FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

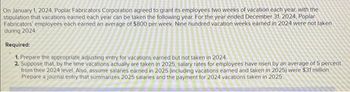

Transcribed Image Text:On January 1, 2024, Poplar Fabricators Corporation agreed to grant its employees two weeks of vacation each year, with the

stipulation that vacations earned each year can be taken the following year. For the year ended December 31, 2024, Poplar

Fabricators' employees each earned an average of $800 per week Nine hundred vacation weeks earned in 2024 were not taken

during 2024

Required:

1. Prepare the appropriate adjusting entry for vacations earned but not taken in 2024.

2. Suppose that, by the time vacations actually are taken in 2025, salary rates for employees have risen by an average of 5 percent

from their 2024 level. Also, assume salaries earned in 2025 (including vacations earned and taken in 2025) were $31 million.

Prepare a journal entry that summarizes 2025 salaries and the payment for 2024 vacations taken in 2025.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Kling Company was organized in late 2019 and began operations On January 2, 2020. Prior to the start of operations, it incurred the following costs: 1. what amount should the compmy expense in 2019? In 2020? 2. Next Level What is the justification of the accounting treatment of these costs?arrow_forwardABC Ltd pays its employees monthly in arrears. The monthly salaries are $236,820. At the end of the 2020, all salaries had been paid except half of the December 2020 salary. Required: Show entries for the year ended 31stDecember 2020: To record the outstanding December salary. As they would appear in the Statement of Profit and Loss. As they would appear in the Statement of Financial Position.arrow_forwardPlease help me in accordance with IFRS 15 Modern Engineering (ME) entered into a contract for 3 - year maintenance services with a manufacturing concern. Same service will be rendered over 3 - year period. Contract required 100% upfront fees of 300,000 payable at the time of agreement on January 1, 2018. Prevailing market interest rate for ME is 12%. ME prepares its financial statements on 31st December every year. Required: All journal entries for above transaction.arrow_forward

- On July 31, 2020, Stewart Security was awarded a contract for $102,000 to provide 3,000 hours of overnight security services to the city of Kaysville for the next 2 years. The full contract price was paid to Stewart on July 31. As of December 31, 2020, Stewart had spent 950 hours providing security services. What amount will Stewart report as a liability related to this contract on December 31, 2020?arrow_forwardOregon Company's employees are eligible for retirement with benefits at the end of the year in which both age 60 is attained and they have completed 35 years of service. The benefits provide 15 years' reimbursement for health care services of $39,000 annually, beginning one year from the date of retirement. Ralph Young was hired at the beginning of 1988 by Oregon after turning age 22 and is expected to retire at the end of 2026 (age 60). The discount rate is 4 %. The plan is unfunded. The PV of an ordinary annuity of $1 where n = 15 and i = 4% is 11.11839. The PV of $1 where n = 2 and i = 4% is 0.92456. With respect to Ralph, what is the service cost to be included in Oregon's 2024 postretirement benefit expense, rounded to the nearest dollar? Multiple Choice $6,881 $ 12, 382 $39,000 $10, 280arrow_forwardOn January 1, 2025, Barbara Brown signed an agreement, covering 5 years, to operate as a franchisee of Ivanhoe Inc. for an initial franchise fee of $51,000. The amount of $11,000 was paid when the agreement was signed, and the balance is payable in five annual payments of $8,000 each, beginning January 1, 2026. The agreement provides that the down payment is nonrefundable and that no future services are required of the franchisor once the franchise commences operations on April 1, 2025. Barbara Brown's credit rating indicates that she can borrow money at 7% for a loan of this type. Click here to view the factor table. Prepare journal entries for Ivanhoe for 2025-related revenue for this franchise arrangement. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round present value factor calculations to 5 decimal places, e.g. 1.25124 and the…arrow_forward

- Sh9arrow_forwardErafone provides a 2-year warranty with one of its products which was first sold in 2020. Erafone sold $1,000,000 of products subject to the warranty. Era Phone expects $125,000 of warranty costs over the next 2 years. In 2020, Erafone spent $70,000 servicing warranty claims. Prepare journal entries in 2020 to record the costs incurred in honoring the warranties (assume expenditures are for repair part costs):arrow_forwardPearl Factory provides a 2-year warranty with one of its products which was first sold in 2025. Pearl sold $1,010,100 of products subject to the warranty. Pearl expects $113,910 of warranty costs over the next 2 years. In that year, Pearl spent $63,100 servicing warranty claims. Prepare Pearl's journal entry to record the sales (ignore cost of goods sold) and the December 31 adjusting entry, assuming the expenditures are inventory costs. (If no entry is required, select "No Entry for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.)arrow_forward

- The Bigelow Health Club sells annual memberships to a prestigious club. The terms of the contracts are that customers are required to pay an up-front non-refundable fee of $200, and then a monthly fee of $50, with the first month due immediately, for the year for a total cost of $800 to join the club. On February 1 2024 Bigelow sold 10 memberships. Prepare the journal entry for the sale on Feb 1 and the adjusting entry on Feb 29, 2024 to report revenue. Explain what revenue Bigelow will report in the month, and over the course of the year. Assume that 100% of the members of the Bigelow club renew their memberships for 3 years. How does that change the revenue reported in February?arrow_forwardGallagher Company has gathered the information needed to complete its Form 941 for the quarter ended September 30, 2019. Using the information presented below, complete Part 1 of Form 941, reproduced on the next page. # of employees for pay period that included September 12—15 employees Wages paid third quarter—$89,352.18 Federal income tax withheld in the third quarter—$10,195.00 Taxable social security and Medicare wages—$89,352.18 Total tax deposits for the quarter—$23,865.92arrow_forwardOn July 1, 2019, Park Company leased office space for ten years to Rudd at a monthly rental of $15,000, and received the following amounts as listed in the table below. Rude made timely rent payments through November 2019; the December rent was paid, together with January 2020 rent, on January 6, 2020. At December 31, 2019, park should report rent receivable of? First Month Rent $ 15,000 Security Deposit $ 25,000 a. $0 b. $ 5,000 c. $15,000 d. $30,000arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education