life and no residual value. A full year's depreciation is taken in

the year of acquisition. The equipment was acquired on March 1

4. The dividends were declared and paid on November 1.

5. Exchange rates were as follows:

January 1

March 1

November 1

December 31

28x1 average

SFr 1

$0.73

Sfr 1 $ 0.74

SFr 1 5 8.77

SFr 1-5 0.80

SFr 1

$0.75

6. The Swiss franc is the functional currency

Required:

a. Prepare a proof of the translation adjustment

b. Where is the translation adjustment reported on Popular Creek's consolidated financial statements and its foreign subsidiary

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 71,000. SunTime's December 31, 20X1, trial balance in SFr is as follows: Cash Accounts Receivable (net) Receivable from Popular Creek Inventory Plant and Equipment Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Sales Cost of Goods Sold Depreciation Expense Operating Expense Dividends Paid Total Additional Information January 1 March 1 Debit SFr 8,300 23,000 7,000 28,000 110,000 SFr 1 = $ 0.73 SFr 1 = $ 0.74 SFr 1 $ 0.77 SFr 1 = $ 0.80 SFr 1 = $ 0.75 70,500 11,100 31,000 18,000 SFr 306,900 Credit SFr 11,100 12,400 52,000 71,000 160,400 1. The receivable from Popular Creek is denominated in Swiss francs. Popular Creek's books show a $6,000 payable to SunTime. 2. Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased November 1. 3. Equipment is depreciated by…arrow_forwardOn January 1, 20X1, Popular Creek Corporation organized SunTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 60,000. SunTime's December 31, 20X1, trial balance in SFr is as follows: Cash Accounts Receivable (net) Receivable from Popular Creek Inventory Plant and Equipment Accumulated Depreciation Accounts Payable Bonds Payable Common Stock Sales Cost of Goods Sold Depreciation Expense Operating Expense Dividends Paid Total Additional Information January 1 March 1 SFr 1 = $0.80 SFr 1 = $0.77 SFr 1 $ 0.74 SFr 1 = $ 0.73 SFr 1 = $ 0.75 Debit SFr 7,000 20,000 5,000 25,000 100,000 November 1 December 31 20X1 average 6. The U.S. dollar is the functional currency. 70,000 10,000 30,000 15,000 SFr 282,000 Credit 1. The receivable from Popular Creek is denominated in Swiss francs. Its books show a $4,000 payable to SunTime. 2. Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased November 1. 3.…arrow_forwardF) On January 1, 20X1, Popular Creek Corporation organized RoadTime Company as a subsidiary in Switzerland with an initial investment cost of Swiss francs (SFr) 60,000. RoadTime's December 31, 20X1, trial balance in SFr is as follows: Debit Credit Cash Accounts Receivable (net) Receivable from Popular Creek Inventory Plant & Equipment Accumulated Depreciation Accounts Payable Bonds Payable Common Stock SFr 7,000 20,000 5,000 25,000 100,000 SFr 10,000 12,000 50,000 60,000 150,000 Sales Cost of Goods Sold Depreciation Expense Operating Expense Dividends Paid 70,000 10,000 30,000 15,000 Tota SFr 282,000 SFr 282,000 Additional Information i. The receivable from Popular Creek is denominated in Swiss francs. Popular Creek's books show a $4,000 payable to RoadTime. Purchases of inventory goods are made evenly during the year. Items in the ending inventory were purchased November 1. ii. iii. Equipment is depreciated by the straight-line method with a 10-year life and no residual value. A full…arrow_forward

- Required: a. Prepare a schedule translating the December 31 20X1, trial balance from swiss francs to dollar. b. Where is the translation adjustment reported on popular Creek's consolidated financial Statement and its foreign Sibsidiary?arrow_forwardIn 1995, Ajax Manufacturing's German subsidiary has the following balance sheet:Cash, marketablesecuritiesAccounts receivableInventory (at market.Fixed AssetsTotal assetsDM 250,0001,000,0002,700,0005,100,000-----------------DM 9,050,000Current liabilitiesLong-term debtEquityTotal liabilitiesplus equityDM 750,0003,400,0004,900,000---------------DM 9,050,000Suppose the DM appreciates from $0.70 to $0.76 during the period.10.16 Under the current/noncurrent method, what is Ajax's translation gain (loss).?a) a gain of $294,000b) a gain of $192,000c) a loss of $174,000d) a loss of $12,000arrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash NGN 15,120 Notes payable NGN 20,160 Inventory 10,800 Common stock 20,160 Land 4,080 Retained earnings 10,080 Building 40,800 Accumulated depreciation (20,400 ) NGN 50,400 NGN 50,400 The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: 2020 Feb. 1 Paid 8,080,000 NGN on the note payable. May 1 Sold entire inventory for 16,800,000 NGN on account. June 1 Sold land for 6,080,000 NGN cash. Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,080,000 NGN cash. Oct. 1 Bought inventory for 20,080,000 NGN cash. Nov. 1…arrow_forward

- Sean Regan Company formed a subsidiary in a foreign country on January 1, Year 1, through a combination of debt and equity financing. The foreign subsidiary acquired land on January 1, Year 1, which it rents to a local farmer. The foreign subsidiary’s financial statements for its first year of operations, in foreign currency units (FC), are presented in Exhibit 9.3 . All revenues and expenses were realized in cash during the year. Thus, the balance in the Cash account at December 31 (FC 1,750) is equal to the beginning balance in cash (FC 1,000) plus net income for the year (FC 750). The foreign country experienced significant inflation in Year 1, especially in the second half of the year. The general price index (GPI) during Year 1 was :January 1, Year 1 100Average, Year 1 125December 31, Year 1 200 The rate of inflation in Year 1 is 100 percent [(200 − 100)/100], and the foreign country clearly meets the definition of a hyperinflationary economy. (in FC) January 1…arrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash NGN 16,800 Notes payable NGN 20,400 Inventory 12,000 Common stock 22,400 Land 4,200 Retained earnings 11,200 Building 42,000 Accumulated depreciation (21,000 ) NGN 54,000 NGN 54,000arrow_forwardRolfe Company (a U.S.-based company) has a subsidiary in Nigeria where the local currency unit is the naira (NGN). On December 31, 2019, the subsidiary had the following balance sheet (amounts are in thousands [000s]): Cash NGN 16,240 Notes payable NGN 20,180 Inventory 10,900 Common stock 21,000 Land 4,090 Retained earnings 10,500 Building 40,900 Accumulated depreciation (20,450 ) NGN 51,680 NGN 51,680 The subsidiary acquired the inventory on August 1, 2019, and the land and building in 2013. It issued the common stock in 2011. During 2020, the following transactions took place: 2020 Feb. 1 Paid 8,090,000 NGN on the note payable. May 1 Sold entire inventory for 16,900,000 NGN on account. June 1 Sold land for 6,090,000 NGN cash. Aug. 1 Collected all accounts receivable. Sept. 1 Signed long-term note to receive 8,090,000 NGN cash. Oct. 1 Bought inventory for 20,090,000 NGN cash. Nov. 1…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you