Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

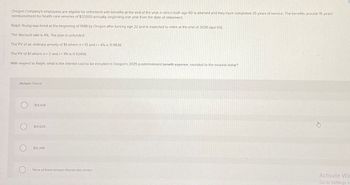

Transcribed Image Text:Oregon Company's employees are eligible for retirement with benefits at the end of the year in which both age 60 is attained and they have completed 35 years of service. The benefits provide 15 years'

reimbursement for health care services of $37,000 annually, beginning one year from the date of retirement.

Ralph Young was hired at the beginning of 1988 by Oregon after turning age 22 and is expected to retire at the end of 2026 (age 60)

The discount rate is 4%. The plan is unfunded.

The PV of an ordinary annuity of $1 where n-15 and /= 4% is 11.11839.

The PV of $1 where n=2 and /= 4% is 0.92456.

With respect to Ralph, what is the interest cost to be included in Oregon's 2025 postretirement benefit expense, rounded to the nearest dollar?

Multiple Choice

C

$14.434

$14,509

$15,398

None of these answer choices are correct

Activate Win

Go to Settings to

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sachs Brands’ defined benefit pension plan specifies annual retirement benefits equal to: 1.6% * serviceyears * final year’s salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginningof 2002 and is expected to retire at the end of 2036 after 35 years’ service. Her retirement is expected tospan 18 years. Davenport’s salary is $90,000 at the end of 2016 and the company’s actuary projects her salary tobe $240,000 at retirement. The actuary’s discount rate is 7%.Required:1. Draw a time line that depicts Davenport’s expected service period, retirement period, and a 2016 measurementdate for the pension obligation.2. Estimate by the accumulated benefits approach the amount of Davenport’s annual retirement payments earnedas of the end of 2016.3. What is the company’s accumulated benefit obligation at the end of 2016 with respect to Davenport?4. If no estimates are changed in the meantime, what will be the accumulated benefit obligation at the end of2019…arrow_forwardClassified Electronics has an unfunded retiree health care plan. Each of the company’s three employees has been with the firm since its inception at the beginning of 2020. As of the end of 2021, the actuary estimates the total net cost of providing health care benefits to employees during their retirement years to have a present value of $72,000. Each of the employees will become fully eligible for benefits after 28 more years of service but aren’t expected to retire for 35 more years. The interest rate is 6%.Required:1. What is the expected postretirement benefit obligation at the end of 2021?2. What is the accumulated postretirement benefit obligation at the end of 2021?3. What is the expected postretirement benefit obligation at the end of 2022?4. What is the accumulated postretirement benefit obligation at the end of 2022?arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.2% x service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2010 and is expected to retire at the end of 2044 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $95,000 at the end of 2024 and the company's actuary projects her salary to be $305,000 at retirement. The actuary's discount rate is 9%. Note: Use tables, Excel, or a financial calculator. (EV of $1. PV of $1. FVA of $1. PVA of $1. EVAD of $1 and PVAD of $1) At the beginning of 2025, the pension formula was amended to: 1.40% * Service years * Final year's salary The amendment was made retroactive to apply the increased benefits to prior service years. Required: 1. What is the company's prior service cost at the beginning of 2025 with respect to Davenport after the amendment described above? 2. Since the amendment occurred at…arrow_forward

- Assume the following scenarios.Scenario 1: During 2021, The Hubbard Group provides services of $900,000 for repair of a state highway. The company receives an initial payment of $300,000 with the balance to be received the following year.Scenario 2: Rolling Stone magazine typically charges $80 for a one-year subscription. On January 1, 2021, Herman, age 72, purchases a one-year subscription to the magazine and receives a 15% senior citizen discount.Scenario 3: During 2021, Waste Management provides services on account for $30,000. The customer pays for those services in 2022.Scenario 4: During 2021, Sysco Corporation sells grocery items to one of its customers for $260,000 on account. Cash collections on those sales are $180,000 in 2021 and $60,000 in 2022. The remaining $20,000 is written off as uncollectible in 2022.Required: For each scenario, calculate the amount of revenue to be recognized in 2021.arrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.6% × service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $90,000 at the end of 2021 and the company's actuary projects her salary to be $240,000 at retirement. The actuary's discount rate is 7%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 1. What is the company's projected benefit obligation at the beginning of 2021 (after 14 years' service) with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 2. Estimate by the projected benefits approach the portion of Davenport's annual retirement payments attributable to 2021 service. 3.…arrow_forward103.arrow_forward

- Godoarrow_forwardSachs Brands's defined benefit pension plan specifies annual retirement benefits equal to 1.3% × service years x final year's salary, payable at the end of each year. Angela Davenport was hired by Sachs at the beginning of 2007 and is expected to retire at the end of 2041 after 35 years' service. Her retirement is expected to span 18 years. Davenport's salary is $91,000 at the end of 2021 and the company's actuary projects her salary to be $285,000 at retirement. The actuary's discount rate is 9%. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.) Required: 2. Estimate by the projected benefits approach the amount of Davenport's annual retirement payments earned as of the end of 2021. 3. What is the company's projected benefit obligation at the end of 2021 with respect to Davenport? (Do not round intermediate calculations. Round your final answer to the nearest whole dollar.) 4. If no estimates are changed in the…arrow_forwardPrince Distribution Incorporated has an unfunded postretirement benefit plan. Medical care and life insurance benefits are provided to employees who render 10 years service and attain age 55 while in service. At the end of 2024, Jim Lukawitz is 31. He was hired by Prince at age 25 (6 years ago) and is expected to retire at age 62. The expected postretirement benefit obligation for Lukawitz at the end of 2024 is $50,000 and $54,000 at the end of 2025. Calculate the accumulated postretirement benefit obligation at the end of 2024 and 2025 and the service cost for 2024 and 2025, as pertaining to Lukawitz. Note: Enter your answers in whole dollar amount. Round your final answers to the nearest whole dollar. APBO Service 2024 ____ _____ 2025 ____ _____arrow_forward

- I need help with requirement 5 please.arrow_forwardOregon Company's employees are eligible for retirement with benefits at the end of the year in which both age 60 is attained and they have completed 35 years of service. The benefits provide 15 years' rimbursement for health care services of $21,000 annually, beginning one year from the date of retirement Ralph Young was hired at the beginning of 1988 by Oregon after turning age 22 and is expected to retire at the end of 2026 (age 60) The discount rate is 3%. The plan is unfunded. The PV of an ordinary annuity of $1 where n-15 and/-3% is 1193794 The PV of $1 where n-2 and/-3% is 094260 With respect to Ralph, what is Oregon's expected postretirement beneft obligation (EPBO) et the end of 2024, rounded to the nearest dolar? Muple Choice O O O $122.195 $236,307 $60 1764.400arrow_forwardOregon Company's employees are eligible for retirement with benefits at the end of the year in which both age 60 is attained and they have completed 35 years of service. The benefits provide 15 years' reimbursement for health care services of $37,000 annually, beginning one year from the date of retirement. Ralph Young was hired at the beginning of 1988 by Oregon after turning age 22 and is expected to retire at the end of 2026 (age 60). The discount rate is 4%. The plan is unfunded. The PV of an ordinary annuity of $1 where n=15 and /= 4% is 11.11839. The PV of $1 where n = 2 and /= 4% is 0.92456. With respect to Ralph, what is the interest cost to be included in Oregon's 2025 postretirement benefit expense, rounded to the nearest dollar? Multiple Choice О $14,434 О $14,509 О $15,398 None of these answer choices are correct Activate Wir Go to Settings toarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education