Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

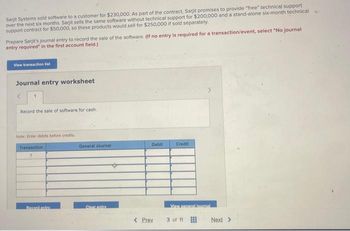

Transcribed Image Text:Sarjit Systems sold software to a customer for $230,000. As part of the contract, Sarjit promises to provide "free" technical support

over the next six months. Sarjit sells the same software without technical support for $200,000 and a stand-alone six-month technical

support contract for $50,000, so these products would sell for $250,000 if sold separately.

Prepare Sarjit's journal entry to record the sale of the software. (If no entry is required for a transaction/event, select "No journal

entry required" in the first account field.)

View transaction list

Journal entry worksheet

1

Record the sale of software for cash.

Note: Enter debits before credits

Transaction

1

General Journal

Debit

Credit

Recept natry

Clear entry

View general journal

< Prev

3 of 11

Next >

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 2 images

Knowledge Booster

Similar questions

- Sarjit Systems sold software to a customer for $80,000. As part of the contract, Sarjit promises to provide “free” technical support over the next six months. Sarjit sells the same software without technical support for $70,000 and a stand-alone six-month technical support contract for $30,000, so these products would sell for $100,000 if sold separately. Prepare Sarjit’s journal entry to record the sale of the software.arrow_forwardSoftware Supplier Inc. sells to a customer a perpetual software license and post-contract customer support for a 12-month period, commencing at the time that the software is activated. Software Supplier Inc. charges $240 upfront when the software is purchased and $16 a month for 12 months, due at the end of the month. Software Supplier Inc. sells the software separately for $320 while the standalone selling price of the post-contract customer support is $160. Note: Carry all decimals in calculations; round the final answer to the nearest dollar. Note: If a journal entry (or a line of the journal entry) isn't required for the transaction, select "N/A" as the account names and leave the Dr. and Cr. answers blank (zero). a. How should the transaction price be allocated among the performance obligation(s)? Performance Obligations Transaction Price as Stated Standalone Selling Price Allocated Transaction Price (rounded) Software Customer support $ $ Account Name To record sale of software.…arrow_forwardSorCo. Inc. has just entered into a sale agreement with a customer. The contract is for $600,000. However, the payments will be made as follows: 1 August 20X1 on date of delivery $400,000; 1 August 20X2 $100,000 and 1 August 20X3 $100,000. SorCo has estimated that the interest rate required for this customer is 8%. SorCo follows IFRS. Required: Prepare the journal entry required to record the sale on 1 August 20X1 and the receipt of cash on 1 August 20X2 and 20X3. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Do not round intermediate calculations and round your final answers to the nearest whole dollar.)arrow_forward

- Sirius XM Holdings Incorporated sells a dash-top satellite radio receiver and one-year subscription for a total price of $80. By purchasing this deal, the subscriber is entitled to receive hardware (i.e., the radio), a software update that is automatically downloaded every second month to the radio, and continuous music service for one year from the date the hardware is delivered.Required:Identify the performance obligation(s) in this contract, and indicate whether the revenue should be recognized at a Point in time or Over time for each identified performance obligation. If the Performance Obligation is "No", then mark the Revenue recognized column with "Not affected".arrow_forwardOn November 1, 2021 a customer enters into a contract with MyWatch, Inc. to purchase an eWatch plus a one year internet data plan for the watch for a combined price of $700. Each item may be purchased separately from MyWatch, Inc. The standalone selling price of the eWatch is $500 and the standalone selling price of the one year internet data plan is $300. The customer pays MyWatch, Inc. $400 when the contract is signed. MyTWatch, Inc. bills the remaining $300 balance evenly over the contract period of one year. What is the correct accounting for the sale of the ewatch and the data plan? Question 19 options: a) MyWatch would record unearned revenue of $200 when the customer takes control of the ewatch. b) MyWatch would record sales revenue of $500 when the customer takes control of the ewatch. c) MyWatch would recored sales revenue of $438 when the customer takes control of the ewatch.…arrow_forwardPopcorn Company manufactures and sells commercial ovens. It is currently running a promotion in which it pays a $750 rebate to any customer that purchases an oven from one of its participating dealers. The rebate must be returned within 60 days of purchase. Given its historical experience and the ease of obtaining a rebate, Popcorn expects all qualifying customers will receive the rebate. Required: Prepare the journal entry to record the sale of an oven to a participating dealer for $8,000.arrow_forward

- On January 1, 2018, PLDC enters into a wireless contract in which customer MBP is provided with handset and a voice and data plan for P 3,500 per month. PLDC identified the handset and wireless plan as separate performance obligations. The handset can be separately sold by PLDC for a price of 20,000 which provides observable evidence of stand-alone selling price. PLDC offers a 12-month service plan without a phone that includes the same level of services for a price of P 2,500 per month. 1. How much is the total transaction price to be allocated to the separate performance obligation? a. P 20,000 b. P 30,000 c. P 42,000 d. P 50,000 2. How much of the transaction price is to be allocated to the wireless plan? a. P 16,800 b. P 22,000 c. P 25,200 d. P 30,000 3. How much of the transaction price is to be allocated to the handset? a. P 16,800 b. P 20,000 c. P 22,000 d. P 25,200 4. On January 1, 2018, what is the entry at the…arrow_forwardCrane Company sells goods on credit that cost $320,000 to Paul Company for $404,500 on January 2, 2025. The sales price includes an installation fee, which has a standalone selling price of $44,000. The standalone selling price of the goods is $360,500. The installation is considered a separate performance obligation and is expected to take 6 months to complete. (a) Your answer is correct. Prepare the journal entries (if any) to record the sale on January 2, 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. List all debit entries before credit entries.) (b) Date Account Titles and Explanation Jan. 2, 2025 Accounts Receivable Sales Revenue Unearned Service Revenue (To record sales on account) Jan. 2, 2025 Cost of Goods Sold Inventory (To record cost of goods sold) eTextbook and Media List of Accounts Your answer is incorrect. Debit 404500…arrow_forwardBarrios Communications is a provider of satellite television services. It will install a satellite dish free of charge for any customer that agrees to a one-year service contract at a price of $50 per month. Installation costs Barrios $150. Customers typically remain with Barrios for much longer than the one year required, an average of 10 years (i.e., 9 years beyond their contractual obligation). Barrios enters into a contract under the terms described above on January 1, 20X1. Required: What amount of revenue should Barrios record related to the contract in 20X1? What amount of expense related to the contract should Barrios record related to the contract in 20X1?arrow_forward

- On May 1, 20x6, Chrome Computer Inc., enters into a contract to sell 5,000 units of keyboard to one of its clients, Website Inc., at a fixed price of P95,000, to be settled by a cash payment on May 1. Delivery is scheduled for June 1, 20x6. As part of the contract, the seller offers a 25% discountcoupon to Website for any purchases in the next six months. The seller will continue to offer a 5% discount on all sales during the same time period, which will be available to all customers. Based on experience, Chrome Computer estimates a 50% probability that Website will redeem the 25%discount voucher, and that the coupon will be applied to P20,000 of purchases. The stand-alone selling price for the Comfort Office Keyboard is P19.60 per unit. Assume the facts and circumstances as above, except that Chrome gives a 5% discount option to Website instead of 25%. In this case, what journal entry would Chrome record on May 1, 20x6? a. DR Cash 95,000 CR Deferred revenue – keyboards…arrow_forwardJones Corporation enters into a contract with Warner Video to add their programs to Jones' network. Warner will pay Jones an upfront fixed fee of $290,000 for 12 months of access, and will also pay a $120,000 bonus if Jones' users access Warner Video for at least 10,000 hours during the 12 month period. Jones estimates that it has a 60% chance of earning the $120,000 bonus. Refer to Jones Corporation. Upon collection of the upfront fee, Jones would recognize a/an ________.arrow_forwardOn January 1, 2019, Loud Company enters into a 2-year contract with a customer for an unlimited talk and 5 GB data wireless plan for $65 per month. The contract includes a smartphone for which the customer pays $299. Loud also sells the smartphone and monthly service plan separately, charging $649 for the smartphone and $65 for the monthly service for the unlimited talk and 5 GB data wireless plan. Required: 1. Calculate the transaction price for the smartphone and unlimited talk and 5 GB data wireless plan assuming that Loud allocates consideration based on stand-alone prices.2. Record the initial journal entry for Loud Company’s sale of a 2-year contract on January 1, 2019, and the monthly journal entry.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning