FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

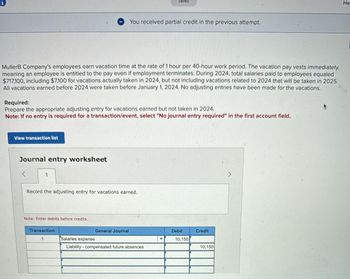

Transcribed Image Text:MullerB Company's employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately,

meaning an employee is entitled to the pay even if employment terminates. During 2024, total salaries paid to employees equaled

$717,100, including $7,100 for vacations actually taken in 2024, but not including vacations related to 2024 that will be taken in 2025.

All vacations earned before 2024 were taken before January 1, 2024. No adjusting entries have been made for the vacations.

View transaction list

Required:

Prepare the appropriate adjusting entry for vacations earned but not taken in 2024.

Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field.

Journal entry worksheet

Record the adjusting entry for vacations earned.

Note: Enter debits before credits.

You received partial credit in the previous attempt.

Transaction

1

General Journal

Saved

Salaries expense

Liability compensated future absences

▼

Debit

10,150

Credit

10,150

He

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Lawrence Corp. has an employee benefit plan for compensated absences that gives each employee 10 paid vacation days and 10 paid sick days. Both vacation and sick days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days; however, no payment is given for sick days not taken. At December 31, 2021, B's unadjusted balance of liability for compensated absences was $42,000. B estimated that there were 300 total vacation days and 150 sick days available at December 31, 2021. B's employees earn an average of $200 per day. In its December 31, 2021, balance sheet, what amount of liability for compensated absences is B required to report? A. $84,000. B. $60,000. C. $90,000. D. $144,000.arrow_forwardA company gives each of its 75 employees (assume they were all employed continuously through 2017 and 2018) 12 days of vacation a year if they are employed at the end of the year. The vacation accumulates and may be taken starting January 1 of the next year. The employees work 8 hours per day. In 2017, they made $24.50 per hour and in 2018 they made $28 per hour. During 2018, they took an average of 9 days of vacation each. The company's policy is to record the liability existing at the end of each year at the wage rate for that year. What amount of vacation liability would be reflected on the 2017 and 2018 balance sheets, respectively? A. $201,600; $245,700 B. $201,600; $252,000 C. $176,400; $252,000 D. $176,400; $245,700arrow_forwardWhat is the revenue earned from award credits for 2022? *see attached a. P 0b. P 28,000c. P 36,000d. P 116,000arrow_forward

- Jon Corp. has an employee benefit plan for compensated absences that gives each employee 10 paid vacation days and 10 paid sick days. Both vacation and sick days can be carried over indefinitely. Employees can elect to receive payment in lieu of vacation days; however, no payment is given for sick days not taken. At December 31, 2021, Jon 's unadjusted balance of liability for compensated absences was $42,000. B estimated that there were 300 total vacation days and 150 sick days available at December 31, 2021. Jon's employees earn an average of $200 per day. In its December 31, 2021, balance sheet, what amount of liability for compensated absences is B required to report? A. $60,000. B. $84,000. C. $90,000. D. $144,000. D. 9.7%.arrow_forwardComplete ALL requirements and ROUND ALL AMOUNTS TO NEAREST DOLLARarrow_forwardAron and Nora Company grant all employees 2 weeks paid vacation for each full year of employment. Unused vacation time can be accumulated and carried forward to succeeding years and paid when vacations are taken or upon termination of employment. No employees resigned during the year.The following information is also available: Liability for accumulated vacations on January 1, 2020: 400,000 Pre-2020 accrued vacations used during January 1 – September 30, 2020 250,000 Vacations earned during 2019 based on current rate 300,000 The entity granted a 10% salary increase to all employees on October 1, 2020. What amount should be reported as vacation pay expense for the year ended December 31, 2020?arrow_forward

- In January 2023, Carla Vista Ltd. estimated that its year-end bonuses to executives for calendar 2023 would be $1050000. In February 2023, $945000 was paid in bonuses for the 2022 year end. The estimate for 2023 is subject to year-end adjustment. How much bonus expense should be reflected in Carla Vista's interim income statement for the three months ended March 31, 2023? O $262500 O $236250 $1050000 O $945000arrow_forwardThe employees of UMPISA NA NG KALBARYO COMPANY are paid biweekly. Occasionally, advances made to employees are paid back by payroll deductions. Information relating to salaries for the calendar years 2018 and 2019 are as follows. On December 31, 2019, what amount should the company report as accrued salaries payable? a. P100,000 b. P94,000 c. P82,000 d. P35,000arrow_forwardGarland incorporated offers a new employee a single-sum sining bonus at the date of employment, june 1,2024. Alternatively, the employee can receive $42,000 at the date of employment plus 13,000 each june 1 for four years, beginning in 2007. Assuming the employee's time value of money is 8% annually, what single amount at the employment date would make the option desirable? A. $50,187 B.$78,915 C.$52,915 D.$76,187arrow_forward

- On July 1, 2020 Walker Inc. signed a $600,000, 15 month, 10% note payable. At due date, the principal and interest will be paid. Calculate the amount of interest expense that Walker Inc. should report on its income statement for the year ended December 31, 2021. (round to the nearest dollar)arrow_forwardJWS Transport Company’s employees earn vacation time at the rate of 1 hour per 40-hour work period. The vacation pay vests immediately (that is, an employee is entitled to the pay even if employment terminates). During 2016, total wages paid to employees equaled $404,000, including $4,000 for vacations actually taken in 2016 but not including vacations related to 2016 that will be taken in 2017. All vacations earned before 2016 were taken before January 1, 2016. No accrual entries have been made for the vacations. No overtime premium and no bonuses were paid during the period. Required: Prepare the appropriate adjusting entry for vacations earned but not taken in 2016.arrow_forwardOn January 1, 2016, Sweetwater Furniture Company leased office space under a 21-year operating lease agreement. The contract calls for annual rent payments on December 31 of each year. The payments are $10,000 the first year and increase by $500 per year. Benefits expected from using the office space are expected to remain constant over the lease term. Required: Record Sweetwater’s rent payment at December 31, 2020 (the fifth rent payment) and December 31, 2030 (the 15th rent payment).arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education