FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

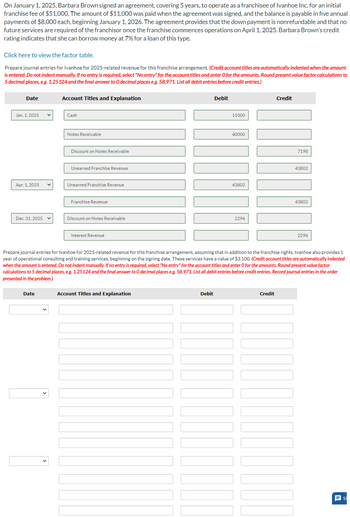

Transcribed Image Text:On January 1, 2025, Barbara Brown signed an agreement, covering 5 years, to operate as a franchisee of Ivanhoe Inc. for an initial

franchise fee of $51,000. The amount of $11,000 was paid when the agreement was signed, and the balance is payable in five annual

payments of $8,000 each, beginning January 1, 2026. The agreement provides that the down payment is nonrefundable and that no

future services are required of the franchisor once the franchise commences operations on April 1, 2025. Barbara Brown's credit

rating indicates that she can borrow money at 7% for a loan of this type.

Click here to view the factor table.

Prepare journal entries for Ivanhoe for 2025-related revenue for this franchise arrangement. (Credit account titles are automatically indented when the amount

is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round present value factor calculations to

5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971. List all debit entries before credit entries.)

Date

Account Titles and Explanation

Jan. 1, 2025

Cash

Notes Receivable

Discount on Notes Receivable

Unearned Franchise Revenue

Apr. 1, 2025

Unearned Franchise Revenue

Franchise Revenue

Dec. 31, 2025

Discount on Notes Receivable

Interest Revenue

Debit

11000

40000

43802

2296

Credit

7198

43802

43802

2296

Prepare journal entries for Ivanhoe for 2025-related revenue for this franchise arrangement, assuming that in addition to the franchise rights, Ivanhoe also provides 1

year of operational consulting and training services, beginning on the signing date. These services have a value of $3,100. (Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts. Round present value factor

calculations to 5 decimal places, e.g. 1.25124 and the final answer to O decimal places e.g. 58,971. List all debit entries before credit entries. Record journal entries in the order

presented in the problem.)

Date

Account Titles and Explanation

Debit

Credit

= St

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $93,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 8%. Winn also paid a $204,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $297,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event,…arrow_forwardOn July 31, 2020, Stewart Security was awarded a contract for $102,000 to provide 3,000 hours of overnight security services to the city of Kaysville for the next 2 years. The full contract price was paid to Stewart on July 31. As of December 31, 2020, Stewart had spent 950 hours providing security services. What amount will Stewart report as a liability related to this contract on December 31, 2020?arrow_forwardAt the beginning of the year. Happy Haus got the franchise of Hogan House, a known steak house of upscale patronage. The franchise agreement required a P5,000,000 franchise fee payable P1.000.000 upon signing of the franchise and the balance in four annual installments starting the end of the current year. The existing discount rate is 12. The fees once paid are not refundable. The franchise may be canceled subject to the provisions of the agreement. Should there be unpaid franchise fee attributed to the balance of main fee (P5,000,000). the same would become due and demandable upon cancellation. Further, the franchisor is entitled to a 5% fee on gross sales payable monthly within the first ten days of the following month. The Credit Investigation Bureau rated Happy as A+ credit rating. The balance of the franchise fee was guaranteed by a commercial bank. The first year of operations yielded gross sales of P90 million. Hogan's earned franchise fees from Happy for the first year of…arrow_forward

- On January 1, 2021, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $78,000 each, beginning December 31, 2021, and at each December 31 through 2023. The lessor, HVAC Leasing calculates lease payments based on an annual interest rate of 5%. Winn also paid a $285,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $363,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2023. Winn's fiscal year is the calendar year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field. Round your answers to nearest whole dollars.) 1. Record the…arrow_forwardAyayai Corporation purchases a patent from Blossom Company on January 1, 2025, for $63,000. The patent has a remaining legal life of 14 years. Ayayai estimates the patent will have a useful life of 10 years, based on expected product innovations in the market. Prepare Ayayai's journal entries to record the purchase of the patent and 2025 amortization. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. List all debit entries before credit entries.) Account Titles and Explanation (To record purchase of patents) (To record amortization of patents) Debit Creditarrow_forwardGarnet Corporation enters into a 4-year construction contract worth $100 million with Gold company on January 1, 2022. At the end of 2022, construction costs totaled $20 million and Garnet estimates $60 million of construction costs remain. If Garnet uses the percent of completion method to determine revenues, how much revenue will Garnet recognize in 2022 related to the construction contract?arrow_forward

- 1. Debbie acquired a franchise to operate a donut shop from Dollar Donuts, Inc., for $100,000. She incurred anadditional $4,000 in legal costs to negotiate the terms with the franchiser. In five years, the franchise contract will berenegotiated. The current contract also states that there will be a $3, 000 annual fee plus a two percent charge basedon the store's annual revenue, which is expected to average 90,000 per year. What is the franchise cost that should becapitalized? a. $88,000 b. $92, 000 c. $100,000 d. $104,000arrow_forwardOn January 1, 2021, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $72,000 each, beginning December 31, 2021, and at each December 31 through 2023. The lessor, HVAC Leasing calculates lease payments based on an annual interest rate of 8%. Winn also paid a $231,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $303,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) (Use appropriate factor(s) from the tables provided.)Required:Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2023. Winn’s fiscal year is the calendar year. (If no entry is required for a transaction/event, select…arrow_forwardOn January 1, 2024, Winn Heat Transfer leased office space under a three-year operating lease agreement. The arrangement specified three annual lease payments of $96,000 each, beginning December 31, 2024, and on each December 31 through 2026. The lessor, HVAC Leasing, calculates lease payments based on an annual interest rate of 5%. Winn also paid a $321,000 advance payment at the beginning of the lease. With permission of the owner, Winn made structural modifications to the building before occupying the space at a cost of $417,000. The useful life of the building and the structural modifications were estimated to be 30 years with no residual value. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: Prepare the appropriate entries for Winn Heat Transfer from the beginning of the lease through the end of 2026. Winn's fiscal year is the calendar year. Note: If no entry is required for a transaction/event,…arrow_forward

- Denim, Inc. entered into a contract to sell equipment to Levi LLC. on October 1, 2021. Along with the equipment, Denim Inc. will provide one-year maintenance services on an as-needed basis, beginning once the equipment is installed. Denim offers similar services to other customers that purchased equipment sold by other vendors for $20,000. Denim Inc. will also provide installation services at no additional cost, a service that Denim Inc. typically charges $10,000. The equipment normally sells for $170,000 on its own. For the package deal, Levi LLC. agrees to pay a total of $180,000. The equipment was delivered and installed on November 1, 2021. Levi LLC. paid the entire invoice in cash on the delivery and installation date. How much revenue should Denim Inc. allocate to the various performance obligations in the above contract (round to the nearest dollar, if needed)? Prepare the Journal Entry for Denim Inc. to record the sale. Assume the equipment cost Denim Inc. $100,000 to…arrow_forwardOn January 1, 2021, Maroon Company entered into a five-year nonrenewable operating lease, commencing on that date, for office space. The office space has a useful life of 50 years and the lease specifies a rent of P20,000 per month. The lessor grants nine months of free rent, how much is the rent income in 2021?arrow_forwardPlease help mearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education