EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

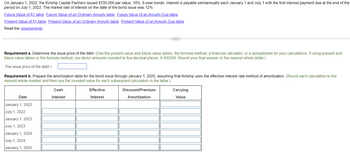

Transcribed Image Text:On January 1, 2022, the Kinship Capital Partners issued $700,000 par value, 18%, 6-year bonds. Interest is payable semiannually each January 1 and July 1 with the first interest payment due at the end of the

period on July 1, 2022. The market rate of interest on the date of the bond issue was 12%.

Future Value of $1 table Future Value of an Ordinary Annuity table Future Value of an Annuity Due table

Present Value of $1 table Present Value of an Ordinary Annuity table Present Value of an Annuity Due table

Read the requirements.

Requirement a. Determine the issue price of the debt. (Use the present value and future value tables, the formula method, a financial calculator, or a spreadsheet for your calculations. If using present and

future value tables or the formula method, use factor amounts rounded to five decimal places, X.XXXXX. Round your final answer to the nearest whole dollar.)

The issue price of the debt =

Requirement b. Prepare the amortization table for the bond issue through January 1, 2025, assuming that Kinship uses the effective interest rate method of amortization. (Round each calculation to the

nearest whole number and then use the rounded value for each subsequent calculation in the table.)

Date

Cash

Interest

January 1, 2022

July 1, 2022

January 1, 2023

July 1, 2023

January 1, 2024

July 1, 2024

January 1, 2025

Effective

Interest

Discount/Premium

Amortization

Carrying

Value

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Chung Inc. issued $50,000 of 3-year bonds on January 1, 2018, with a stated rate of 4% and a market rate of 4%. The bonds paid interest semi-annually on June 30 and Dec. 31. How much money did the company receive when the bonds were issued? The bonds would be quoted at what rate?arrow_forwardVolunteer Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $540,000. Interest is payable annually. The premium is amortized using the straightline method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of premium D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of premiumarrow_forwardAggies Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018, and received $540,000. Interest is payable semi-annually. The premium is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. Dec. 31, 2018: entry to record payment of interest to bondholders C. Dec. 31, 2018: entry to record amortization of premiumarrow_forward

- On January 1, 2018, Wawatosa Inc. issued 5-year bonds with a face value of $200,000 and a stated interest rate of 12% payable semi-annually on July 1 and January 1. The bonds were sold to yield 10%. Assuming the bonds were sold at 107.732, what is the selling price of the bonds? Were they issued at a discount or a premium?arrow_forwardOn July 1, a company sells 8-year $250,000 bonds with a stated interest rate of 6%. If interest payments are paid annually, each interest payment will be ________. A. $120,000 B. $60,000 C. $7,500 D. $15,000arrow_forwardDixon Inc. issued bonds with a $500,000 face value, 10% interest rate, and a 4-year term on July 1, 2018 and received $480,000. Interest is payable annually. The discount is amortized using the straight-line method. Prepare journal entries for the following transactions. A. July 1, 2018: entry to record issuing the bonds B. June 30, 2019: entry to record payment of interest to bondholders C. June 30, 2019: entry to record amortization of discount D. June 30, 2020: entry to record payment of interest to bondholders E. June 30, 2020: entry to record amortization of discountarrow_forward

- On January 1, a company issued a 5-year $100,000 bond at 6%. Interest payments on the bond of $6,000 are to be made annually. If the company received proceeds of $112,300, how would the bonds issuance be quoted? A. 1.123 B. 112.30 C. 0.890 D. 89.05arrow_forwardWilbury Corporation issued 1 million of 13.5% bonds for 985,071.68. The bonds are dated and issued October 1, 2019, are due September 30, 2020, and pay interest semiannually on March 31 and September 30. Assume an effective yield rate of 14%. Required: 1. Prepare a bond interest expense and discount amortization schedule using the straight-line method. 2. Prepare a bond interest expense and discount amortization schedule using the effective interest method. 3. Prepare adjusting entries for the end of the fiscal year December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. If income before interest and income taxes of 30% in 2020 is 500,000, compute net income under each alternative. 5. Assume the company retired the bonds on June 30, 2020, at 98 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight line method of amortization b. effective interest method of amortization 6. Compute the companys times interest earned (pretax operating income divided by interest expense) for 2020 under each alternative.arrow_forwardBats Corporation issued 800,000 of 12% face value bonds for 851,705.70. The bonds were dated and issued on April 1, 2019, are due March 31, 2023, and pay interest semiannually on September 30 and March 31. Bats sold the bonds to yield 10%. Required: 1. Prepare a bond interest expense and premium amortization schedule using the straight-line method. 2. Prepare a bond interest expense and premium amortization schedule using the effective interest method. 3. Prepare any adjusting entries for the end of the fiscal year, December 31, 2019, using the: a. straight-line method of amortization b. effective interest method of amortization 4. Assume the company retires the bonds on June 30, 2020, at 103 plus accrued interest. Prepare the journal entries to record the bond retirement using the: a. straight-line method of amortization b. effective interest method of amortizationarrow_forward

- A company issued bonds with a $100,000 face value, a 5-year term, a stated rate of 6%, and a market rate of 7%. Interest is paid annually. What is the amount of interest the bondholders will receive at the end of the year?arrow_forwardDiana Inc. issued $100,000 of its 9%, 5-year bonds for $96,149 when the market rate was 10%. The bonds pay interest semi-annually. Prepare an amortization table for the first three payments.arrow_forwardDisclosure of Debt On May 1, 2019, Ramden Company issues 13% bonds with a face value of 2 million. The bond contract calls for retirement of the bonds in periodic installments of 200,000, starting on May 1, 2020, and continuing on each May 1 thereafter until all bonds are retired. Required: How would the preceding information appear in Ramdens balance sheets on December 31, 2019, and 2020?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning