Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

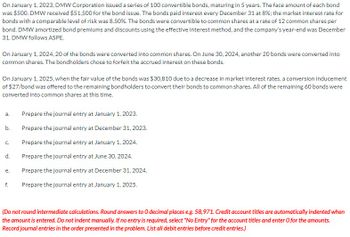

Transcribed Image Text:On January 1, 2023, DMW Corporation issued a series of 100 convertible bonds, maturing in 5 years. The face amount of each bond

was $500. DMW received $51,500 for the bond issue. The bonds paid interest every December 31 at 8%; the market interest rate for

bonds with a comparable level of risk was 8.50%. The bonds were convertible to common shares at a rate of 12 common shares per

bond. DMW amortized bond premiums and discounts using the effective interest method, and the company's year-end was December

31. DMW follows ASPE.

On January 1, 2024, 20 of the bonds were converted into common shares. On June 30, 2024, another 20 bonds were converted into

common shares. The bondholders chose to forfeit the accrued interest on these bonds.

On January 1, 2025, when the fair value of the bonds was $30,810 due to a decrease in market interest rates, a conversion inducement

of $27/bond was offered to the remaining bondholders to convert their bonds to common shares. All of the remaining 60 bonds were

converted into common shares at this time.

a.

Prepare the journal entry at January 1, 2023.

b.

Prepare the journal entry at December 31, 2023.

Prepare the journal entry at January 1, 2024.

C.

d.

Prepare the journal entry at June 30, 2024.

e.

Prepare the journal entry at December 31, 2024.

f.

Prepare the journal entry at January 1, 2025.

(Do not round intermediate calculations. Round answers to O decimal places e.g. 58,971. Credit account titles are automatically indented when

the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.

Record journal entries in the order presented in the problem. List all debit entries before credit entries.)

Transcribed Image Text:No.

Date

Account Titles and Explanation

Debit

a.

b.

d.

e.

f.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardChung Inc. issued $50,000 of 3-year bonds on January 1, 2018, with a stated rate of 4% and a market rate of 4%. The bonds paid interest semi-annually on June 30 and Dec. 31. How much money did the company receive when the bonds were issued? The bonds would be quoted at what rate?arrow_forwardEvie Inc. issued 50 bonds with a $1,000 face value, a five-year life, and a stated annual coupon of 6% for $980 each. What is the total amount of interest expense over the life of the bonds?arrow_forward

- On July 1, Somerset Inc. issued $200,000 of 10%, 10-year bonds when the market rate was 12%. The bonds paid interest semi-annually. Assuming the bonds sold at 58.55, what was the selling price of the bonds? Explain why the cash received from selling this bond is different from the $200,000 face value of the bond.arrow_forwardOn January 1, a company issued a 5-year $100,000 bond at 6%. Interest payments on the bond of $6,000 are to be made annually. If the company received proceeds of $112,300, how would the bonds issuance be quoted? A. 1.123 B. 112.30 C. 0.890 D. 89.05arrow_forwardStarmount Inc. sold bonds with a $50,000 face value, 12% interest, and 10-year term at $48,000. What is the total amount of interest expense over the life of the bonds?arrow_forward

- A company issued bonds with a $100,000 face value, a 5-year term, a stated rate of 6%, and a market rate of 7%. Interest is paid annually. What is the amount of interest the bondholders will receive at the end of the year?arrow_forwardOn Jan. 1, Year 1, Foxcroft Inc. issued 100 bonds with a face value of $1,000 for $104,000. The bonds had a stated rate of 6% and paid interest semiannually. What is the journal entry to record the issuance of the bonds?arrow_forwardKrystian Inc. issued 10-year bonds with a face value of $100,000 and a stated rate of 4% when the market rate was 6%. Interest was paid semi-annually. Calculate and explain the timing of the cash flows the purchaser of the bonds (the investor) will receive throughout the bond term. Would an investor be willing to pay more or less than face value for this bond?arrow_forward

- On July 2, 2018, McGraw Corporation issued 500,000 of convertible bonds. Each 1,000 bond could be converted into 20 shares of the companys 5 par value stock. On July 3, 2020, when the bonds had an unamortized discount of 7,400 and the market value of the McGraw shares was 52 per share, all the bonds were converted into common stock. Required: 1. Prepare the journal entry to record the conversion of the bonds under (a) the book value method and (b) the market value method. 2. Compute the companys debt-to-equity ratio (total liabilities divided by total shareholders equity, as described in Chapter 6) under each alternative. Assume the companys other liabilities are 2 million and shareholders equity before the conversion is 3 million. 3. Assume the company uses IFRS and issued the bonds for 487,500 on July 2, 2018. On this date, it determined that the fair value of each bond was 930 and the fair value of the conversion option was 45 per bond. Prepare the journal entry to record the issuance of the bonds.arrow_forwardPiedmont Corporation issued $200,000 of 10-year bonds at par. The bonds have a stated rate of 6% and pay interest annually. What is the journal entry to record the first interest payment to the bondholders?arrow_forwardNeubert Enterprises recently issued $1,000 par value 15-year bonds with a 5% coupon paid annually and warrants attached. These bonds are currently trading for $1,000. Neubert also has outstanding $1,000 par value 15-year straight debt with a 7% coupon paid annually, also trading for $1,000. What is the implied value of the warrants attached to each bond?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning  Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT